Data: After Bitcoin halving, the stock prices of several Bitcoin mining companies have risen

According to data reported by Motley Fool, within a week after the halving of Bitcoin block rewards, despite miners' income being cut in half, several Bitcoin mining companies saw their stock prices rise. Riot Platforms' stock price rose as much as 36.3%, while Marathon Digital and Cipher Mining increased by 20.1% and 20.3% respectively. Analysts believe that the halving could eventually trigger consolidation in the mining industry, with well-capitalized mining companies acquiring less efficient competitors' assets, concentrating market share among a few competitors which helps improve profitability, especially when Bitcoin prices are rising. Furthermore, although an increase in market share may be positive, miners still need to profit from the spread between costs and Bitcoin prices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

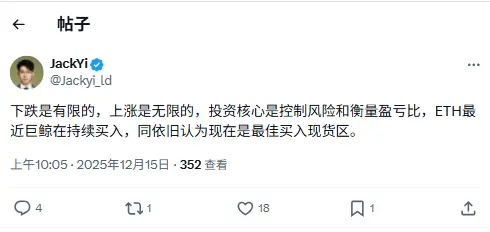

Yilihua: ETH whales are continuing to buy, and I still believe now is the best time to buy spot.

Eric Trump: Bitcoin Has No "Management," No Issues of Corruption, Fraud, or Abuse

Data: Hyperliquid platform whales currently hold $5.517 billions in positions, with a long-short ratio of 0.93.

AI blockchain security platform TestMachine completes $6.5 million financing, led by BlockChange Ventures and others