Marketnode to Launch Blockchain Funding Settlement Infrastructure in Late June, Tokenized Credit Product Next Q1

Marketnode, a digital asset company founded by Temasek and the Singapore Exchange (SGX), has announced its intention to launch a funds settlement infrastructure built on Blockchain technology in late June, and expects to announce additional strategic partners for the network, including financial institutions and infrastructure participants, later in 2024, and to launch tokenized credit products in Q1 2025 (e.g. bonds and loans). In previous news, Marketnode went live to announce the completion of a Series A funding round led by HSBC for an undisclosed amount.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

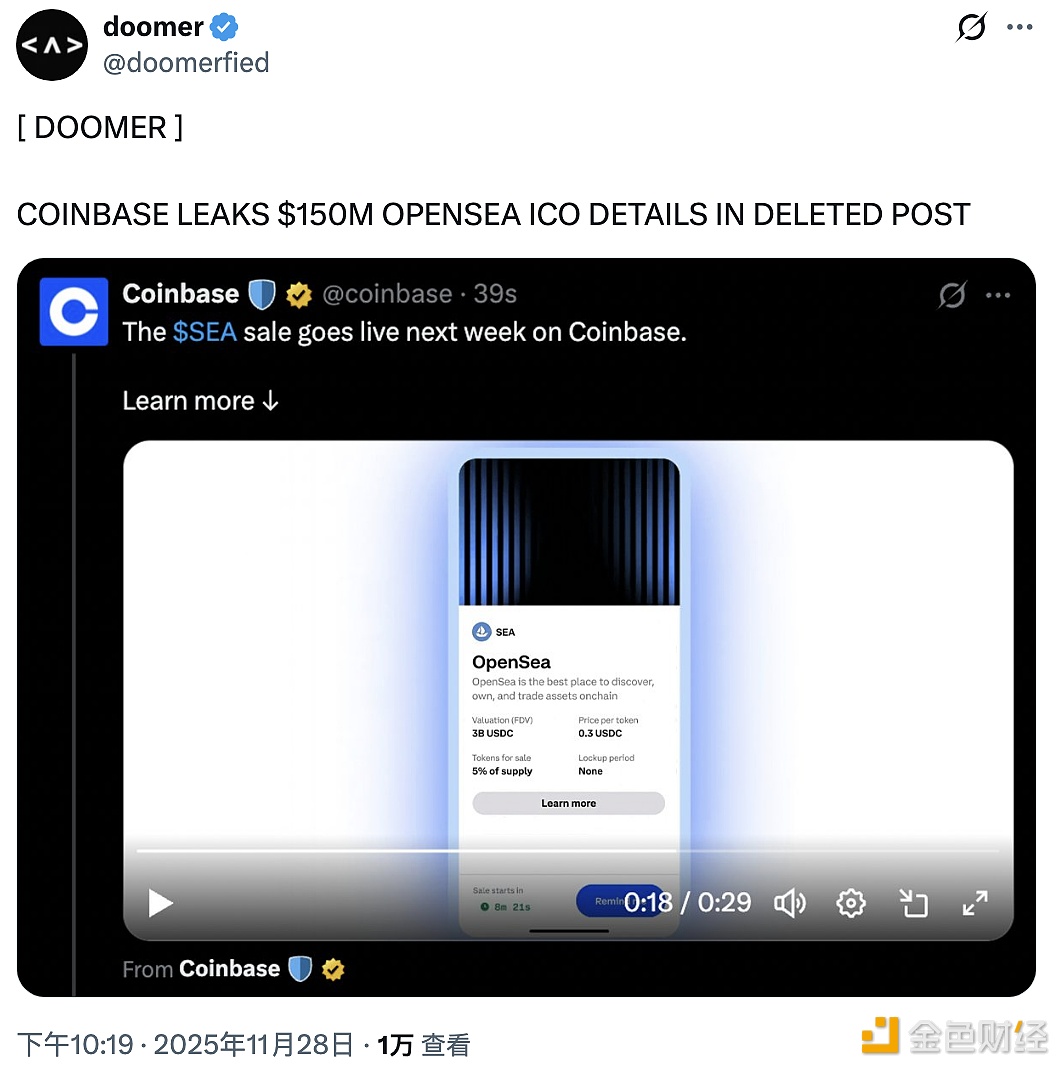

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.