The Bitcoin price dropped 3% in the last 24 hours to trade at $63,878 as of 00:52 a.m. EST on trading volume that surged 26% to $35 billion.

Bitcoin’s price plunged below $65,000 for the first time since July 25 after the US Federal Reserve decided to keep interest rates unchanged while Chair Jerome Powell hinted at an interest rate cut in September.

The BTC price correction is also influenced by reports of escalating conflict in the Middle East, prompting investors to become more risk averse.

Bitcoin Price Bearish – Could The Bulls Stage A Bullish Trend Reversal?

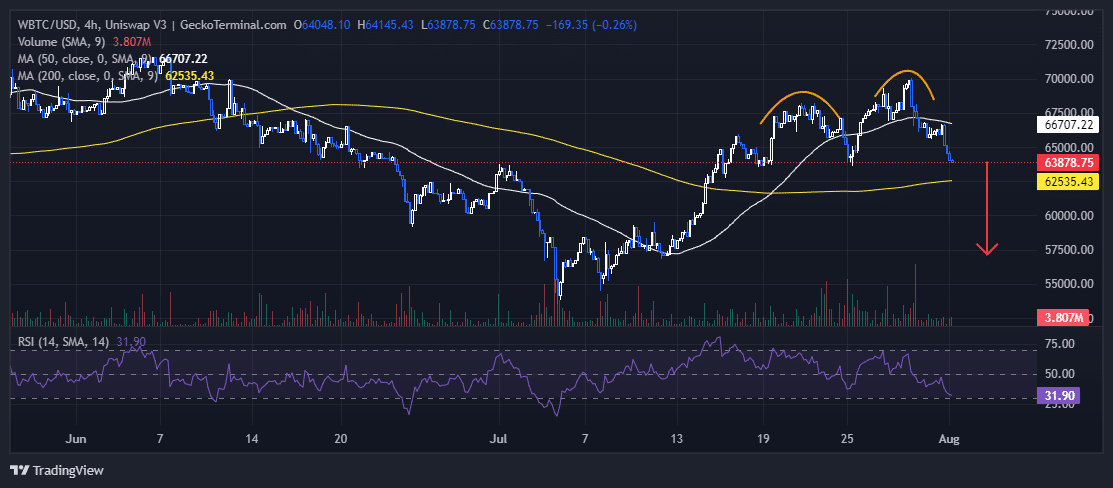

The Bitcoin price was on a rally in July, as it soared from $57,256 support to rally to as high as $69,968 on July 29, according to data from GeckoTerminal . However, the BTC price has formed a double-top pattern, which has created some bearish prospects, with BTC trading within the neckline.

The Relative Strength Index (RSI) is dropping towards the 30-oversold level, currently at 31, showing that the asset is undervalued and under intense selling pressure.

However, BTC trades above the 200-day Simple Moving Average (SMA), which the bulls could use to stage a bullish trend reversal. If the price surges, the 50-day SMA, at $66,707, acts as the immediate resistance.

According to the Bitcoin price analysis on the 4-hour chart, BTC is currently on a bearish trend. The bears capitalize on the double top pattern, as the RSI shows sellers have the upper hand.

If this pattern sustains, the BTC price could breach the $62,535 support to drop to the next support zone at $57,500.

Bitcoin price Chart Analysis Source: GeckoTerminal.com

Bitcoin price Chart Analysis Source: GeckoTerminal.com

Conversely, with the token trading above the 200-day SMA, there could be a bullish stance in the coming days, with a bullish trend reversal likely to push BTC up to $68,507.

Moreover, Bitcoin’s RSI is now at the oversold level, which could be a potential buy signal, pushing the price of Bitcoin up.