The net asset value of Bitcoin spot ETFs is $60.009 billion, with a cumulative net inflow of $15.522 billion

According to SoSoValue data, as of yesterday (Eastern Time June 12), the net inflow of Bitcoin spot ETFs was $101 million USD. In detail:

Grayscale's ETF GBTC had a net outflow of $0.00 for the day, with a historical net outflow of $18.093 billion USD;

The Bitcoin spot ETF with the highest single-day net inflow was Fidelity's FBTC, which had a single-day net inflow of $50.623 million USD and has reached a total historical net inflow of $9.61 billion USD;

Next is BlackRock's IBIT, which had a single-day net inflow of $15.5789 million USD and has reached a total historical net inflow of $17.621 billion USD.

As at press time, the total asset value in Bitcoin spot ETFs stands at approximately 60.009 billion dollars; The ratio between this figure and bitcoin’s overall market cap — also known as its Net Asset Value Ratio — is currently around 4.47%. The cumulative historic flow into these funds totals about 15.522 billion dollars.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Suspected BitMine address increases holdings by 20,532 ETH

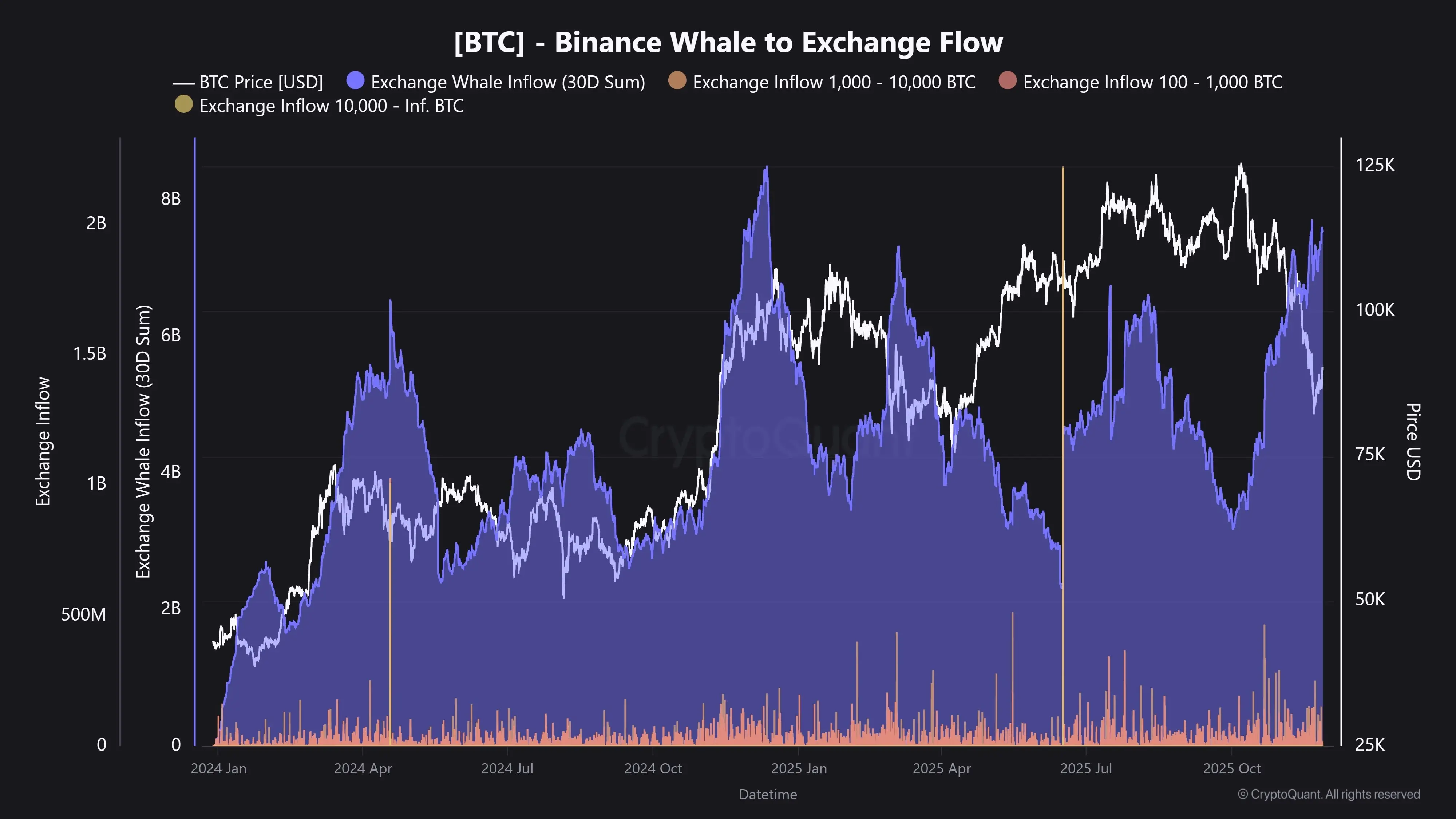

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month