PEPE, WIF, SHIB Drop Hard as BTC Struggles to Maintain $69K (Market Watch)

SHIB has slumped by more than 5% in the past day, while PEPE is down by 8%.

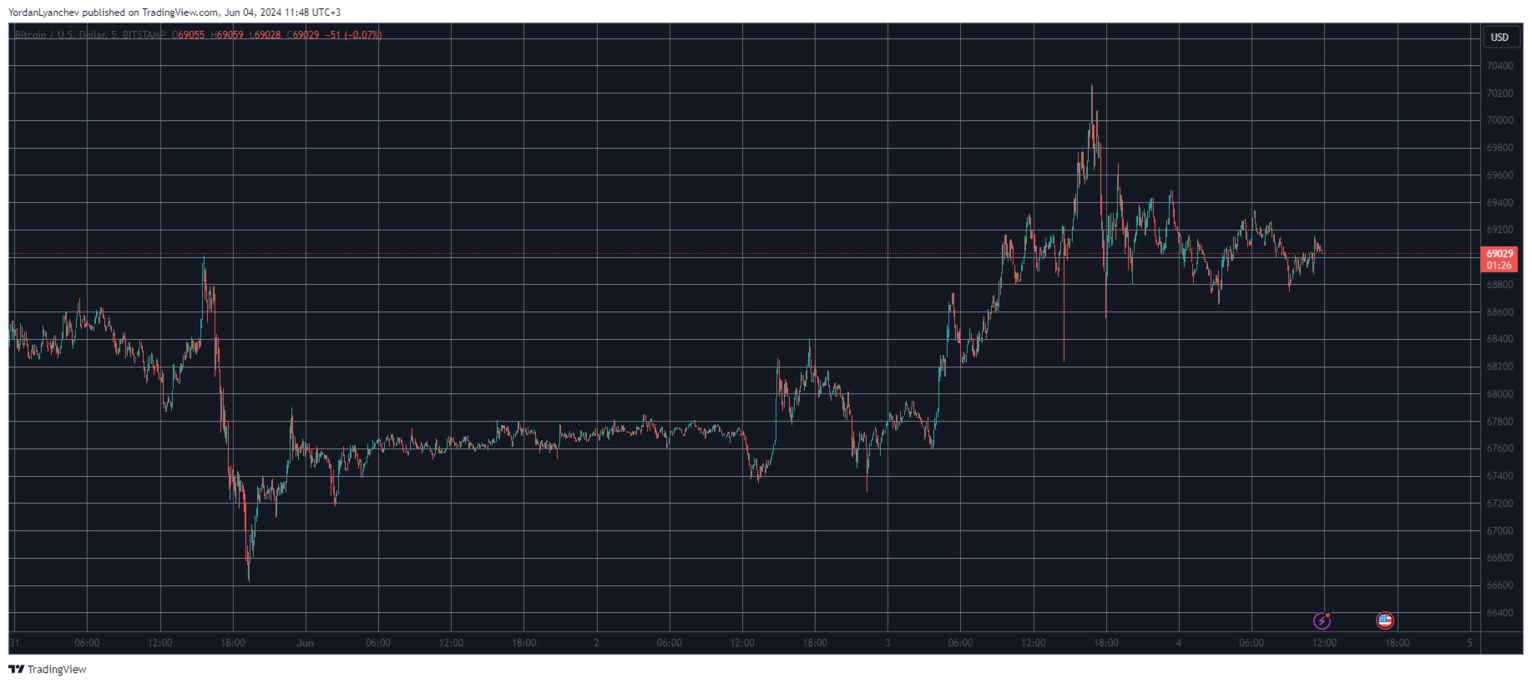

Bitcoin’s price faced some enhanced volatility in the past 24 hours as it popped to $70,200 but was violently rejected there and pushed down to $69,000.

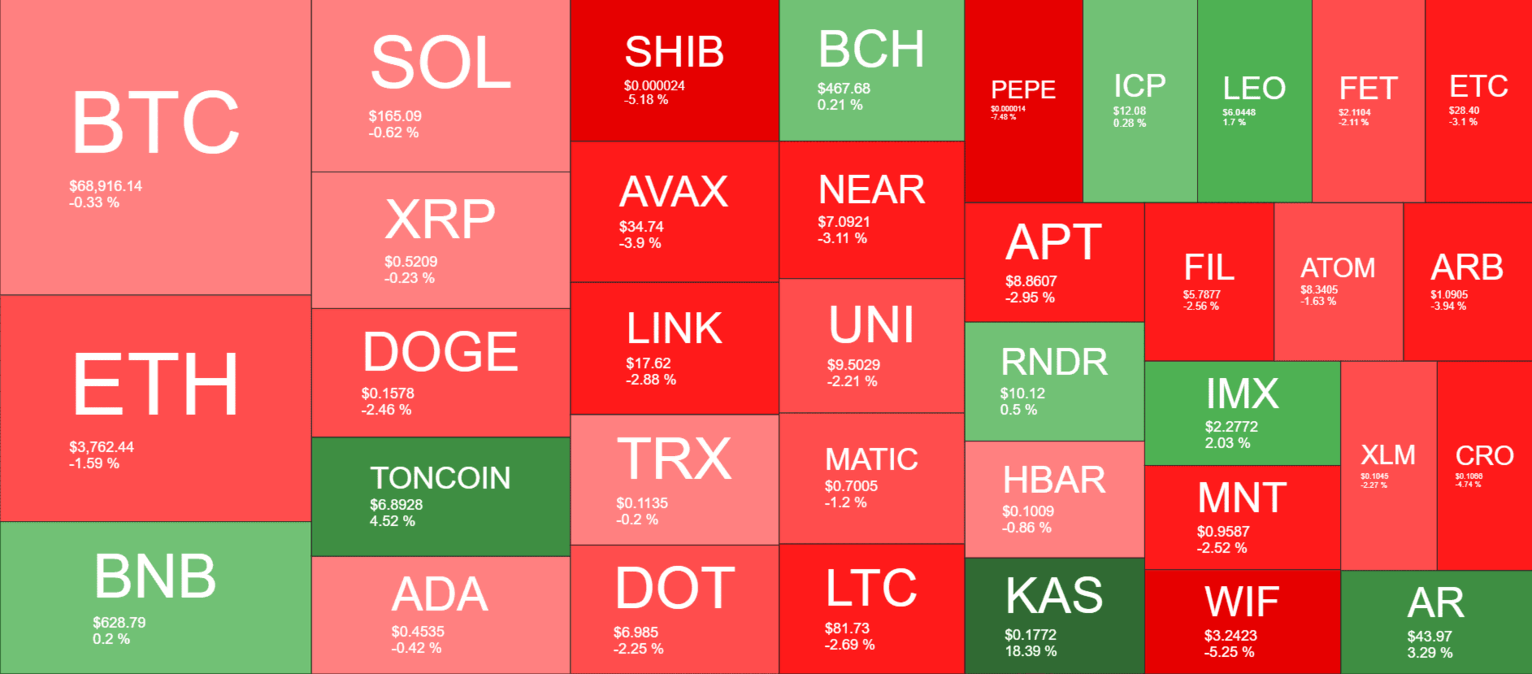

The altcoins are mostly in the red, while KAS skyrocketed by 19% and now trades close to $0.18

BTC Shaky at $69K

The primary cryptocurrency had a fluctuating end of the previous business week in which it attempted to overcome $69,000 but was stopped there by the bears. Moreover, the subsequent rejection saw the asset slump to $66,600, which became a multi-day low.

The bulls finally stepped up at this point and didn’t allow any further pain. Just the opposite, BTC bounced off and spent most of the weekend trading sideways at around $67,500.

It all started to change on Monday when bitcoin started a leg up that drove it to just over $70,200 for the first time in about a week. However, as it happened during the previous such attempt, BTC was stopped and it pulled back by nearly two grand.

Since then, the cryptocurrency has been shaky at around $69,000. Its market cap is just over $1.360 trillion, while its dominance over the alts has increased to 50.4% on CG.

Meme Coins in Retreat

Most of the larger-cap alts have turned red today, aside from TON, which has gained 4.5% and trades close to $7. ETH has slipped by 1.5% and is now close to breaking below $3,750, while SOL, XRP, ADA, TRX, MATIC, and UNI are with minor losses.

Shiba Inu, Avalanche, Chainlink, and NEAR have all dropped by 3-5%. More losses come from meme coins like Pepe (-7.5%) and WIF (-5%).

On the other hand, KAS has skyrocketed by 18% and now trades close to $0.18.

The total crypto market cap has shed samo value since yesterday but still remains north of $2.7 trillion on CG.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

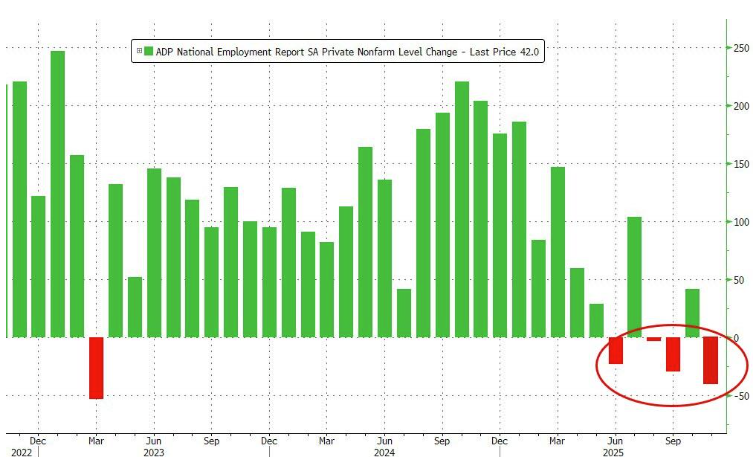

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.