Bitcoin ( BTC ) spiked through $62,000 after the Aug. 23 Wall Street open as the United States Federal Reserve announced the first interest rate cuts since 2019.

Bitcoin price taps $62K sell wall as analyst sees 'up only' for crypto

Bitcoin bulls charge into key BTC price resistance as the US Federal Reserve gives a clear signal over interest rate cuts.

BTC price volatile as Fed's Powell says policy should "adjust"

Data from Cointelegraph Markets Pro and TradingView showed new local BTC price highs of $62,323 on Bitstamp.

Investors reacted warmly to confirmation by Fed Chair Jerome Powell that interest rates were now due to fall.

“The time has come for policy to adjust,” he said during a speech at the annual Jackson Hole symposium.

The event, which markets had keenly watched for policy easing cues, saw a dovish Powell herald an “appropriate dialling back of policy restraint” while not giving a concrete timeline for the cuts to begin.

“The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions,” he continued.

Employment had formed a key topic of debate over the week after a snap drawdown saw job openings for the twelve months through March 2024 revised lower by 818,000 .

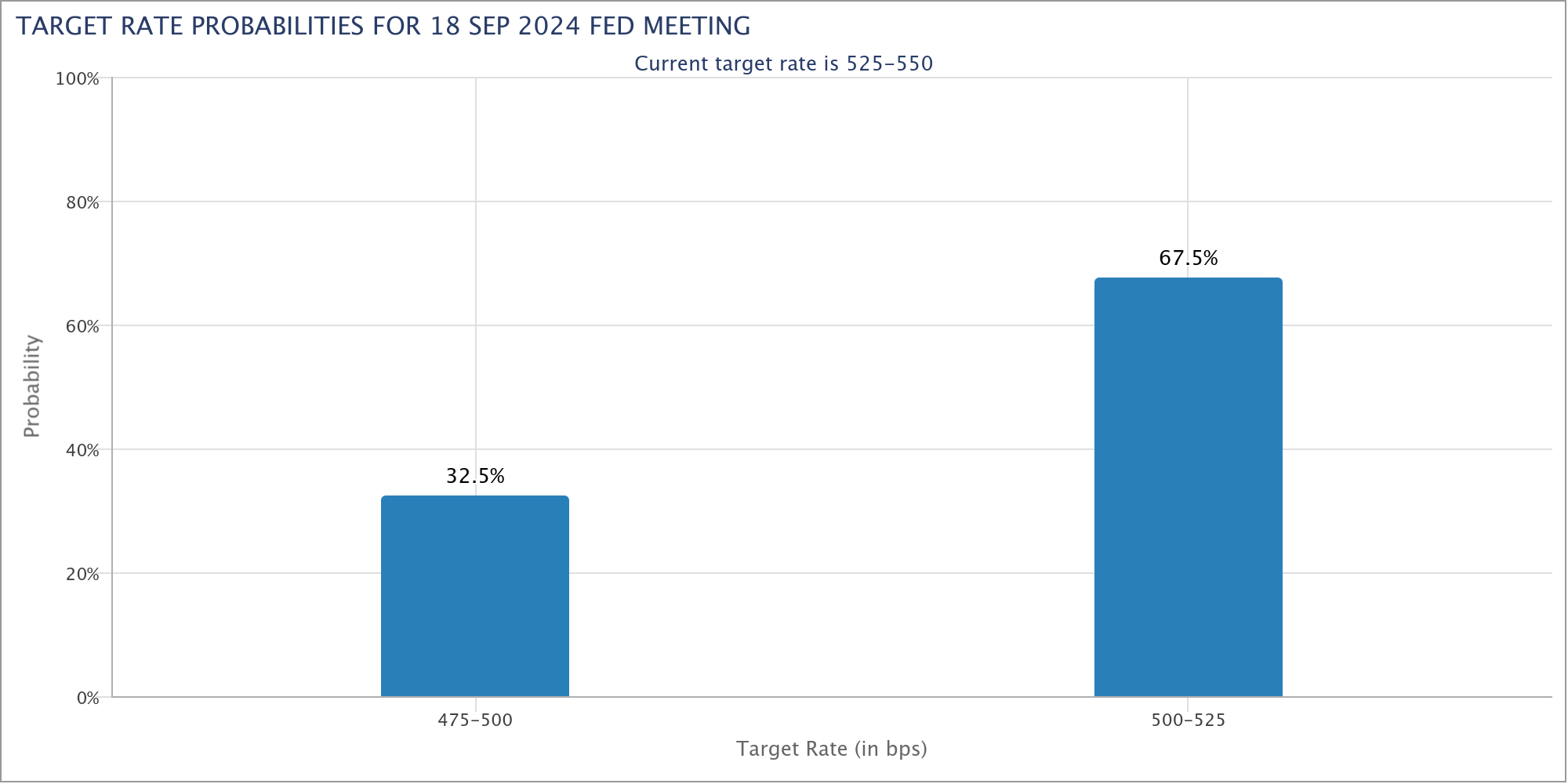

The latest data from CME Group’s FedWatch Tool meanwhile saw markets betting on a 0.25% rate cut at the Fed’s next meeting at the end of September.

Responding, Bitcoin market commentators were in a bullish mood.

“Powell goes full dove,” trader, analyst and podcast host Scott Melker, known as the “Wolf of All Streets,” summarized in a post on X alongside Powell’s quotes.

Arthur Hayes, former CEO of crypto exchange BitMEX, predicted “up only time for crypto.”

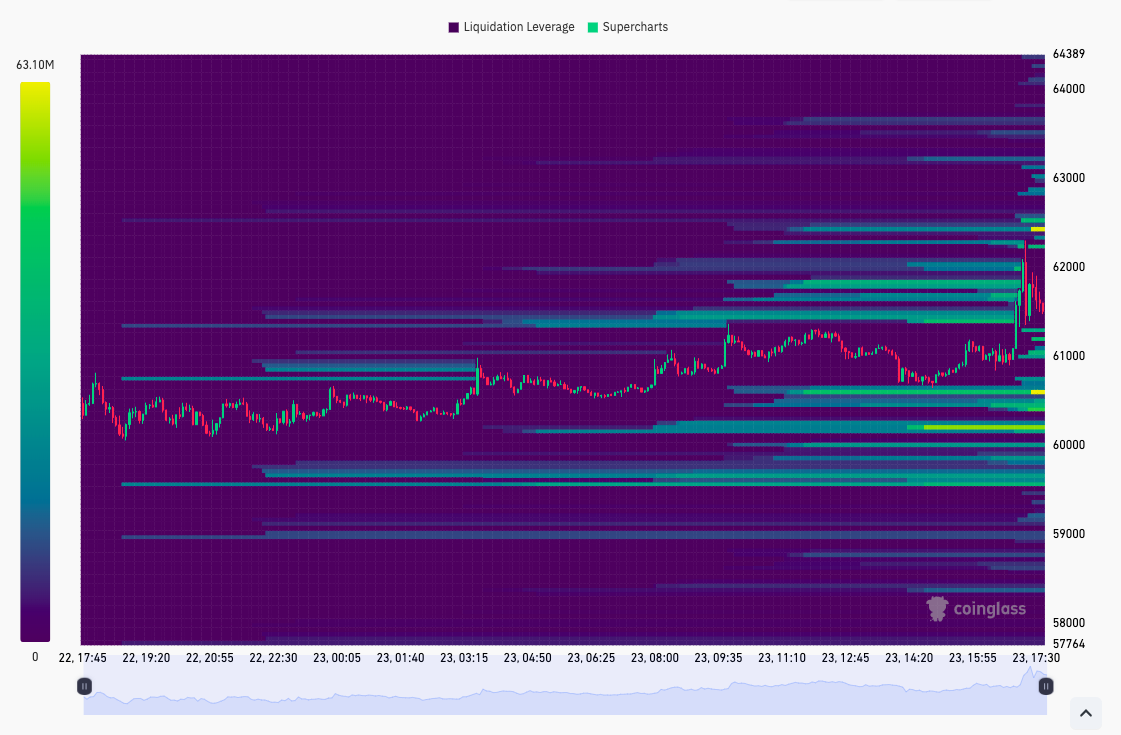

“$BTC liquidations to the upside getting hit and a long wick forming,” popular trader CrypNuevo wrote while ananlyzing low-timeframe market moves.

Bitcoin traders up liquidity games

The latest data from monitoring resource CoinGlass tracked liquidity shifts across exchange order books. It revealed a new block of ask liquidity being added at $62,450, keeping price from heading any higher at the time of writing.

$62,000 nonetheless remained the key breakout level for bulls to flip to support on daily timeframes.

“Bitcoin is still facing a crucial breakout. If it breaks through $62K, that would be a sign for the markets to continue rallying this week,” Michaël van de Poppe, founder and CEO of trading firm MNTrading, confirmed in his latest X analysis.

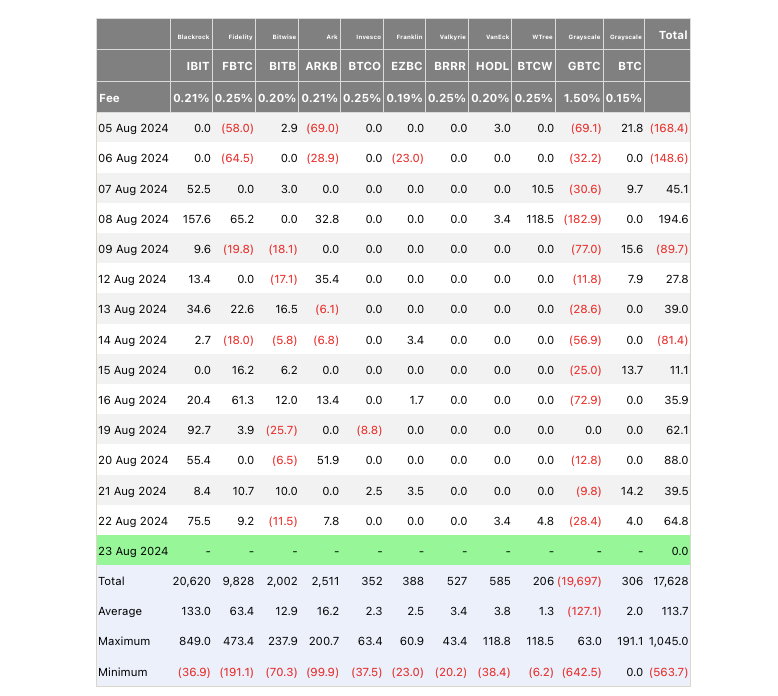

Van de Poppe added that the influx of capital to the US spot Bitcoin exchange-traded funds (ETFs) over the past week meant such a scenario was “likely.”

“We'll likely have that breakout, given the massive inflow we've seen in the ETF the past week,” he wrote.

Data from sources including United Kingdom-based investment firm Farside Investors put net ETF inflows for the first four days of the week at just over $250 million.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.