Grayscale’s latest survey reveals that if the spot Ethereum ETF gets approved, 25% more US voters will show interest in investing in Ethereum.

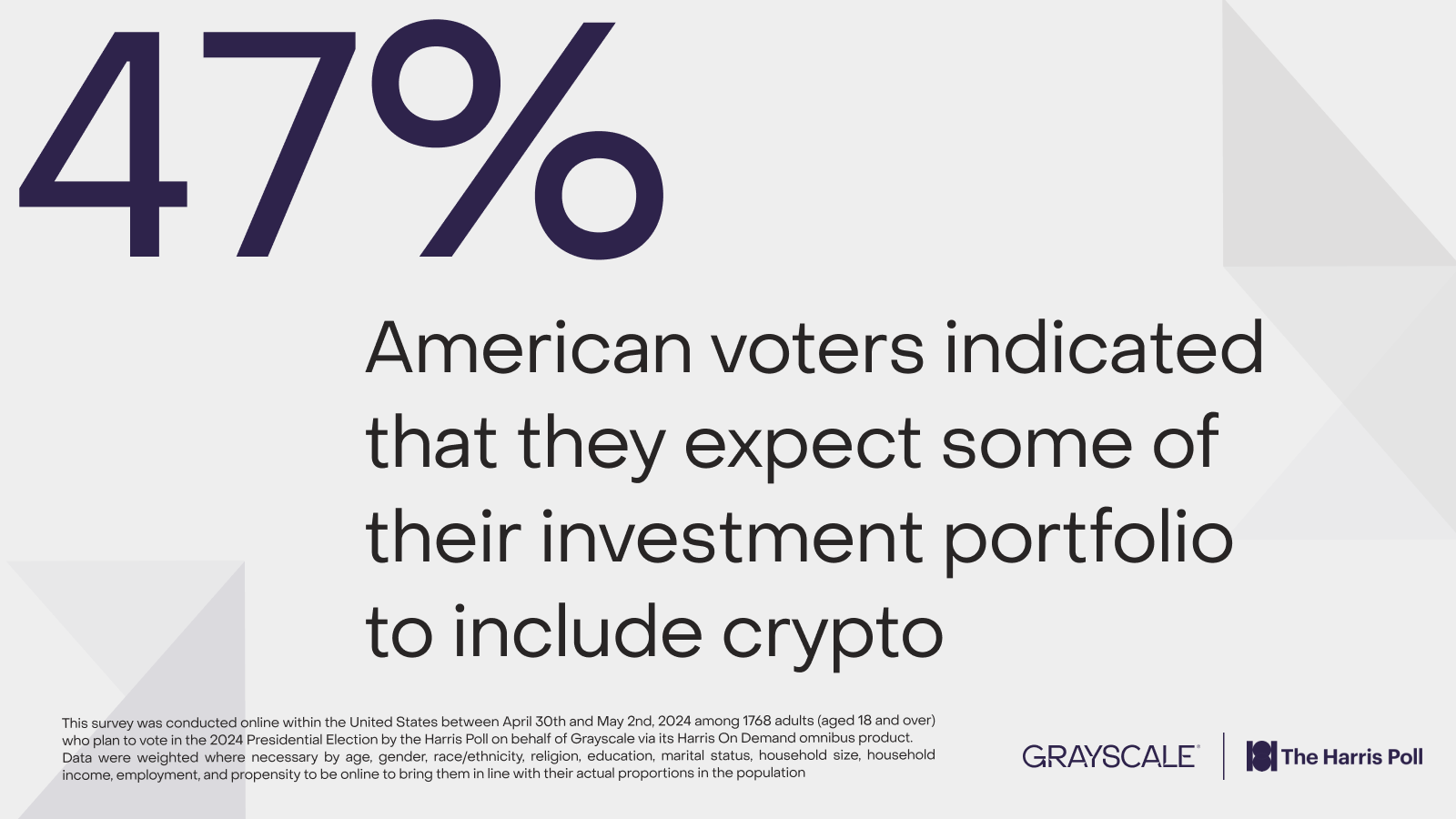

Last year, the survey showed that 40% of voters wanted to add cryptocurrencies to their portfolios. At the moment, it has increased to 47%.

Source: Grayscale

Source: Grayscale

The main motivation behind Americans’ newfound love for crypto is their concerns for financial stability as inflation and high costs of living plagues the nation.

Grayscale’s survey ranks “financial stability and being able to pay my bills” as the second motivation.

Economic concerns drive crypto interest

Economic concerns have historically been intertwined with cryptos. Bitcoin’s limited supply allows it to function like gold, acting as a store of value.

Grayscale found that the more familiar people are with cryptocurrencies, the more likely they are to see Bitcoin as a hedge against inflation and other macroeconomic events.

Nearly 70% of respondents report owning some type of investment asset, and about 19% own cryptocurrencies. Ownership is particularly high among men (23%), Black and Hispanic voters (26% and 32%), and younger voters.

31% of Gen Z respondents said they own crypto. These groups are also more likely to say that inflation has increased their interest in cryptocurrencies.

Despite the FTX crash, there’s still a lot of love for crypto in the country. Around 40% of investors believe their future portfolios will have Bitcoin.

Crypto: A bipartisan issue

Although Donald Trump is more openly supporting crypto on the campaign trail, Grayscale’s data shows that cryptocurrency is a bipartisan issue.

Ownership rates are similar among Republicans (18%) and Democrats (19%).

Voters are split on which party is more favorable to the crypto industry, with 30% of voters thinking that both the Democratic and Republican parties have favorable position on crypto policies.

This balanced interest aligns with recent bipartisan support in Congress for the resolution of SAB 121. This enables banks to serve as custodians for crypto, making crypto more accessible.

However, there are differences in how each party views the importance of crypto-related issues. Republican voters are more likely to see inflation and the economy as the most pressing issues facing America. 54% compared to 33% of Democrats.

While ownership levels are similar, Republicans care more. On the other hand, Democrats have prioritized issues like gun violence, climate change, and income inequality more than Republicans.

Meanwhile, Bitcoin and Ether’s prices continue to suffer due to government sell-offs and Mt. Gox’s repayment. After tumbling under $54,000, BTC has managed to stabilize at around $56,000 as of press time. Ether was worth $3,003.

Reporting by Jai Hamid