Bitcoin short sellers are nursing millions in losses after Bitcoin ( BTC ) rocketed upwards nearly 11% to briefly notch a new yearly high of $57,000.

According to data from crypto data platform Coinglass, over $161 million in BTC shorts were liquidated in the last 24 hours. Traders looking to gain short exposure to Ether ( ETH ) didn’t fare much better, with liquidations reaching almost $44 million within the same timeframe.More than $268 million in short positions were liquidated as Bitcoin briefly touched $57,000.

More than $270 million in short positions were liquidated in total as the market spiked upward.

More than $270 million in short positions were liquidated in the last 24 hours. Source: CoinGlass

The wider market has been led by a massive surge in the price of Bitcoin, which rose 10.8% from $51,471 to $57,035 in less than 24 hours, per TradingView data . Bitcoin has since cooled off and is changing hands for $56,000, though it's still up 32% in the last month.

In a statement to Cointelegraph, Swyftx lead analyst Pav Hundal described the crypto market as being “on fire right now.”

“We’re at average per person trade volumes in retail that we last witnessed at the top of the last bull run in November 2021, plus institutional buying pressure is immense,” he said.

Hunal, like many others, looked to the significant volumes of institutional capital flowing into the recently approved spot Bitcoin exchange-traded funds in the United States.

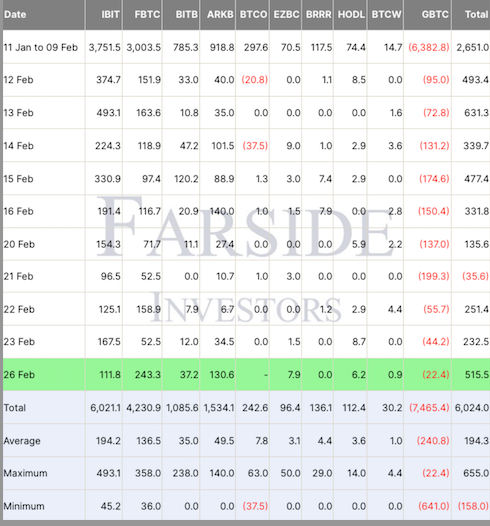

Net inflows into the ten Bitcoin ETFs topped $515 million on Feb. 26, one of the highest days of inflows on record since the ETFs were approved on Jan. 11., per Farside data .

![]()

Bitcoin ETFs notched $515 million in daily inflows on Feb. 26. Source: Farside Investors

“Exchange Traded Funds alone are cannibalizing close to a quarter of the Bitcoin that is currently being produced by the network,” Hundal added.

Hunal wasn’t alone in his enthusiasm for the price of Bitcoin moving forward, with several market pundits throwing their weight behind the asset on X.

Tyler Winklevoss, the co-founder of U.S.-based crypto exchange Gemini offered a succinct “We’re so back!” while outspoken Bitcoin bull Dan Held said today’s price action marked the “beginning of the bull run.”

Welcome to the beginning of the Bitcoin bull run.

Be prepared for many sleepless nights

— Dan Held (@danheld) February 27, 2024