Kaiko: BTC traders may be conducting profit-taking operations

Cryptocurrency data provider Kaiko stated that, according to its analysis of data from 33 global CEX markets, the gap between the total USD value of sell orders (known as ask side) and buy orders (bid side) within a 2% range of current market prices has widened to nearly $100 million, approximately five times higher than usual. Since late January, there has been relatively more liquidity on the ask side, indicating potential supply in the market and suggesting that investors have been seeking to sell off. Dessislava Aubert, a research analyst at Kaiko, mentioned that there is currently a significant imbalance in the 2% BTC bid depth, which may indicate that traders are now taking profits as Bitcoin approaches historical highs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

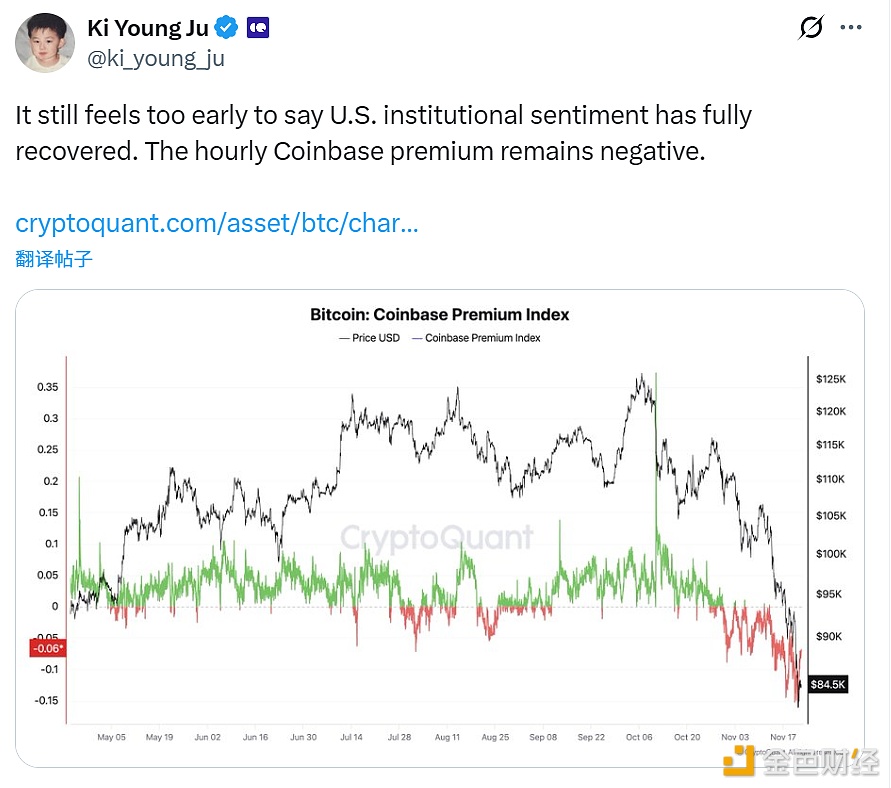

CryptoQuant CEO: It is too early to assert that the confidence of US institutional investors has fully recovered

Aerodrome: Investigating Front-End Breach, All Smart Contracts Remain Secure

Lendep has passed the Certik audit and will continue to strengthen smart contract security.