Solana ( SOL ) looks poised to undergo a bull run in the current crypto market boom led by Bitcoin ( BTC ), argues independent market analyst Hansolar.

SOL price could reach $600

At the core of Hansolar’s bullish analogy for Solana is its potential to replicate Ether’s (ETH) price trends during the previous crypto market bull runs. For instance, in the 2020-2021 bullish cycle, ETH’s price surged from around $85 to as much as $4,935, tailing Bitcoin’s uptrend.

Interestingly, ETH’s uptrend increased by approximately 1,400% after Bitcoin established a new record high above $20,000, as shown in the three-day chart below.

![]() BTC/USD vs. ETH/USD three-day price performance chart. Source. TradingView

BTC/USD vs. ETH/USD three-day price performance chart. Source. TradingView

This fractal could repeat in 2024 as Bitcoin pursues an extended bull run above its November 2021 record high of $69,000. Nonetheless, as Hansolar argues, Bitcoin refreshing its all-time high could benefit Solana equally this time.

"Previously, ETH took off when BTC actually broke out into ATHs. It's then when retail buys into SOL as the high beta catch up play," he stated, adding:

"Currently SOL is at around 50% from ATHs similarly to how ETH was around the 50% mark as BTC was nearing ATHs in the previous cycle."

![]() BTC/USD vs. ETH/USD and SOL/USD three-day price performance chart. Source: TradingView

BTC/USD vs. ETH/USD and SOL/USD three-day price performance chart. Source: TradingView

That said, Bitcoin's run-up toward $150,000, a valuation predicted by Fundstrat's Head of Research Tom Lee on ETF approval prospects, could have Solana target $600 as its long-term upside target. That is nearly 450% above the current SOL price.

Do Solana fundamentals support bullish SOL predictions?

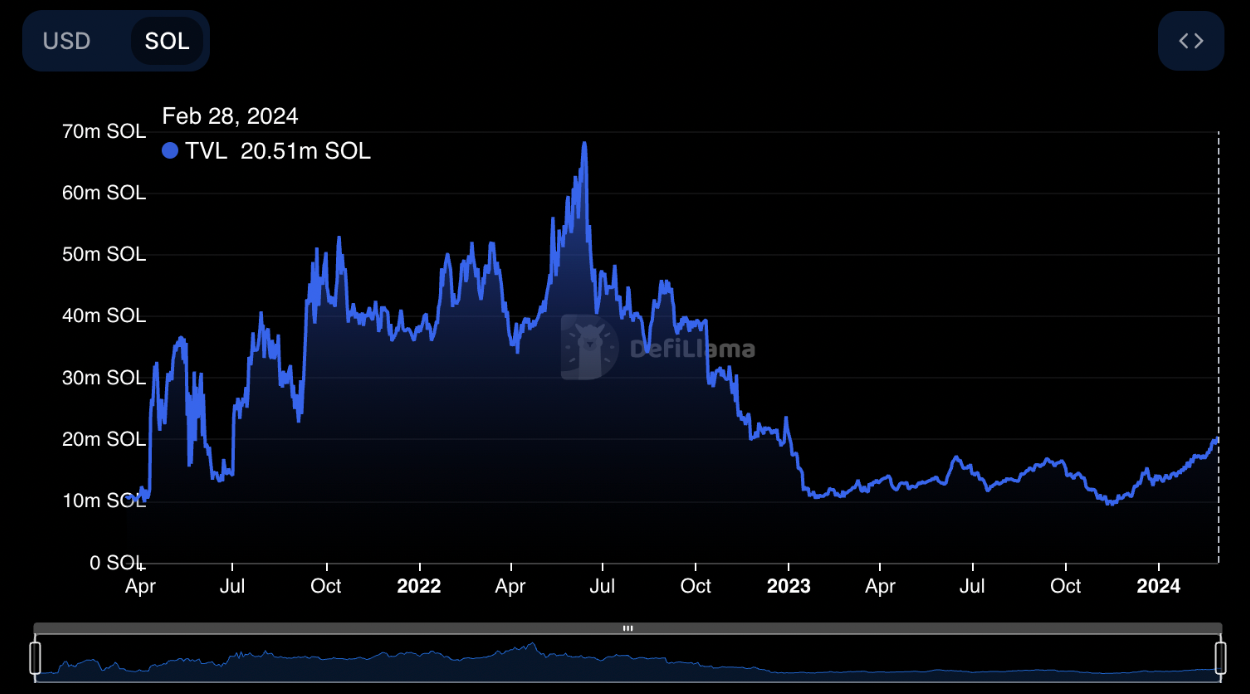

Fundamentally, Solana has fared well in terms of network adoption recently, with the total-value-locked (TVL) across its ecosystem at 20.51 million SOL, its highest level since January 2023.

![]() Solana TVL performance chart. Source: Defi Llama

Solana TVL performance chart. Source: Defi Llama

Theoretically, as more assets are locked into DeFi platforms, the circulating supply of these tokens may decrease, leading to a potential increase in demand relative to supply. This scarcity effect can contribute to price appreciation of the locked tokens.

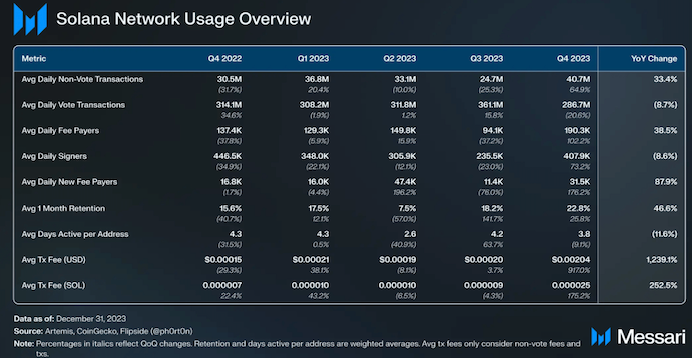

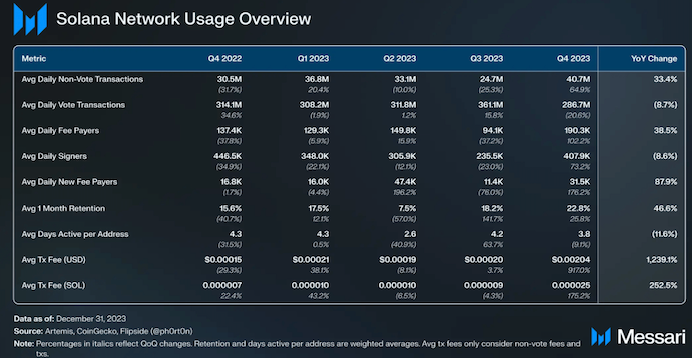

Solana’s rising TVL appears synchronous to its sustained quarter-over-quarter (QoQ) growth tracked by the data resource platform Messari.

Notably, the network’s average daily fee payers during Q4/2023 surged 103%. In the same period, its average daily DEX (Decentralized Exchange) volume rose by 961%, with a 359% increase in average daily NFT (nonfungible token) volume.

![]() Solana network usage overview by the end of 2023. Source: Messari

Solana network usage overview by the end of 2023. Source: Messari

In Q1/2024, the airdrop of Jupiter DEX’s native token, JUP, also spurred on-chain activity atop the Solana blockchain. Also, its NFT volumes peaked near $5 billion, underscoring a strong underlying demand for SOL tokens.

Solana technical analysis

In the near-term, Solana eyes $200 as its primary upside target due to the formation of a bullish continuation pattern on its daily chart.

Dubbed bull pennant, the pattern develops when the price consolidates inside a symmetrical triangle structure after a strong move upward. Meanwhile, it resolves after the price breaks above the upper trendline and rises by as much as the height of the previous uptrend.

As of Feb. 28, SOL’s price was testing the pennant’s upper trendline for a potential breakout. If that happens, the price could rise toward $200 during March, up approximately 75% from the current price levels.

![]() SOL/USD daily price chart. Source: TradingView

SOL/USD daily price chart. Source: TradingView

Conversely, a breakdown below the pennant’s lower trendline risks invalidating the bullish setup altogether. Should it happen, SOL’s price can drop by as much as the previous upside move, i.e., toward $60.75, down circa 45% from current price levels.