Bitcoin ( BTC ) threatened to give back early week gains on May 14 as volatility increased into macro data reports.

Bitcoin 'guardrail' gets stronger at $60K as bulls brace for macro data

BTC price moves become increasingly erratic in the hours leading up to a slew of U.S. macroeconomic data prints after Bitcoin bulls fail to flip $63,000.

BTC price "barts" up and down into PPI, Powell

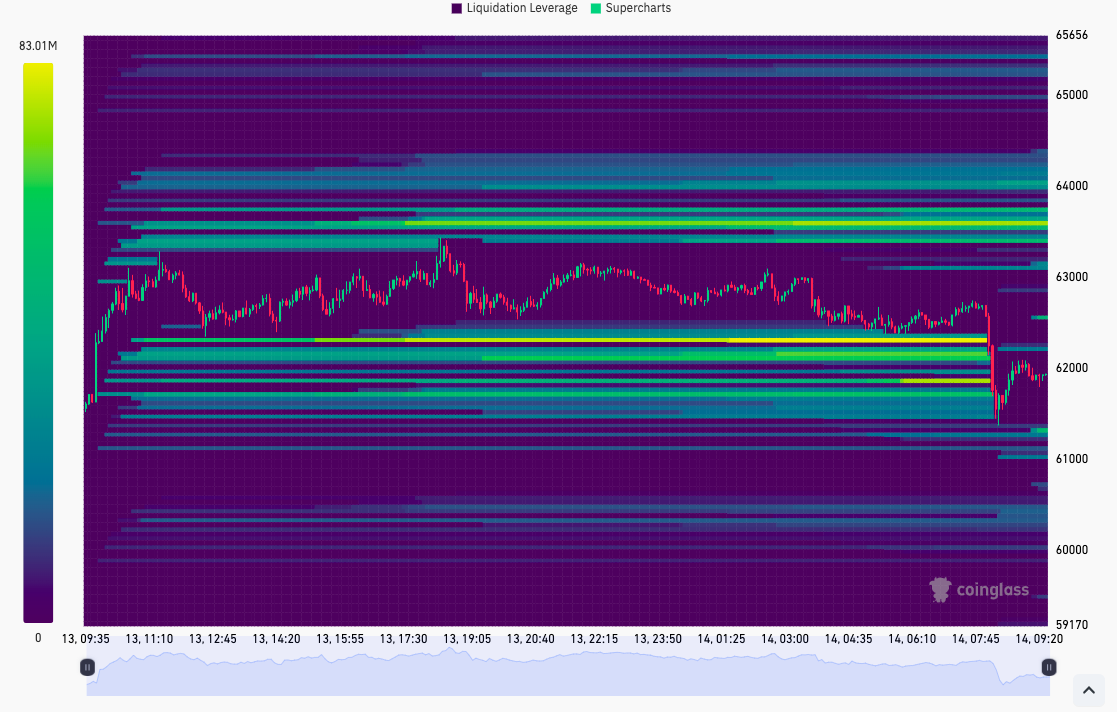

Data from Cointelegraph Markets Pro and TradingView showed BTC price weakness entering on hourly timeframes, producing a dip to $61,440 on Bitstamp.

BTC/USD had managed as high as $63,450 the day prior — a level at which shorts faced clear danger.

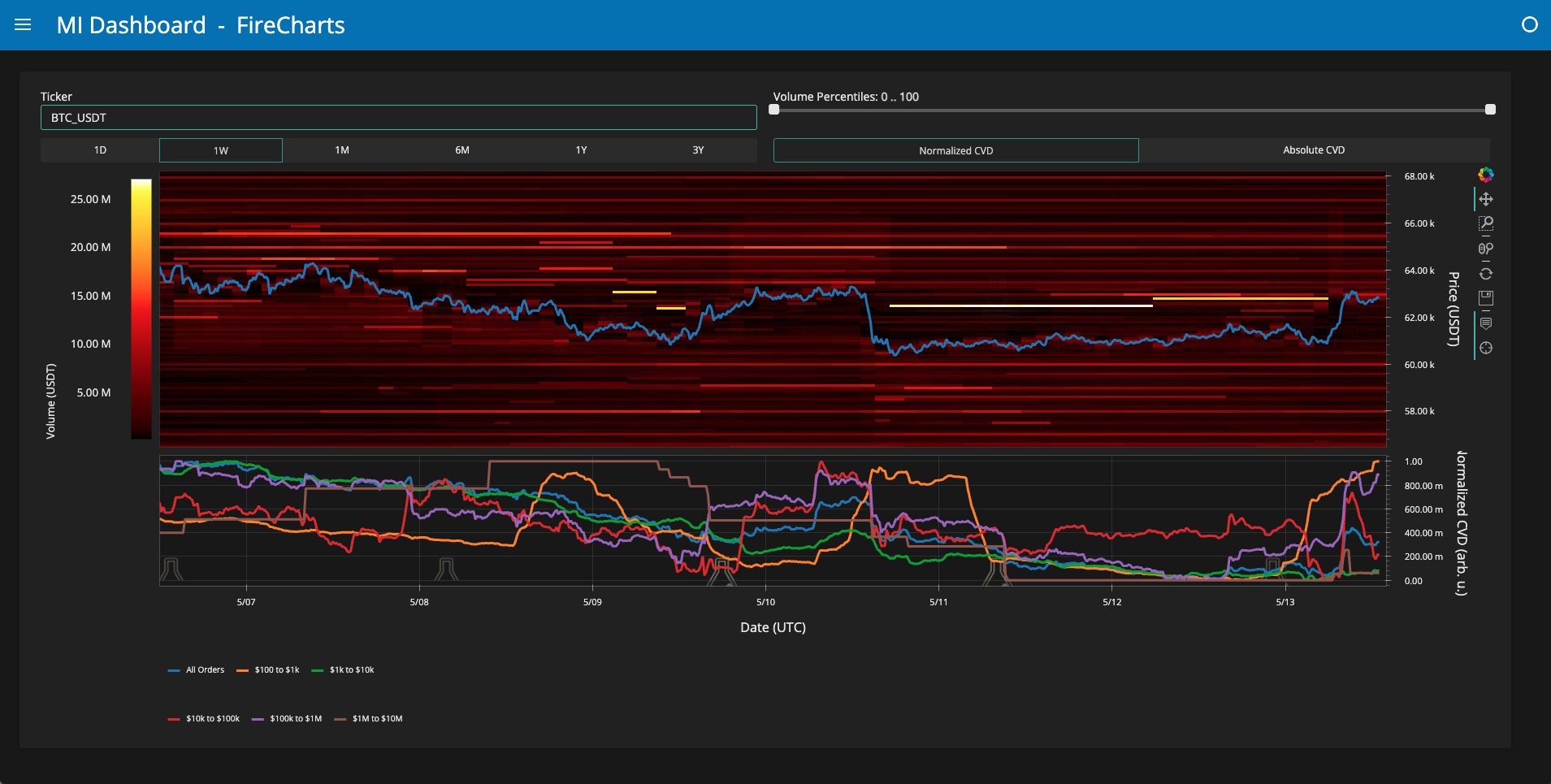

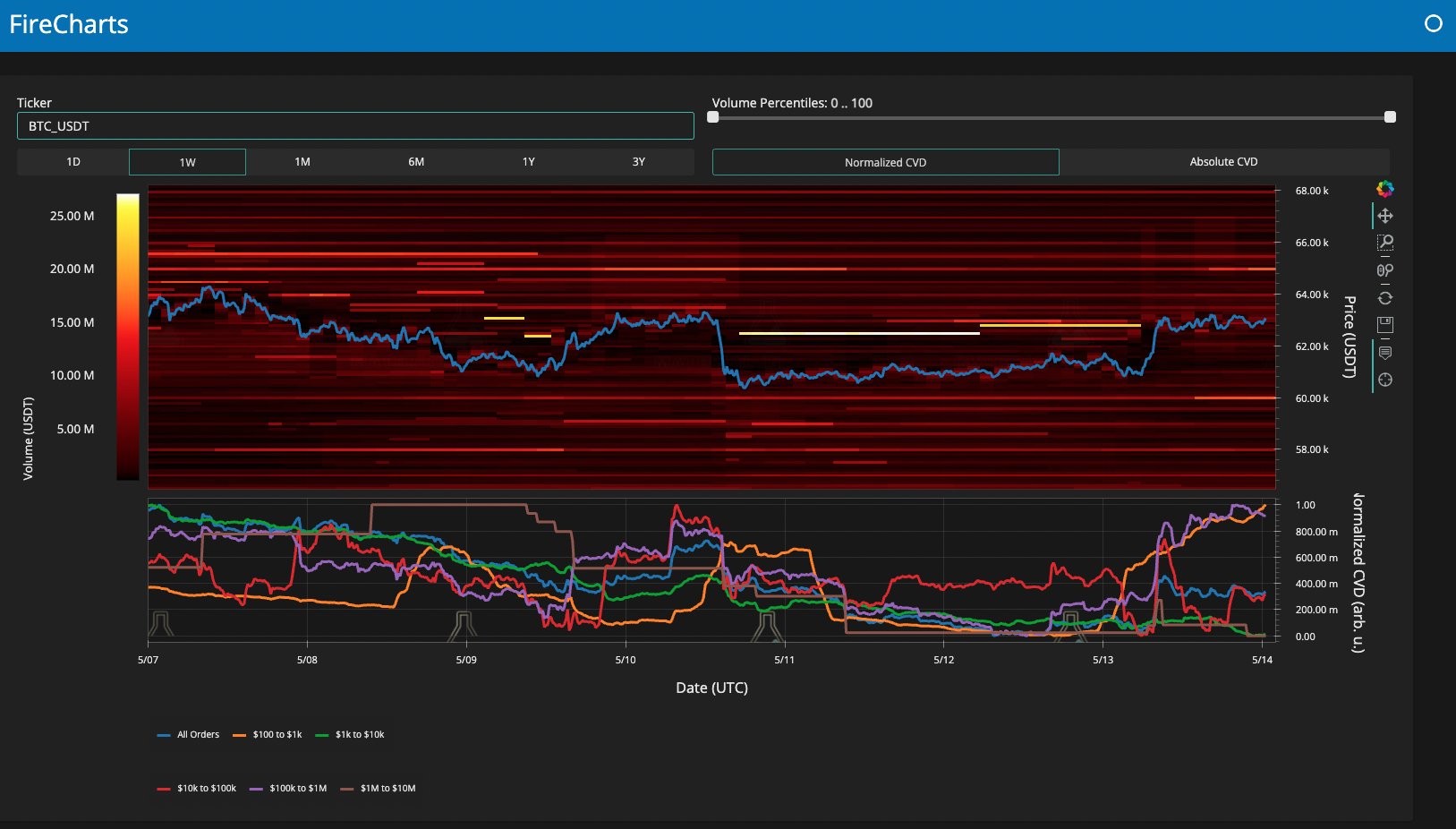

“If Bitcoin can clear $63k, over leveraged shorts are going to get squeezed,” trading resource Material Indicators warned in part of a post on X (formerly Twitter) at the time.

Bulls ultimately failed to find momentum, and at the time of writing, a hefty chunk of liquidity had been taken to the downside, per data from monitoring resource CoinGlass .

Zooming out, Material Indicators noted that bids were strengthening at both $60,000 and $65,000 in advance of economic reports from the United States.

These would take the form of the Producer Price Index (PPI) print on the day, along with commentary from Jerome Powell, Chair of the Federal Reserve.

“It's not uncommon to see ‘guardrails’ placed in the order book ahead of FED speeches and economic reports,” part of another X post read .

“It's also not uncommon to see them get pulled at the last minute.”

As Cointelegraph continues to report , Bitcoin has created a habit of neutralizing liquidity both above and below spot price while remaining in a narrow range since the end of last month.

Analyst: Expect "more significant" reactions to macro data

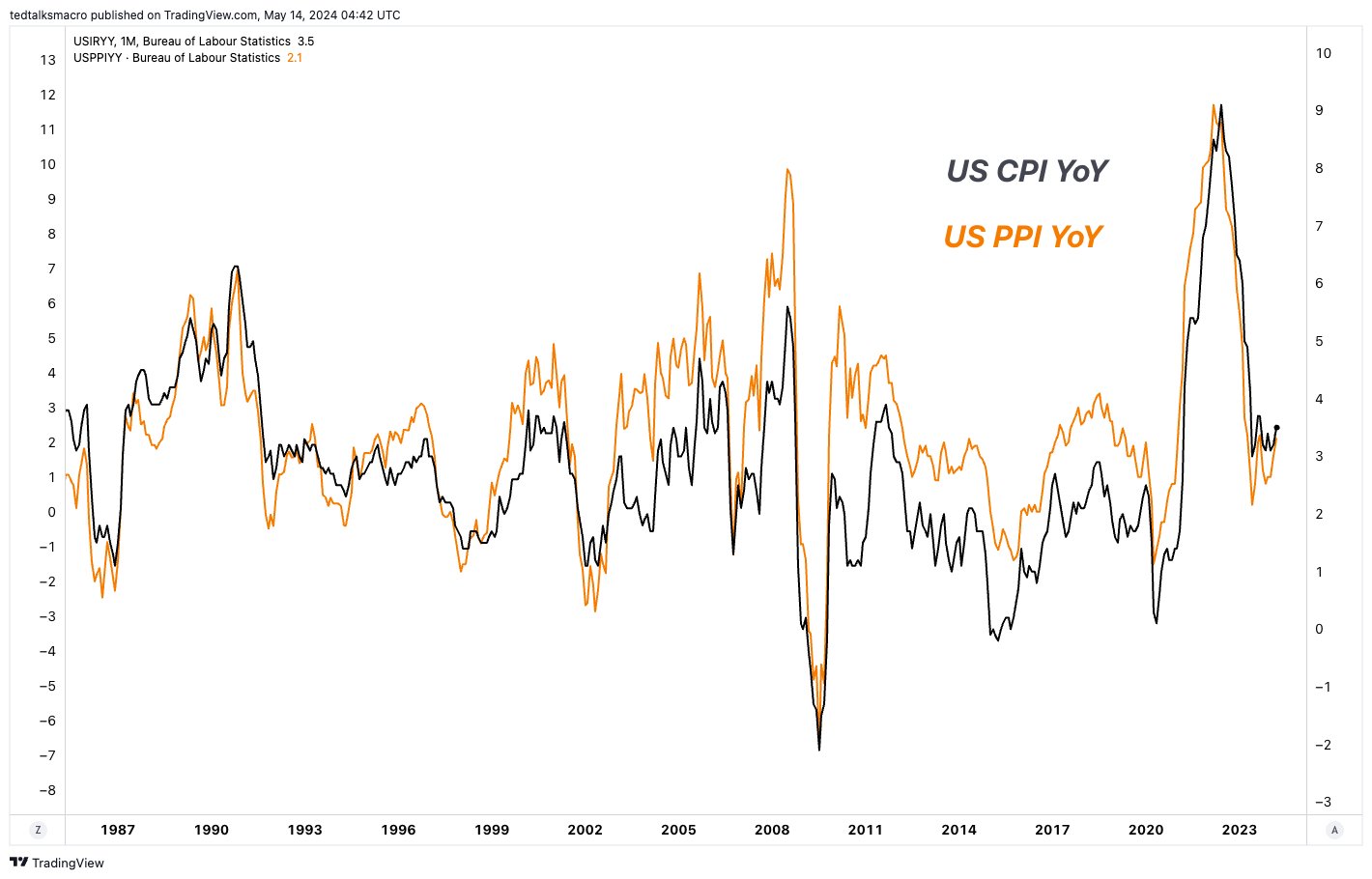

Considering the potential impact of the PPI numbers, financial commentator Tedtalksmacro revealed an unusual setup this week.

PPI, he noted, would come before the Consumer Price Index (CPI) readout for April — presenting a rare scenario for traders, not accounting for wildcard misses in the data itself.

“Today is a rare occasion where US PPI data is released the day prior to CPI data,” he told X followers.

“PPI + CPI data have a very strong correlation. PPI leading the way for CPI numbers historically. Thus expect the market to react more significantly than usual on any miss on expectations.”

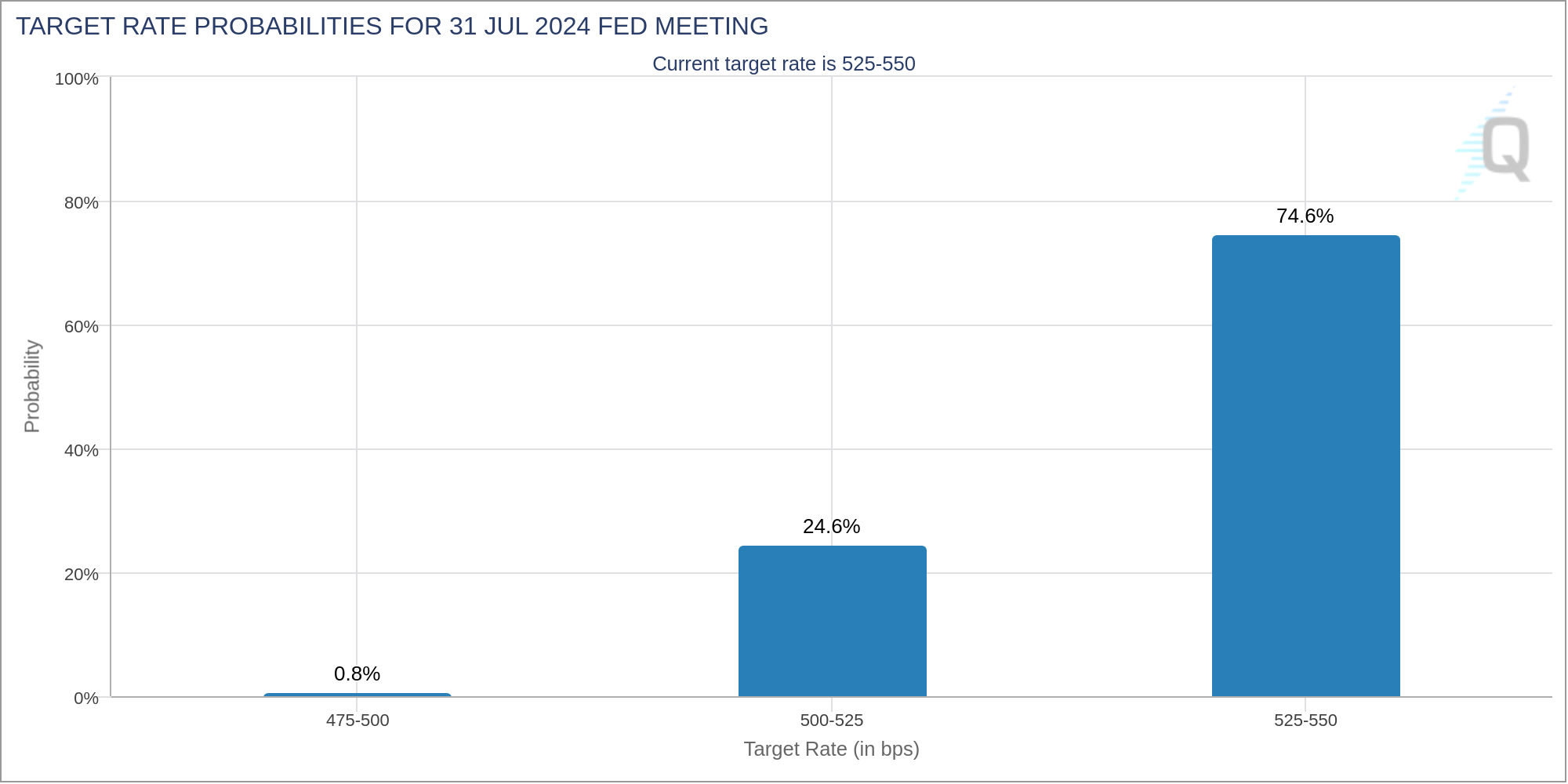

Data from CME Group’s FedWatch Tool underscored the need for serious surprises in order to shift market expectations of an interest rate cut from the Fed coming any sooner than September.

The odds of a 25-basis-point cut at the June meeting of the Federal Open Market Committee, or FOMC, stood at just 3.5% at the time of writing, with 24.6% for the July meeting.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Has the four-year cycle of Bitcoin failed?

The various anomalies in this cycle—including waning sentiment, weakening returns, disrupted rhythms, and institutional dominance—have indeed led the market to intuitively feel that the familiar four-year cycle is no longer effective.

At an internal Nvidia meeting, Jensen Huang admitted: It's too difficult. "If we do well, it's an AI bubble," and "if we fall even slightly short of expectations, the whole world will collapse."

Jensen Huang has rarely admitted that Nvidia is now facing an unsolvable dilemma: if its performance is outstanding, it will be accused of fueling the AI bubble; if its performance disappoints, it will be seen as evidence that the bubble has burst.

After a 1460% Surge: Reassessing the Value Foundation of ZEC

Narratives and sentiment can create myths, but fundamentals determine how far those myths can go.

The demise of a DAT company

The $1 billion Ethereum DAT plan led by Li Lin and others has been shelved due to the bear market, and funds have been returned. This "going with the flow" approach may reflect consideration of investor sentiment.