In the past 24 hours, many new popular tokens and topics have emerged in the market, which could potentially be the next wealth creation opportunity.

Overview

In the past 24 hours,

Bitcoin experienced a sharp decline of over 15% after reaching a new all-time high of $69,000, with the greatest drop being $10,000, leading to a market correction. The highlights are as follows:

As market sentiment cools and irrational high leverage is cleared, the overall market structure is expected to improve. Considering the potential positive effect and the rebound strength of funds, investors may consider strategically entering at lower prices into sectors represented by OP, STRK, and ARB, known as the Cancun upgrade, as well as the DEX sector represented by UNI, SUSHI, DYDX.

Data collection time: March 6, 2024, 4:00 AM (UTC+0)

1. Market Environment

In the past 24 hours, the BTC price surged to a new all-time high surpassing $69,000, followed by a sharp decline on the 4-hour chart, with the highest drop reaching 15%. This decline led the crypto market to a widespread pullback, with the previously hot memecoin sector experiencing declines of over 50%. However, fundamentally strong cryptocurrencies like OP and UNI were quickly bought up during the drop, resulting in significant rebounds. Such strong cryptocurrencies are likely to sustain their upward momentum.

Recently, there has been a lull in macroeconomic policy, with expectations for the Federal Reserve to cut interest rates by the end of Q2. Therefore, BTC is likely to undergo a brief correction period. During this period, active funds may shift into trending sectors, engaging in sector rotation. It's advisable to keep a close eye on tokens from sectors like the Cancun upgrade and DEX, which hold significant potential.

2. Wealth Creation Sectors

1) Sector Movements: L2 (OP, STRK, ARB)

Primary reason: The Cancun upgrade is scheduled for March 13, a significant positive development for the Layer 2 sector.

Price increase: OP and STRK strongly recovered from their dips, with STRK breaking out of its recent low volatility range and entering an uptrend, rising 12% in the past 24 hours.

Factors affecting future market conditions:

-

Whether Layer 2 prices initiate a second upward trend: Leading Layer 2 tokens like OP and STRK indicate investment directions. If their prices further break upwards, it could lead the overall sector sentiment into a new market phase.

-

Price and TVL changes in ecosystem projects: Whether core Layer 2 DeFi, Meme, and Gaming applications attract fund inflows and experience TVL growth. Typically, core DEXs are the first to show price movements, making it a suitable time to strategically invest in major ecosystem projects.

2) Sector Movements: DEX Sector

Main reason: The proposal for Uniswap to distribute dividends through fee staking is nearing its conclusion. Currently, it has received 44 million votes in favor and 10,000 votes against. A16z, which holds significant influence with an expected 60 million votes, has yet to make a statement, setting high expectations for approval.

Price increase: After a drop, UNI's price hit new highs, rising 9% in 24 hours with an amplitude of 30%.

Factors affecting future market conditions:

-

The Uniswap vote ends on March 7. If the proposal passes, UNI is likely to see significant gains. However, if it fails, the DEX sector could face downward pressure on prices again, necessitating timely stop-loss measures to mitigate risks.

-

Potential upward momentum in other DEX sector tokens: A successful Uniswap proposal could refocus attention and funds on the DEX sector, potentially driving up prices of leading DEX and DeFi tokens like SUSHI, DYDX, COMP, and CRV. Therefore, should the proposal pass and the UNI price surge, it may be wise to quickly consider investing in tokens such as SUSHI and DYDX.

3) Sectors to focus on next: BTC ecosystem, Gaming

Primary reason: BTC breaking past its previous high will further drive the development and prosperity of BTC ecosystem projects. Simultaneously, the optimizations from the Cancun upgrade will positively impact gaming sector projects that offer a strong user experience.

Specific tokens list:

-

ORDI: A leading project in the BTC ecosystem BRC inscriptions. With BTC reaching a new all-time high and the ongoing development of BTC L2 is expected to continuously empower ORDI.

-

SATS: A leading project in the BTC ecosystem BRC inscriptions, also featuring meme attributes.

-

IMX: A leading gaming L2 token.

3. User Trending Searches

1) Popular DApps

Pixels :

Pixels is a gaming project on the Ronin chain. Yesterday, the Pixels team hosted a Twitter space event titled "The Dark Side of Web 3," attended by 5984 people. Meanwhile, Pixels continues to attract new users, with the total number of Pixels users reaching 1.1 million and its monthly DAU hitting 314,000. Therefore, over the past 24 hours, Pixels' unique active wallet count increased by 145.7%.

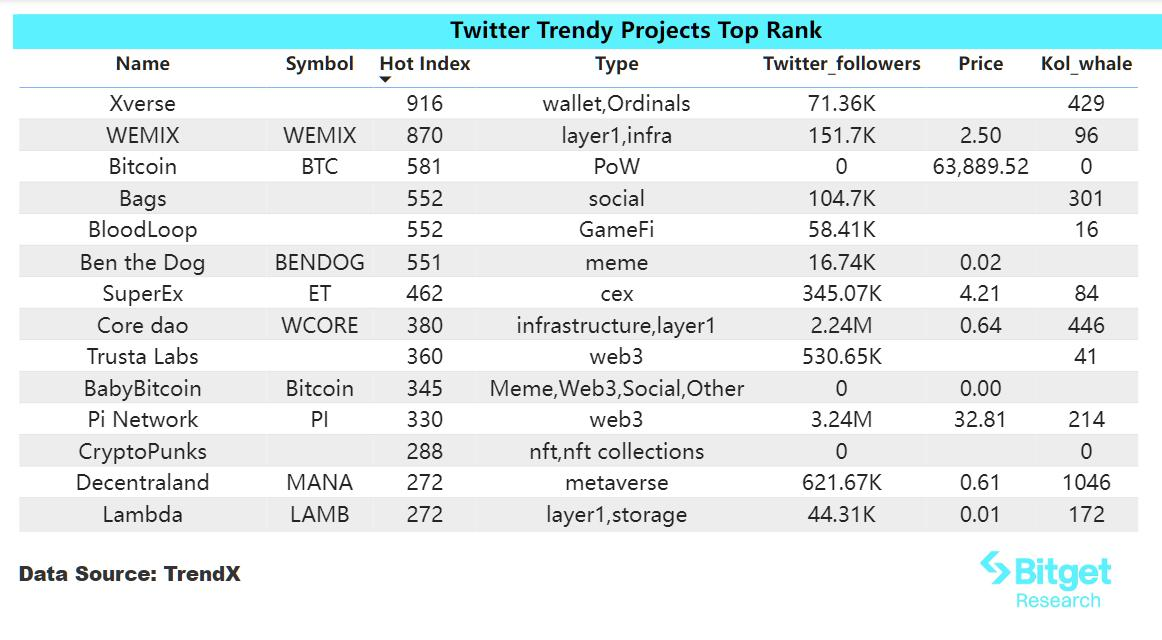

2) Twitter

(1) Bitcoin (Token symbol: BTC)

Bitcoin began to decline yesterday after breaking the new high of $69,000. According to Bitget data, it dropped to a low of $59,130 yesterday, with a total liquidation of $1.045 billion in the past 24 hours, including $816 million in long positions and $229 million in short positions. The decline can be attributed to three main reasons: first, some investors took profits after Bitcoin broke the new high; second, the high funding rates and leverage ratio for Bitcoin attracted some to close their short positions, which triggered a chain of liquidations; third, U.S. stocks opened and continued lower, with all three major indices falling over 1%, and major tech stocks such as Intel, Tesla, Microsoft, and Apple all dropping more than 3%, creating market pressure that contributed to the collective downturn in the

cryptocurrency market.

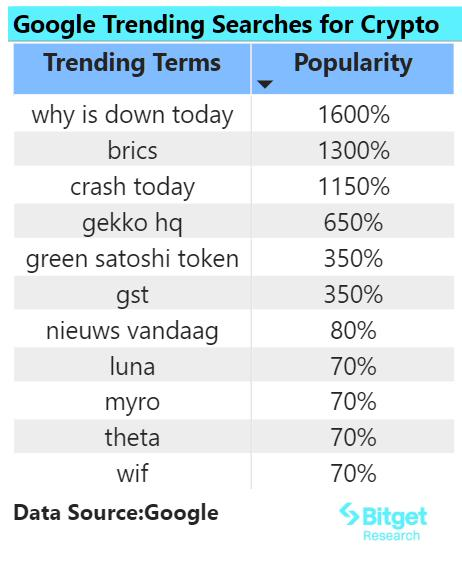

3) Google Search

From a global perspective:

(1) BRICS (Brazil, Russia, India, China, and South Africa)

According to a report by Russia's TASS news agency, the BRICS nations are working towards establishing a payment system based on

blockchain and digital technology. The BRICS group has been striving to reduce its dependence on the US dollar for settlements, and a peer-to-peer payment system could facilitate the de-dollarization of currency settlements and swaps within the BRICS countries. From collaborations with the

Ethereum Foundation to Bitfury, Russia has a tradition of developing blockchain projects in cooperation with blockchain companies. The development of such systems could potentially benefit the token prices of related concept blockchain projects in the future.

From a regional perspective:

(1) In Asia and Europe, there's a high interest in LUNA's price increase:

-

Terra's incarcerated co-founder Do Kwon achieved a rare "victory" as Montenegro's appellate court cited "significant violations of criminal procedure" to overturn a lower court's decision from February to extradite him to the United States, meaning Do Kwon does not have to be extradited to the U.S.

-

Driven by this news, Luna's price increased by 31.73% in 24 hours.

(2) The English-speaking and African regions showed interest in GST:

-

GST is a reward token earned in STEPN, a Web3 lifestyle application with engaging social elements and gamified design, primarily focusing on earning rewards through running.

-

GST saw a significant rise yesterday, with an increase of 208% for the day and a daily trading volume of $160 million. Coinbase had the largest volume, at $116 million, indicating its popularity among North American traders.

-

Meanwhile, GST has seen continuous whale interest. A

Solana whale address starting with 4Baw has consistently withdrawn GST from Coinbase over the past week, now holding GST worth $3.57 million.

4. Potential Airdrop Opportunities

Rabby Wallet

Rabby Wallet, developed by the DeBank team, is an open-source cryptocurrency wallet supporting multiple chains, designed specifically for DeFi users. In December 2022, DeBank completed a $25 million equity financing at a valuation of $200 million, led by HongShan Capital, with participation from Dragonfly, Hash Global, Youbi, Coinbase Venture, Crypto.com, Circle, and Ledger.

The project has a user-friendly interface and introduced a points system in January this year. Users can download and install Rabby Wallet from the official website, and accumulate points through wallet usage and interactions with various DApps by transferring assets.

To participate, users can select "Install Rabby Wallet" to install the plugin, copy the referral code, import private key or mnemonic phrase to view their points, and enter the invitation code to receive extra points. Points can also be earned through swaps within the wallet and through regular use.

Owlto Finance

Owlto Finance is a decentralized Cross-Rollup bridge focused on Layer 2. It currently supports cross-chain transactions among over 15 L2 networks, including Ethereum mainnet, zkSync Era, and Starknet.

Since its launch, Owlto Finance has gradually joined the official ecosystems of zkSync, Starknet, Arbitrum, Optimism, Linea, Base,

Polygon, BNB Chain, Mantle, Scroll, Taiko, Manta, and Kroma, especially gaining endorsements and retweets from their official Twitter accounts, indicating close relationships with various Layer 2 projects. The project has introduced a points system. In addition to aiming for an Owlto airdrop, users can also accumulate transaction counts for other Layer 2 networks that have not yet issued tokens.

To participate, visit the official website, select the source and target chains, and enter the amount. Owlto currently supports ETH, USDC, USDT, and BNB tokens. The project also supports points accumulation through daily check-ins on the website.