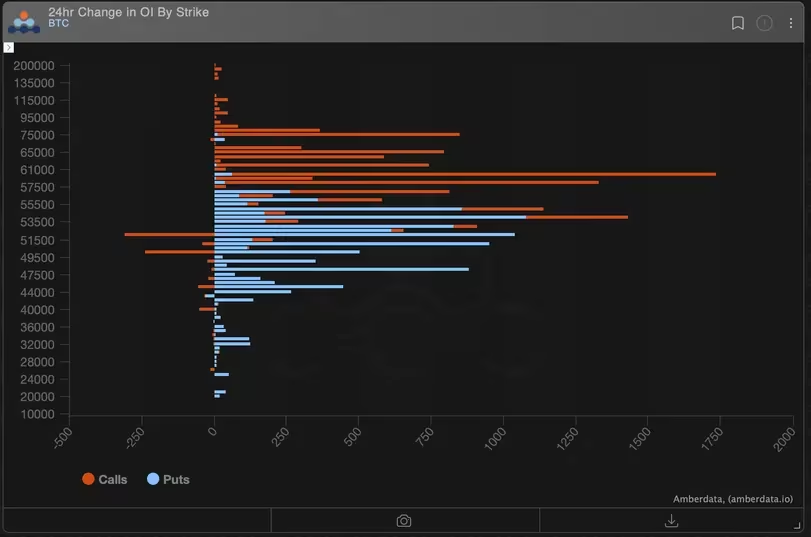

BTC Derivative Traders Eying $60,000 Mark

Futures Market Updates

Bitcoin Futures Updates

Ether Futures Updates

Top 3 OI Surges

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is 80% Just Hype? Six Major Red Lines Reveal the True Intentions of Stable

It appears to be an infrastructure upgrade, but in essence, it's an early insider-friendly issuance.

80% is Hype? Six Major Red Flags to See Stable's True Intent

It seems to be an infrastructure upgrade, essentially an early insider-friendly distribution.

Is building a native Layer2 blockchain the ultimate strategy for Ethereum DAT to boost mNAV?

With the ongoing evolution of the “crypto-equity integration” trend, a category of publicly listed companies known as “crypto asset treasury companies” is emerging within the industry. Currently, the top three institutional holders have collectively accumulated 4.16 million ETH, forming a significant institutional force that cannot be ignored.