Bitcoin sinks under $60,000 as $157 million in long positions are liquidated

Key Takeaways

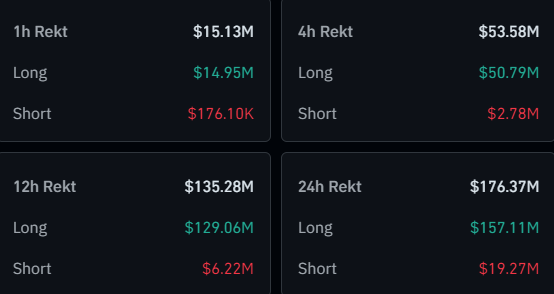

- Bitcoin fell 4.4% in 24 hours, dropping below $60,000 and triggering $157m in long position liquidations.

- Market concerns stem from potential Mt. Gox creditor sell-offs and Fed Chairman Powell's remarks on US economic instability.

Bitcoin (BTC) is down 4.4% in the past 24 hours after losing the $60,000 price floor today, according to data aggregator CoinGecko. This movement prompted a price slump in the whole market, resulting in nearly $157 million in long positions being liquidated intraday.

Image: Coinglass

Image: Coinglass

The negative performance of Bitcoin and other crypto could be tied to the looming fears of a Mt. Gox creditors’ sell-off this month, and a potential negative reaction to Jerome Powell’s remarks yesterday about the US economy.

As reported by Crypto Briefing, a CoinShares study highlights that the fear of a huge BTC sell-off by the repayment of Mt. Gox creditors might be exaggerated. The worst-case scenario shared in the study reveals a single 19% daily drop in price, although CoinShares analysts find this outcome to be unlikely.

Moreover, the speech by the Chairman of the Federal Reserve yesterday, in Portugal, raised some concerns among investors. Highlights from Powell’s remarks are the budget deficit being “very large and unsustainable,” the unemployment rate at 4% is still very low, and the Fed is not confident enough to cut interest rates.

This paints a picture of continuous economic instability in the US and leaves the market wondering how long it will take for the first interest rate cut. Therefore, this impacts crypto directly, as risk assets need both smaller interest rates and an optimistic landscape to become more attractive.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.