Germany finished selling off its Bitcoin yesterday, and almost immediately, the bearish pressure they triggered disappeared. Technical indicators turned bullish pretty quickly. Are we witnessing a full-on bullish reversal?

Check out my BTC/USD chart below. It is loaded with indicators. First, we have the 200-day moving average (blue line) sitting around $58,171.61.

This line is important because it’s acting like a safety net for the price. Bitcoin hovering near it means it could be finding solid ground.

But the price is also between other moving averages – the 20, 50, 100, and 200 EMAs. This mix makes it hard to predict the bulls’ next move.

The Ichimoku Cloud shows potential resistance levels at $60,051 and $62,737. Bitcoin might hit a wall here if it tries to climb higher.

The Parabolic SAR (those little dots above the price) tells us the trend is bearish right now. The dots need to flip below the price to signal a bullish turn. Currently, the SAR level is at $60,805, adding to the resistance around the $60,000 mark.

Next up, the MACD (Moving Average Convergence Divergence) is showing some hope for bulls. The MACD line (blue) is at 151.03, while the signal line (orange) is at -1,891.19.

Although the histogram is negative, it’s shrinking, which means the bearish momentum is slowing down.

If the MACD line crosses above the signal line, we could see a proper bullish reversal. But for now, it’s still in bearish territory, just not as strong. The Stochastic RSI is at 75.55 (blue line) and 68.60 (orange line), both above the overbought level of 70.

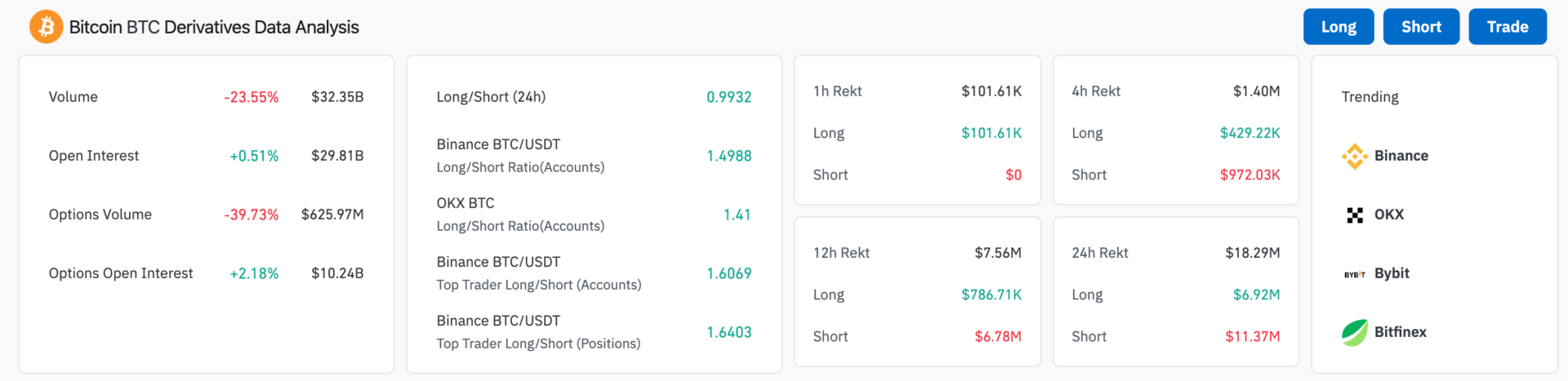

Source: Coinglass

Source: Coinglass

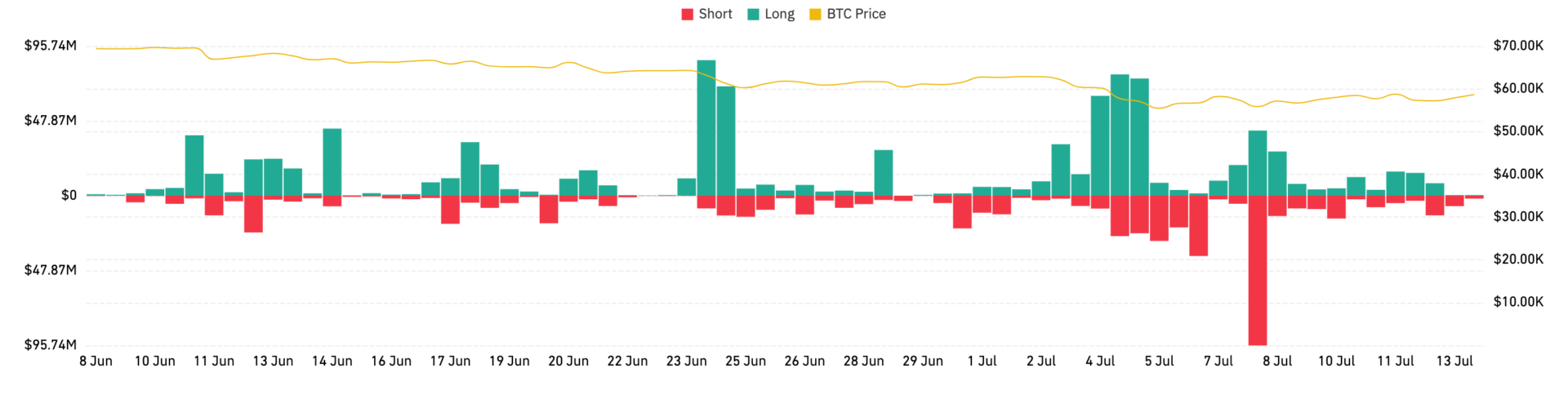

This means Bitcoin might be due for a correction as we see some short-term selling pressure thanks to traders taking profits. As for Bitcoin’s derivatives , they’ve seen some major liquidations recently.

Huge spikes in both long and short liquidations tell us that the market is still very volatile. But the most pronounced liquidations are in short positions, so the bulls’ presence is stronger in derivatives. Even though there has been a decrease in trading volume by 23.55% over the past twenty-four hours.

Source: Coinglass

Source: Coinglass

Clearly, traders are being cautious. However, open interest has increased by 0.51% to $29.81 billion, meaning more contracts are active in the market.

If Bitcoin can break through the key resistance around $60,000, we might see a strong bullish reversal. But with the overbought Stochastic RSI, a short-term pullback is also on the cards.