The EU is considering including cryptocurrencies in the 12 trillion euro investment market, and its impact may far exceed that of US ETFs

Golden Finance reported that the European Securities and Markets Authority (ESMA) is consulting the industry and experts on whether crypto assets should be included in investment products. This move is expected to open up a wider market for cryptocurrencies, far exceeding the market size of spot Bitcoin ETFs. The plan aims to expand the scope of application of UCITS (EU Transferable Securities Collective Investment Scheme), and the UCITS market size is as high as 12 trillion euros. If this move is implemented, it will be a key step in the mainstreaming of crypto assets in Europe. The consultation deadline for ESMA is August 7, and whether it will be approved remains to be seen. DLA Piper lawyer Andrea Pantaleo said that the impact of this move will far exceed that of US ETFs, as many fund departments may invest part of their liquidity in crypto assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

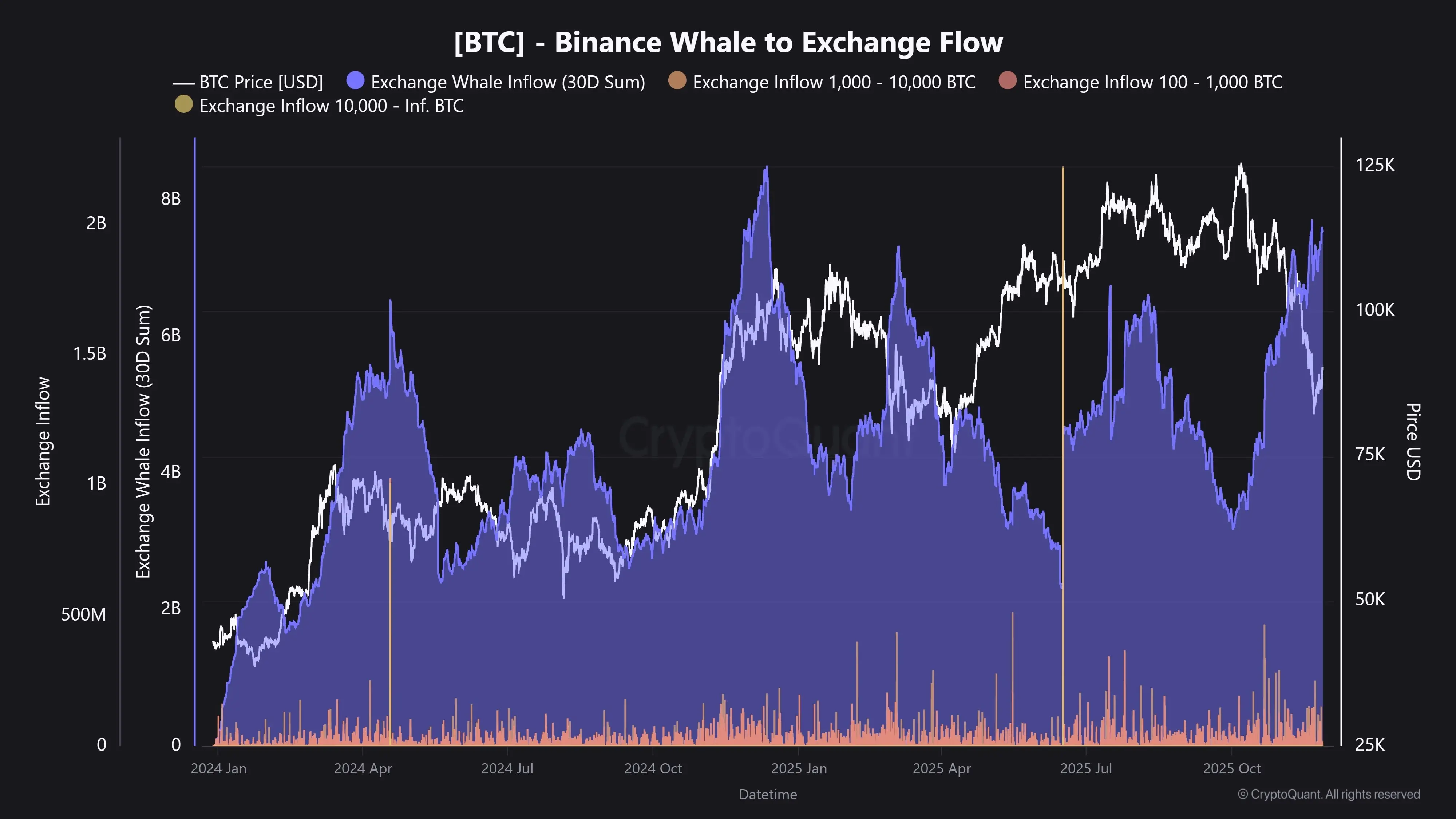

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month

Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.

CME Group: BrokerTec EU market is now open for trading, all other markets remain suspended