Option data: Short-term IV rises above 80%, with bulk trading exceeding 800 million US dollars

According to Greeks.live, last night, as Bitcoin broke through the $60,000 mark, the short-term implied volatility (IV) exceeded 80%, with a large volume of over 13,000 contracts traded and a nominal value exceeding $800 million. The largest transaction was a butterfly spread option combination worth over $100 million in total:

Sell 100x BTC-29MAR24-65000-C

Buy 200x BTC-29MAR24-60000-C

Sell 100x BTC-29MAR24-55000-C

The intention of this combination is very clear. In an extremely FOMO market sentiment situation, Bitcoin will only have two trends: either breaking out to new highs or failing at the high and reversing downwards.

Whales believe that the probability of Bitcoin trading sideways at the current price level is very low. Moreover, this three-legged combination perfectly balances premium payments and represents a sophisticated trading technique.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin OG opens 5x ETH short position worth $15.04 million

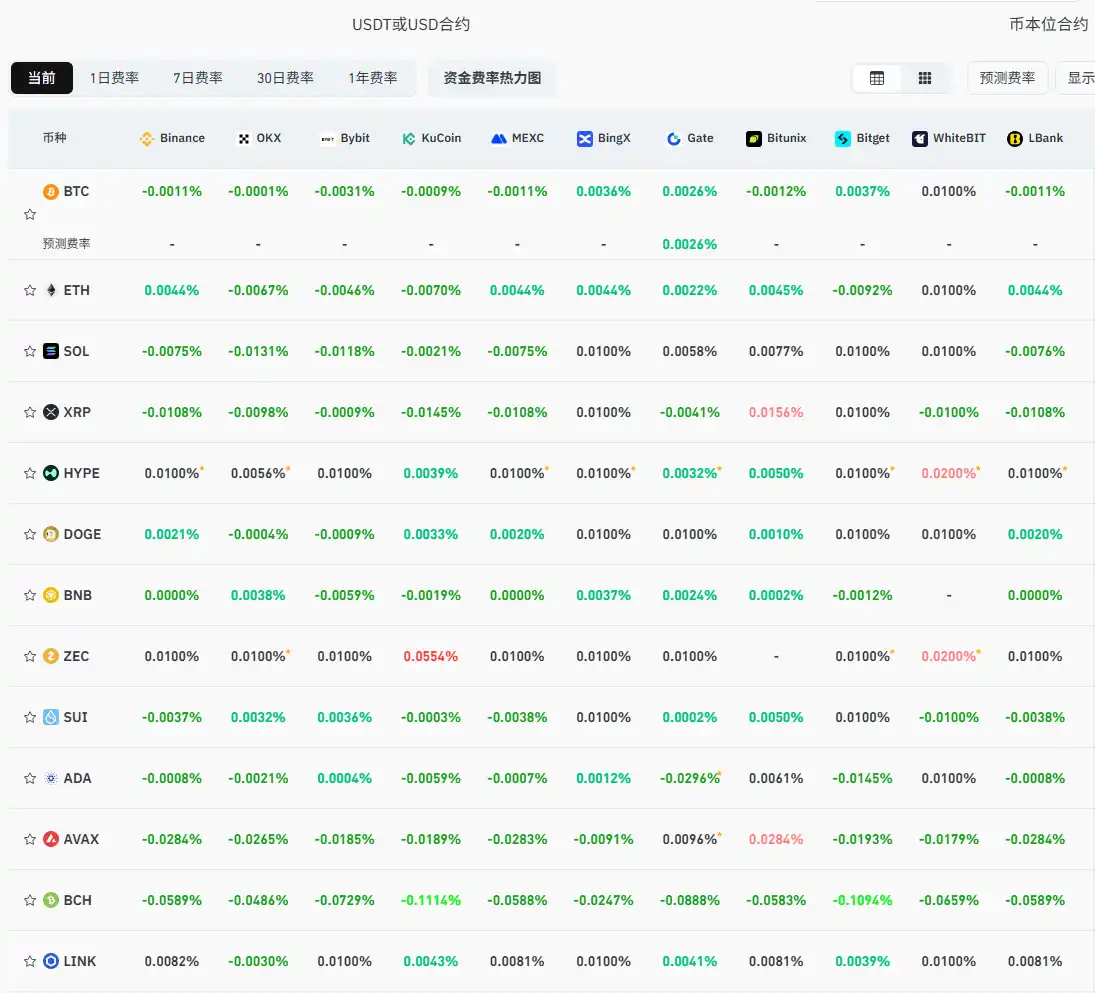

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish

The Crypto Fear Index rises to 28, escaping the "Extreme Fear" zone

Analyst: The current macro environment is similar to the pandemic period, and bitcoin still has room to rise