STX, the native token of the Bitcoin-focused Stacks layer 1 smart contract platform, is making waves in the crypto market after posting a 400% rally since October 2023.

STX trading volume has jumped a staggering 2,600% over the same period to $437.6 million on Feb. 22. STX’s performance surpasses Bitcoin’s ( BTC ) 90% increase since Oct. 15, 2023, and according to Messari, STX outperformed Bitcoin in 2023 with a 600% increase year-on-year.

This year has seen a growing interest in Bitcoin layer-2 projects not only because of spot Bitcoin ETFs, which now have more than $10 billion in assets under management (AuM), but also because of their focus on Bitcoin Ordinals, which already have a $2.5 billion market cap.

Stacks focuses on Bitcoin layer 2 smart contracts

Stacks is a layer 2 network for Bitcoin designed to support the core decentralized finance (DeFi) features similar to those found within other layer 1 ecosystems such as the Ethereum network and Solana .

![]()

Stacks - Explained. Source: Stacks.co

Stacks allows users to issue custom cryptocurrencies similar to Ethereum’s ERC-20 tokens and stablecoins , wrapped Bitcoin, and nonfungible tokens. Stacks also supports a decentralized exchange (DEX) and a liquid staking protocol (LSP).

The growing interest in Bitcoin layer 2s is hinged on their role of strengthening the network’s value proposition (and currency) by enabling it to process more transactions.

Increasing network activity on the Bitcoin network is usually credited to the popularity of the BRC-20 token standard and Ordinals inscriptions.

STX price rallies as an upcoming Network update approaches

The STX price rally comes as the community prepares for the upcoming update known as the Nakamoto Release , which is expected to take place before the Bitcoin halving in April.

The upgrade is expected to speed up transactions and introduce a new Bitcoin-pegged token (sBTC), among other improvements. sBTC will be used by Bitcoin holders who want to participate in smart contracts and developers who want to build applications on Bitcoin.

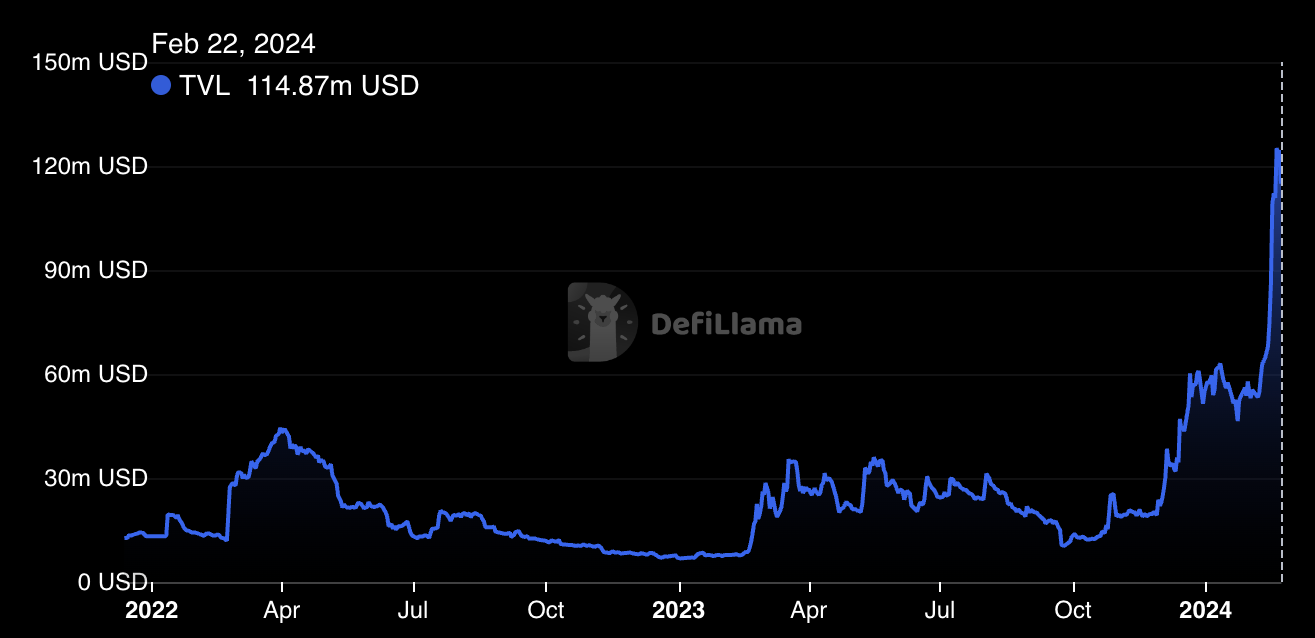

All these developments have increased user interest in Stacks. Data from crypto analytics firm Artemis shows that the number of daily active addresses on Stacks has increased from 961 to over 4,000 over the last 90 days. Similarly, daily transactions have jumped from around 8,340 to 33,000 over the same period.

![]() Daily active addresses and daily transactions on Stacks. Source: Artemis

Daily active addresses and daily transactions on Stacks. Source: Artemis

Another metric used to measure the interest of users in and how much they trust a blockchain network is the total value locked (TVL) on the platform. According to data from DefiLlama, Stacks’ TVL has increased by 830% from $12.35 million on Oct. 15, 2023, to $114.87 million on Feb. 22.

![]()

Total value locked on Stacks. Source: DefiLlama

The surge in TVL indicates a significant capital infusion into the Stacks DeFi ecosystem, underscoring investor confidence and active participation in DApps.

Related: Valkyrie launches 2x leveraged Bitcoin futures fund

Bitcoin’s uptrend drives a rally in STX

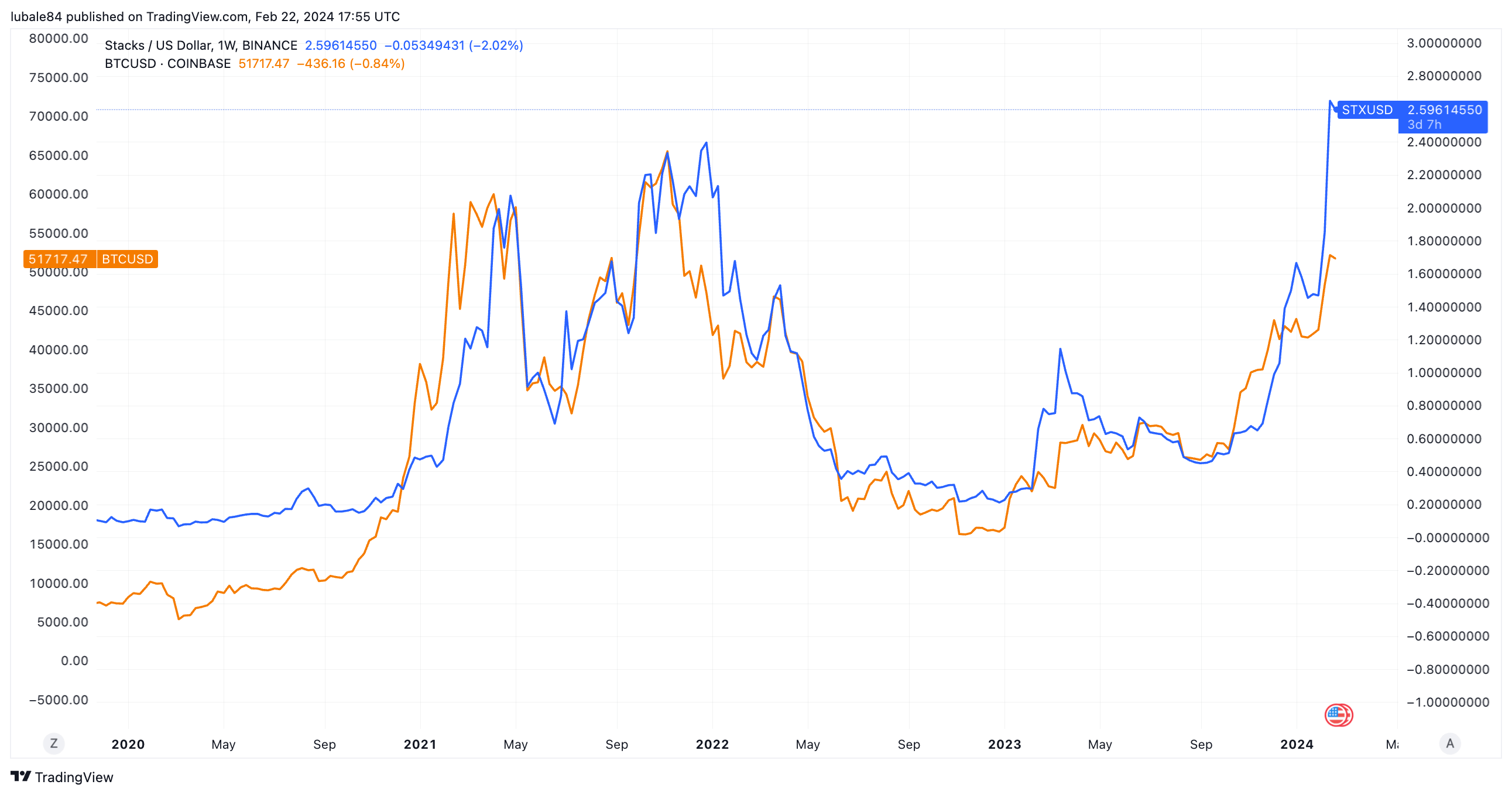

Excitement about spot Bitcoin ETFs in late 2023 and the eventual approval by the U.S. Securities and Exchange Commission in January 2023 saw BTC price rise to a two-year high of $49,000. Similarly, STX rose to hit $2.06, the best price in nearly two years.

Recently, increasing Bitcoin ETF inflows have been driving a strong rally in the BTC price as it rose as high as $53,000 on Feb. 20. STX, again, followed in Bitcoin’s footsteps, gaining 85% in the last 30 days to hit a new high at $2.90.

![]()

STX/USD vs. BTC/USD daily chart. Source: TradingView

With traders expecting Bitcoin price to continue rising in 2024 and the layer 2 Bitcoin development gaining traction, Stacks may further establish itself as one of the dominant projects in the layer 2 Bitcoin sector.