A recent $1.7 billion shift of “dormant” Bitcoin could lead to increased selling pressure in the crypto market, according to an on-chain Bitcoin analyst.

In an Aug. 13 post to CryptoQuant, pseudonymous trader XBTManager wrote that a total of 29,206 Bitcoin ( BTC ) that had been laying dormant for up to three years had been transferred on-chain between Aug. 11 and Aug. 12.

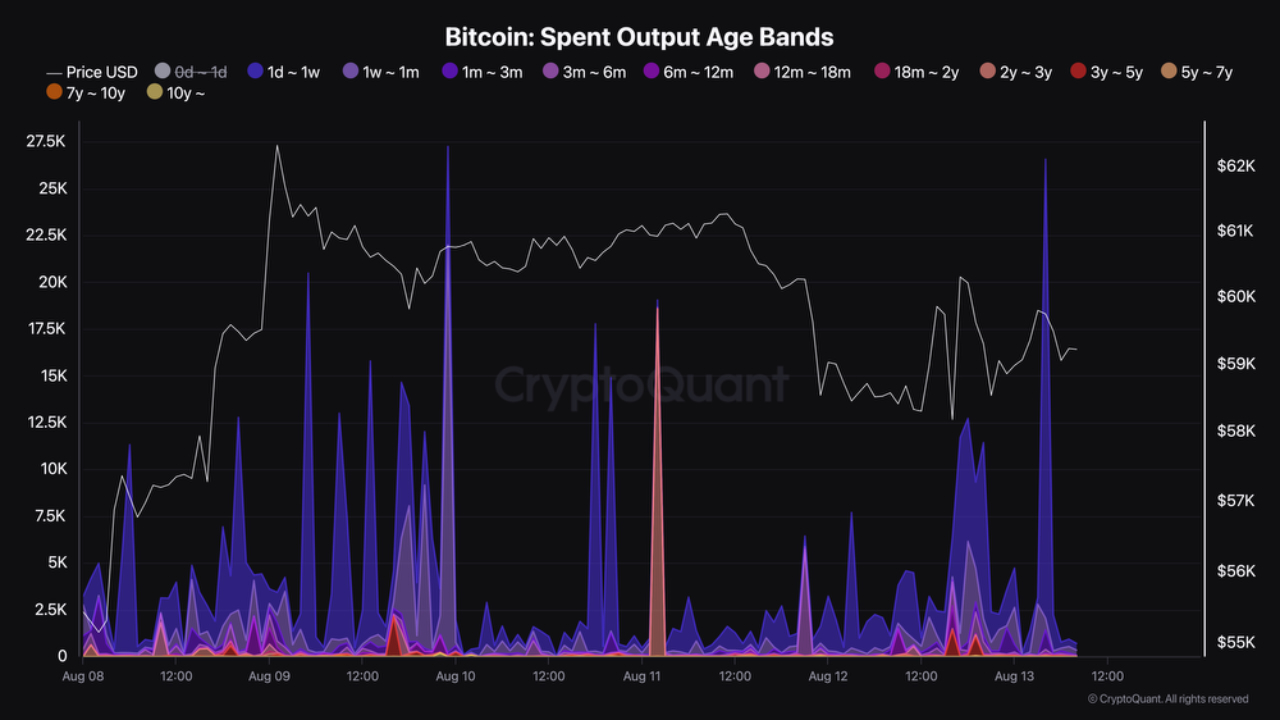

29,206 dormant BTC was shifted between Aug. 11 and Aug. 12. Source: CryptoQuant

XBT shared that 18,536 BTC that had been inactive for 2-3 years were shifted on Aug. 11 and created noticeable pressure on the price of Bitcoin. An additional 5,684 BTC that had been inactive for 3-6 months were also moved a few hours later.

On Aug. 12, 4,986 BTC that had been inactive for 3-12 months, along with 2,394 BTC that had been dormant for 3-5 years, were moved on-chain.

“When these long-dormant Bitcoin are moved, it often leads to increased selling pressure in the market. In times of low liquidity, this can create downward pressure on prices, which could potentially continue.”

In an Aug. 14 investment note viewed by Cointelegraph, IG markets analyst Tony Sycamore offered a more bullish perspective on Bitcoin in the mid-term, noting strengthening macro conditions following last week’s $500 billion crypto market sell-off.

Sycamore said Bitcoin had been “boosted by the continued improvement in risk sentiment and sell-off in US yields” following cooler-than-expected US PPI data.

“With positioning significantly cleaner after last week’s false break below $50,000 we look for Bitcoin to extend gains toward trend channel resistance near $70,000 in the sessions ahead.”

In an Aug 13 market report , Glassnode analysts said the current market was characterized by a “discernible level of uncertainty.” However, they noted that a preference for HODLing was beginning to emerge among market participants.

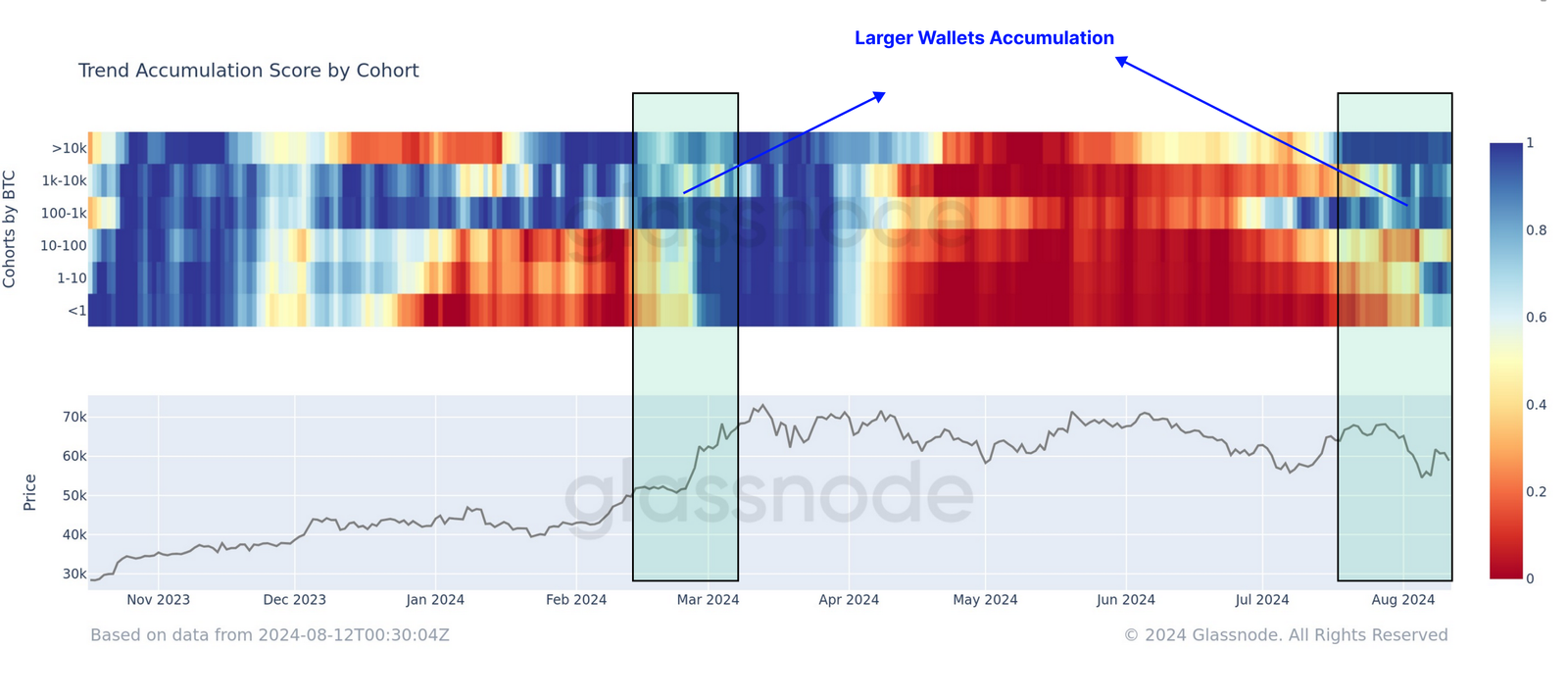

The analysts said that following Bitcoin notching a new all-time high in March , the crypto market faced an extensive “supply distribution” period — a technical way of saying that funds were moved around a lot.

“Over the last few weeks, this trend is showing early signs of reversing, particularly for the largest wallet sizes which are often associated with ETFs. These large wallets appear to be returning to a regime of accumulation,” wrote the analysts.

Large wallets have begun accumulating Bitcoin again. Source: Glassnode

The analysts concluded that overall, current on-chain conditions point to an “undertone of high conviction” amongst the Bitcoin holder base.