Bitcoin ( BTC ) plugged intraday lows at the March 22 Wall Street open despite lower outflows from the Grayscale Bitcoin Trust (GBTC).

Bitcoin bulls fail to catch a break as BTC price weakness defies a slowdown in GBTC offloading.

Bitcoin ( BTC ) plugged intraday lows at the March 22 Wall Street open despite lower outflows from the Grayscale Bitcoin Trust (GBTC).

Data from Cointelegraph Markets Pro and TradingView tracked limp BTC price performance as $63,000 returned to the radar.

The largest cryptocurrency failed to hold higher levels, which resulted from an earlier rebound , with its old 2021 all-time highs at $69,000 staying unchallenged.

The day’s flows into and out of the United States spot Bitcoin exchange-traded funds (ETFs) began promisingly. GBTC saw just $96 million in outflows, per initial data from crypto intelligence firm Arkham — less than a third of the tally at the start of the week.

So far, every day this week has seen net outflows from the spot ETFs — a unique time in their short history.

Analyzing current BTC price action, popular trader Skew suspected deliberate moves to undermine bullish momentum.

“Looks like someone is trying to force a cascade here again during weak price action,” he commented in a post on X (formerly Twitter) about spot order book data from the world’s largest exchange by volume, Binance.

Skew added that it was “pretty clear” that certain traders were selling into price.

Fellow trader Crypto Tony joined those calling for a reclaim of $69,000 in order to ensure upside continuation.

“All eyes on the weekly close,” trader Jelle continued.

Adopting a characteristically optimistic take on the market, Jelle outlined the upside potential if Bitcoin were able to flip the current range to support.

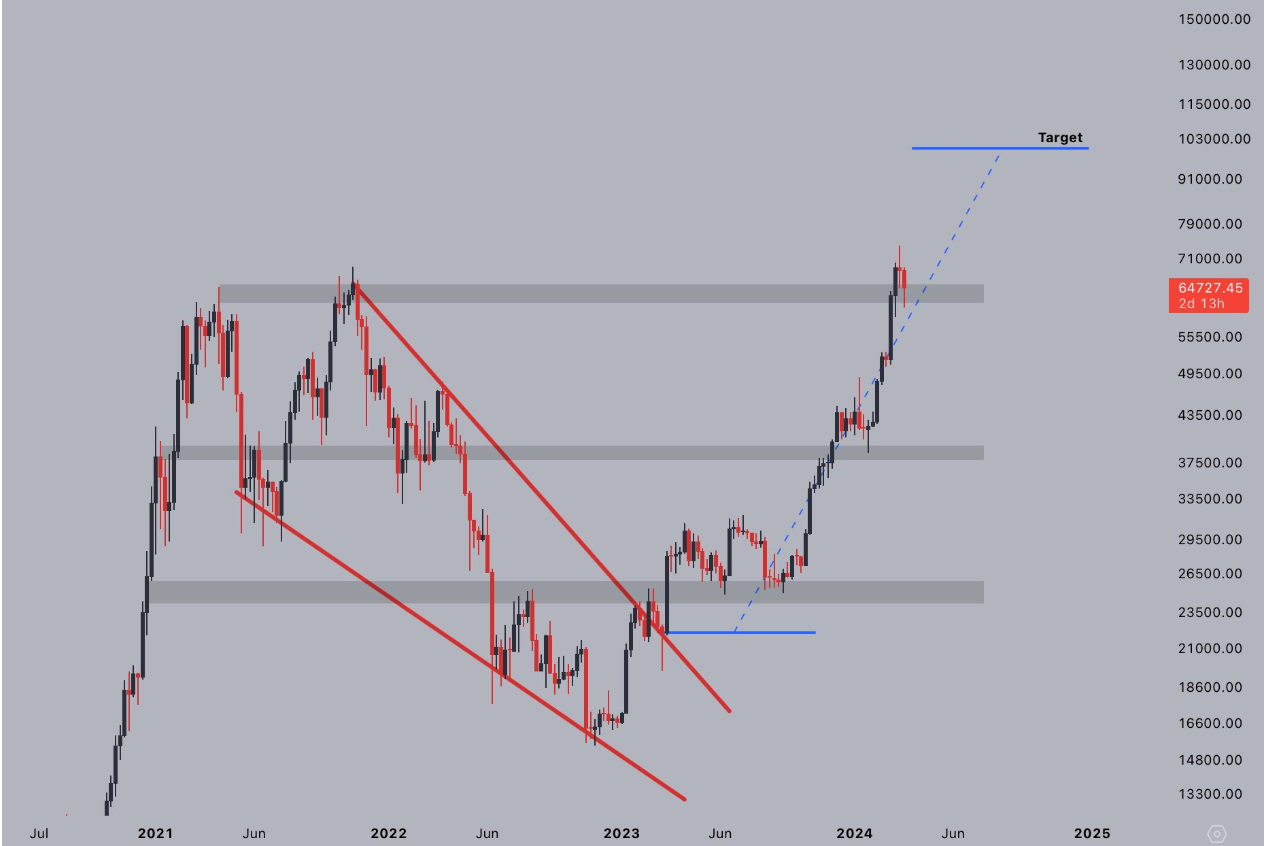

“If Bitcoin successfully flips this zone for support, there is very little standing in the way of price making its way towards the target of this falling wedge: $100,000,” he told X followers.

Eyeing downside, meanwhile, trader and analyst Rekt Capital drew comparisons to Bitcoin’s 2016 bull market.

Then, he noted, the period immediately before the block subsidy halving produced marked downside.

“Recently, Bitcoin has also produced a long downside wick on its Pre-Halving Retrace,” he explained .

“Bitcoin will need to continue to maintain these current highs to avoid a 2016-like fate where the initial reaction was strong but short-lived.”

The next halving event is currently due to hit in mid-April .

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.