Bitcoin ( BTC ) is leaving exchanges at the quickest rate in years as BTC price action vies for all-time highs.

In a post on X (formerly Twitter) on Mar. 3, James Van Straten, research and data analyst at crypto insights firm CryptoSlate, flagged multi-billion dollar BTC withdrawals.

BTC exchange withdrawals echo 2021

Mainstream investors may not yet have returned to crypto, but in the background, Bitcoin exchanges are getting drained of BTC reserves.

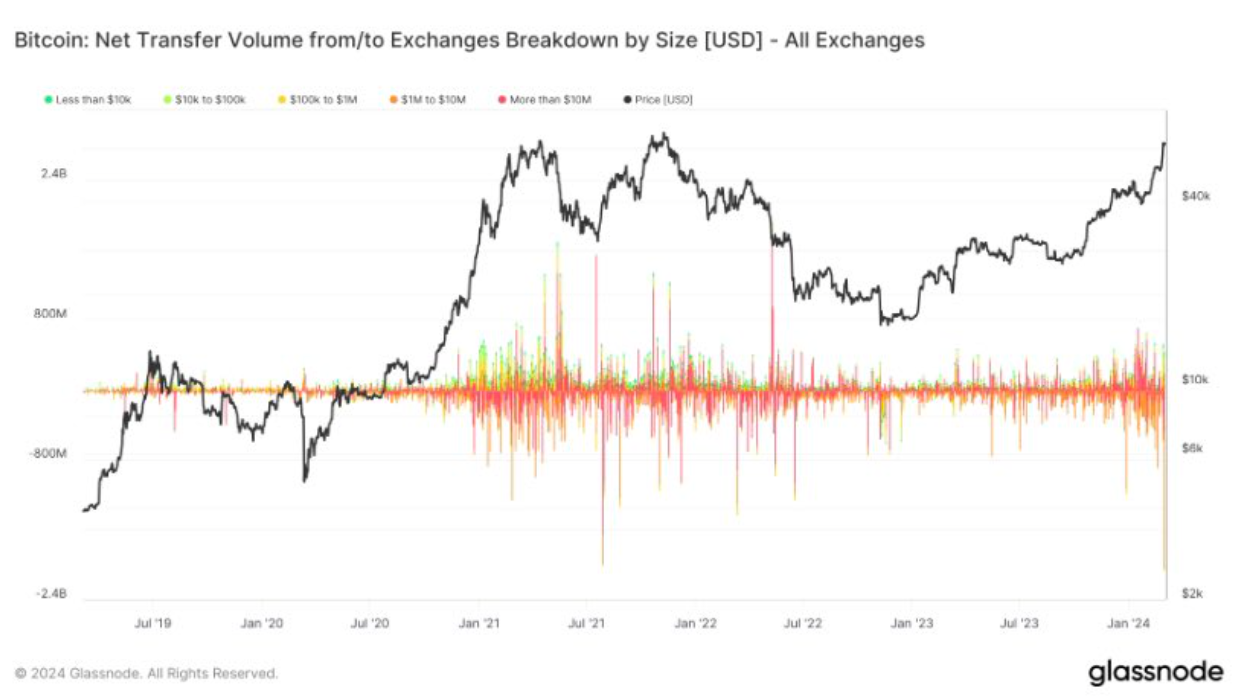

Uploading data from on-chain analytics firm Glassnode, Van Straten revealed that on Mar. 1 alone, withdrawals were around $2 billion.

“I don’t think I’ve quite seen anything like this before,” he commented.

“All in all on the Friday, just over $2.3B worth of Bitcoin left exchanges. One of the biggest withdrawals in over 5 years.”

Bitcoin Net Transfer Volume from/to Exchanges Breakdown by Size. Source: James Van Straten/X

Glassnode itself appears to show daily BTC outflows roughly equalling June 28-29, 2021, which combined to see record withdrawals.

Van Straten noted the role of the United States spot Bitcoin exchange-traded funds (ETFs), excluding approximately $200 million sent to custodian Coinbase Pro.

“Binance saw about $400M, and seen fairly big outflows for the past few days,” he continued.

“Coinbase saw the rest. Binance outflows are the interesting ones because they have nothing to do with the ETF.”

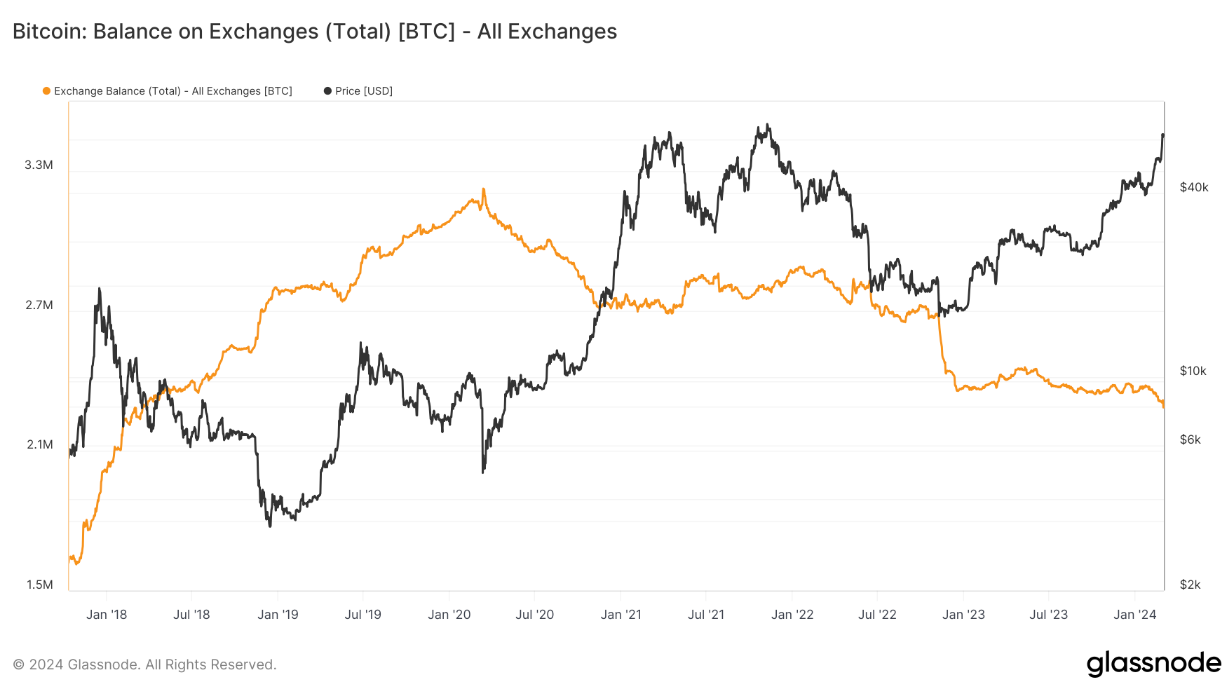

Bitcoin Balance on Exchanges. Source: Glassnode

Glassnode puts the total BTC assets available on the major trading platform it monitors at 2,286,347 BTC ($142.5 billion) as of Mar. 2.

This is the lowest amount since March 2018, when BTC/USD traded at just $8,000.

New Bitcoin investors "flowing in"

Meanwhile, separate figures tracking Bitcoin market composition show that new entities are now coming on board.

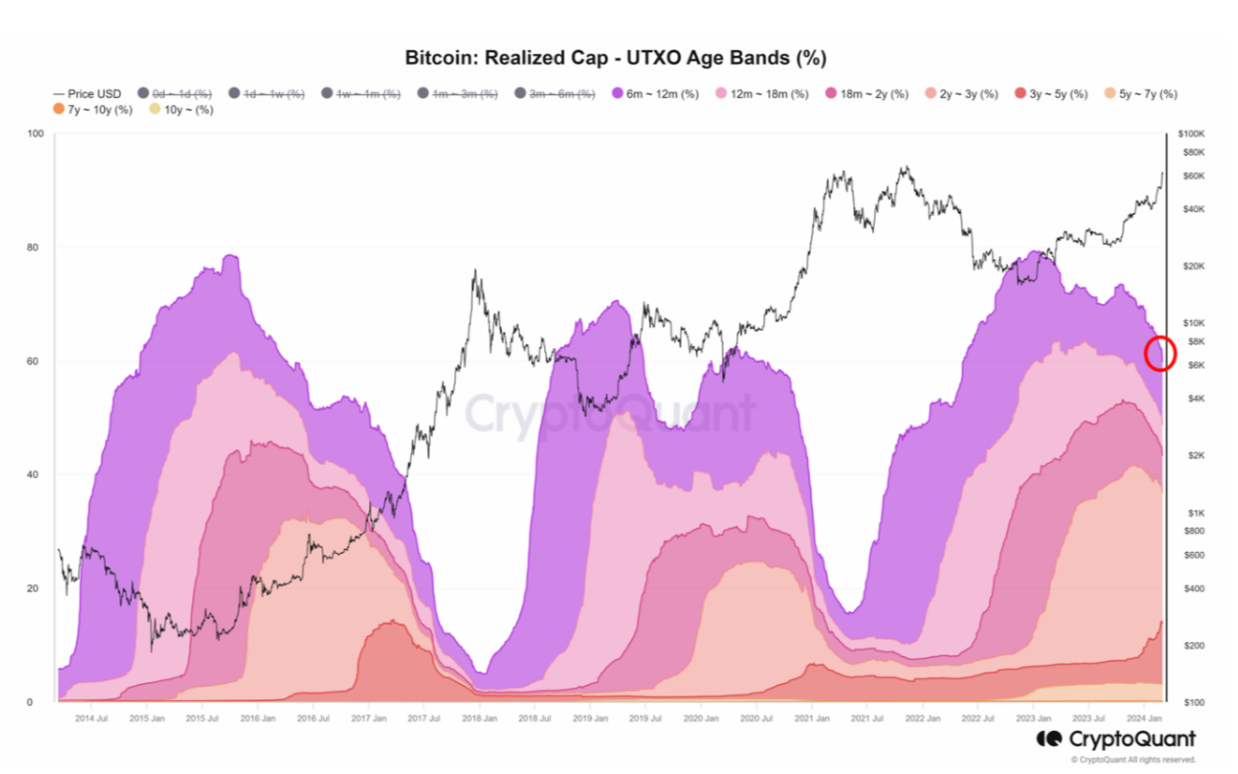

In one of its recent Quicktake market updates , Crypto Dan, a contributor to on-chain analytics platform CrryptoQuant, captured ongoing changes in unspent transaction output (UTXO) ages.

More “younger” coins are involved, with “older” ones — dormant for six months or more — waking up.

“New investors are flowing in, and in the near future we can expect the influx of many new ‘individual’ investors,” he summarized.

“Eventually, this ratio will continue to decline sharply, leading to the ‘true bull market’ we desire.”

![]()

Bitcoin UTXO age bands annotated chart. Source: Crypto Dan/CryptoQuant

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.