The Bitcoin price rose 1% in the last 24 hours to trade at $60,530 as of 09:55 p.m. EST, despite trading volume falling 28% to $32 billion.

The price of Bitcoin jumped higher yesterday to soar over the $60K level, tracking a surge in broader risk-driven markets as the positive U.S. labor market helped soothe last week’s concerns that a recession was imminent.

Bitcoin Price Could Still Rally

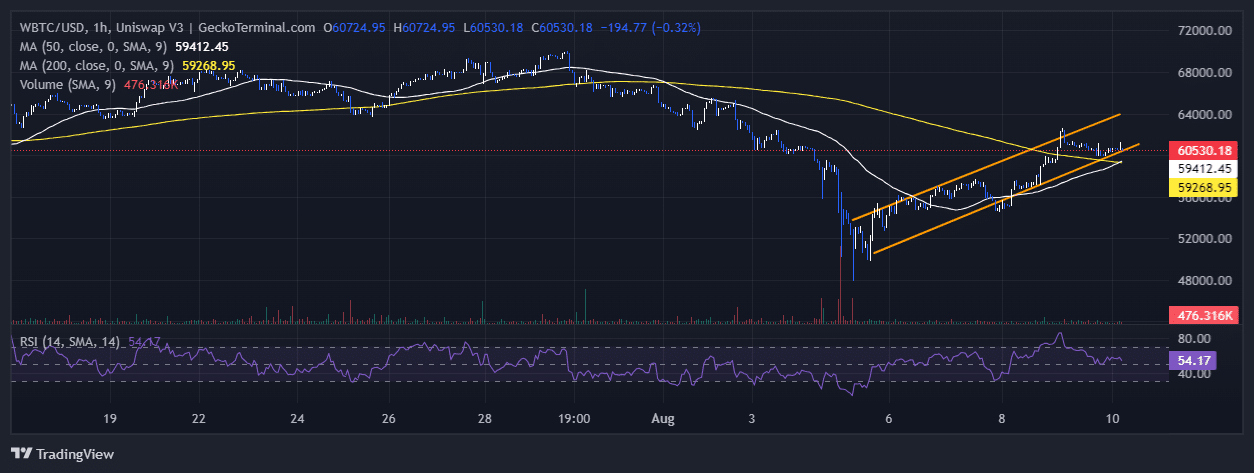

According to the Bitcoin price analysis on the 1-hour chart, BTC has been on a sustained rally in the last three days, rallying within the rising channel pattern. The bulls capitalized on the $50,000 support to push the token up, according to data from GeckoTerminal .

BTC now trades above both the 50-day and 200-day Simple Moving Averages (SMAs), a confirmation of the uptrend.

Moreover, after a recent crash, the Relative Strength Index seems to be rebounding from within the 50-midline level to trade currently at 54, which is an indication that BTC bulls are actively buying.

BTCUSD Chart Analysis Source: GeckoTerminal.com

BTCUSD Chart Analysis Source: GeckoTerminal.com

If the buying continues, the price of Bitcoin could soar above this point as the bulls target the $68,000 resistance. The 50-day SMA has now crossed above the 200-day SMA, forming a golden cross at $60,000. A Golden cross could encourage the bulls to take more buying positions, which could then propel the price of Bitcoin.

However, if the bears take control and breach the lower boundary of the channel, the price of Bitcoin could tumble back to the next major support at $55,000.