Bitcoin ( BTC ) now has a shot at hitting $180,000, if a new bull signal repeats historical gains.

In a post on X (formerly Twitter) on Mar. 1, Caleb Franzen, founder of Cubic Analytics, suggested that BTC price returns could hit 260% from current levels this cycle.

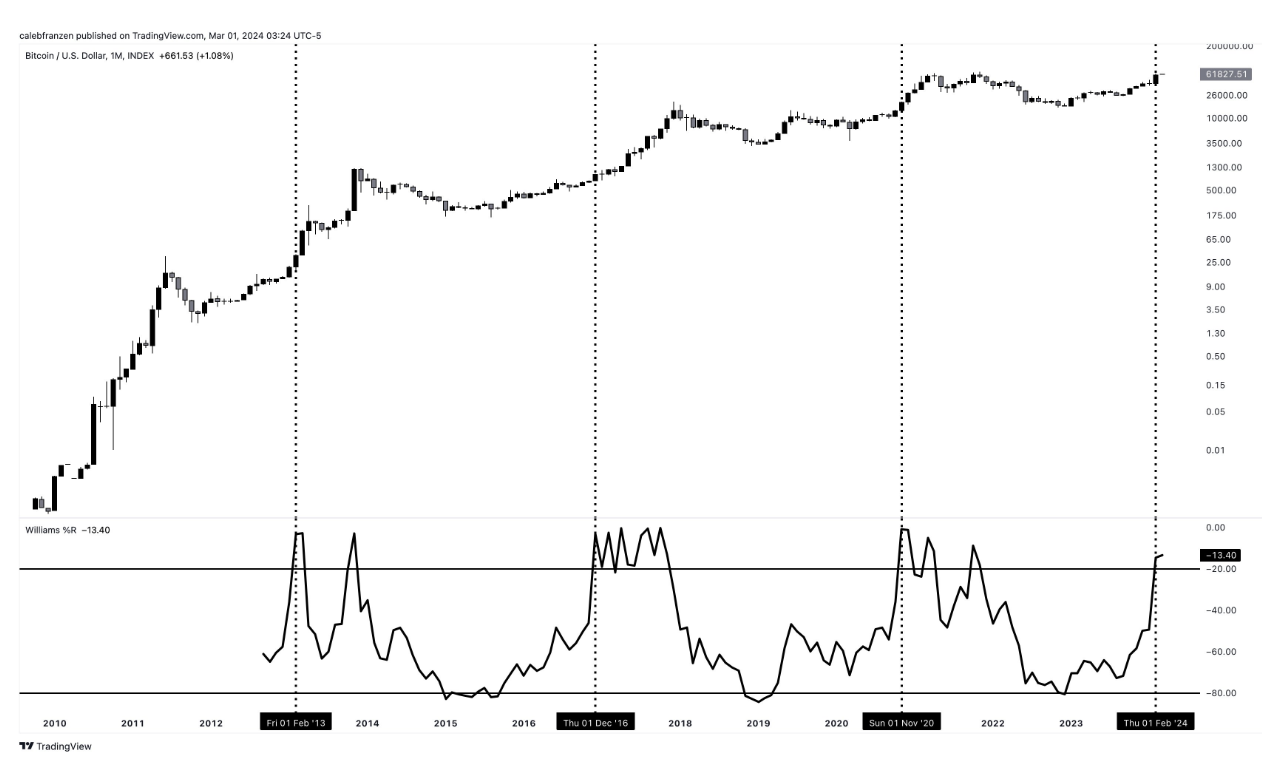

Analyst eyes ultra rare Williams%R Oscillator signal

Bitcoin has added more than 43% in February alone, but a long-term BTC price metric is already calling for much higher levels.

Analyzing the Williams%R Oscillator on 3-year timeframes, Franzen revealed a rare bull signal flashing for only the fourth time ever.

“Bitcoin just completed the highest monthly close since Oct.'21, but it gets even better more bullish... The 36-month Williams%R Oscillator just closed above the overbought level for the 4th time in history,” he summarized.

The Williams%R Oscillator is used to gauge the strength of BTC price trends. As Cointelegraph reported, Franzen showed that the tool was essential in charting the start of Bitcoin’s recovery from the 2022 bear market lows.

While it was 12-month timeframes in play then, now, an even rarer occurrence is back — the 36-month Williams%R Oscillator is headed into “overbought” territory above -20.

“I say it all the time I'll continue to repeat it: overbought signals are incredibly bullish and should be viewed as momentum signals, not signals to fade,” Franzen continued.

Prior signals appeared in 2013, 2016 and 2020 — all years marking the early innings of a Bitcoin bull market.

While the returns have decreased each cycle — from 1,900% in 2013 to 260% in 2020 — even matching the latter would produce a $180,000 BTC price.

Franzen nonetheless acknowledged that even these unusual events should not be treated as a guarantee of future performance.

“The same analysis that I shared for the 12M and 24M Williams%R signals have worked perfectly; however, this study guarantees nothing. It simply tells us how market participants have behaved in the past when investor behavior was similar from a statistical perspective,” he explained.

“This study is unequivocally bullish, but we should view it simply as improving bullish probabilities rather than being outright bullish from a binary perspective.”