Bitget Futures Market Update: T-minus 2 Months Until Bitcoin's Next Halving

Bitget2024/02/23 03:53

By:Bitget

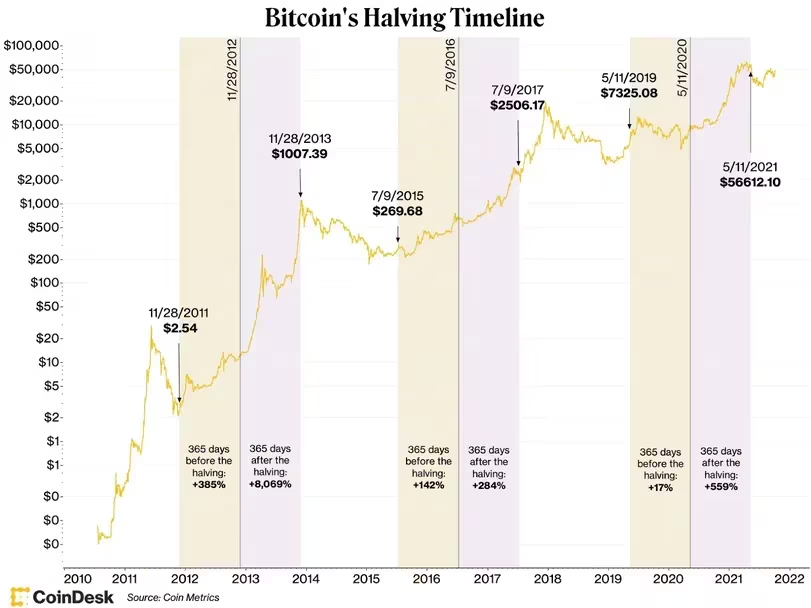

The anticipation of the halving event can also lead to increased interest in bitcoin, and this comes with the inevitable rise in speculation and the potential for a “sell the news” event. As we saw in the buildup to the greenlighting of U.S. spot bitcoin ETFs in January – another event which placed a large spotlight on bitcoin – prices increased in anticipation of an SEC approval. When the funds were approved, a large short-term self-off occurred, causing the price to fall steeply. Bitcoin’s price has since recovered from the sell-off; however, the point remains that investors need to be wary of market sentiment and speculative trends leading up to the halving in order to position themselves in a way that best supports their bitcoin investment thesis.

Futures Market Updates

Over the past 24 hours, the BTC futures market went through a series of liquidations on long positions after a dip while the ETH futures market suffered from short position liquidations due to anticipation of spot ETH ETF. Major cryptocurrencies such as BTC and ETH still dominate the market. Investors are balanced between their long contracts and short contracts.

Bitcoin Futures Updates

Total BTC Open Interest: $23.38B (-0.44%) BTC Volume (24H): $45.67B (-25.06%) BTC Liquidations (24H): $21.49M (Long)/$9.42M (Short) Long/Short Ratio: 50.12%/49.88% Funding Rate: 0.0108%

Ether Futures Updates

Total ETH Open Interest: $10.67B (+1.07%) ETH Volume (24H): $36.57B (-7.04%) ETH Liquidations (24H): $11.37M (Long)/$18.99M (Short) Long/Short Ratio: 50.17%/49.83% Funding Rate: 0.0121% ---

Top 3 OI Surges

SPELL: $31.98M (+565.89%) LIT: $14.54M (+86.68%) AXL: $7.11M (+67.79%)

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

深潮•2025/11/29 05:56

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

Coinpedia•2025/11/29 04:57

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Coinpedia•2025/11/29 04:57

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes

Coinpedia•2025/11/29 04:57

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$90,597.09

-0.88%

Ethereum

ETH

$3,012.12

-0.11%

Tether USDt

USDT

$1

+0.04%

XRP

XRP

$2.18

-1.19%

BNB

BNB

$879.82

-1.05%

Solana

SOL

$137.16

-1.82%

USDC

USDC

$1

+0.03%

TRON

TRX

$0.2810

+0.05%

Dogecoin

DOGE

$0.1493

-0.61%

Cardano

ADA

$0.4161

-2.27%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now