Bitcoin ( BTC ) lurched toward $60,000 on March 17 as selling persisted through the weekend.

![]() BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

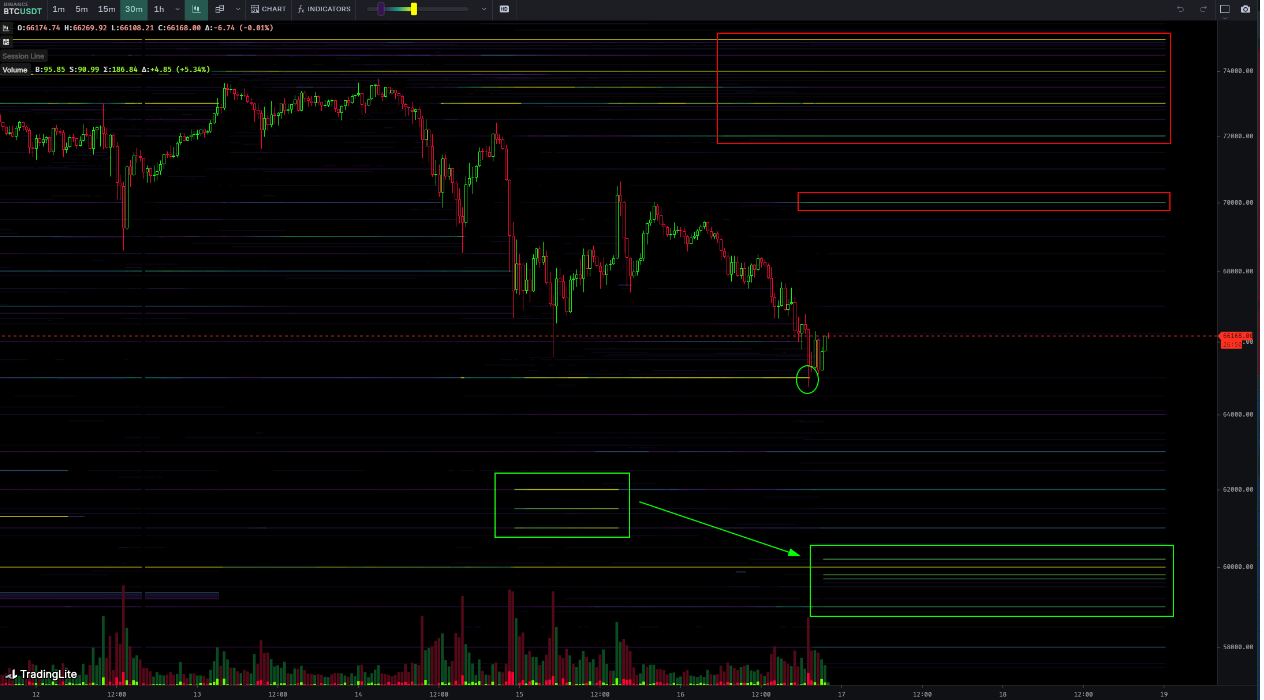

"Constant spot selling" pressures BTC price action

Data from Cointelegraph markets Pro and TradingView showed new BTC price lows of $64,522 on Bitstamp.

After hitting new all-time highs during the week, Bitcoin faced considerable sell-side pressure, with a series of lower lows accompanied by failed rebounds.

On the day, offloading continued to gather speed well in advance of the hotly-anticipated weekly candle close.

Analyzing the situation, popular trader Skew outlined zones of interest for bidders on major exchanges. These focused on between $60,000 and $64,000.

“Majority of the selling has been driven by takers (market selling),” part of a post on X (formerly Twitter) explained .

“Constant spot selling since $74K especially from coinbase binance.”

BTC/USDT order book data with bid liquidity. Source: Skew/X

Skew added that some entities were engaging in largescale dollar cost averaging (DCA) at the lows, helping provide the low-timeframe bounces.

Bitcoin’s latest bull market correction thus totaled around 12%. As Cointelegraph reported , previous cycles saw considerably deeper pullbacks while still preserving the broader uptrend.

Optimistic market observers thus remained positive, referencing the ongoing buying from the United States spot Bitcoin exchange-traded funds (ETFs) which would resume on March 18.

![]() Source: https://twitter.com/thomas_fahrer/status/1769161466056434097

Source: https://twitter.com/thomas_fahrer/status/1769161466056434097

“Yes, this is Bear Trap,” Thomas Fahrer, CEO of crypto-focused reviews portal Apollo, which tracks ETF flows, responded on X.

“Waves of liquidity are going to rain down on the

Bitcoin ETFs. Real money hasn't even started allocating. If a 1B Hedge Fund position sent BTC tumbling 10%, how high do you think 150B from advisers is going to send it?”

Fahrer appeared to reflect rumors of a fresh institutional wealth allocation to BTC potentially arriving in the coming months.

Latest Bitcoin futures gap nears $4,000

With more than 12 hours left until the weekly close, meanwhile, others eyed the potential for an early-week comeback.

![]() CME Group Bitcoin futures 1-hour chart. Source: TradingView

CME Group Bitcoin futures 1-hour chart. Source: TradingView

Countering the bearish streak could be a job for the gap in CME Group’s Bitcoin futures market, this rapidly widening amid the weekend’s drawdown.

CME futures closed on March 15 at $69,135, and the resulting “gap” between there and spot price could provide an impetus for relief — in line with historical precedent .

![]()

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.