Bitcoin ( BTC ) went nowhere at the Aug. 26 Wall Street open as analysis stepped up warnings of a short-term BTC price correction.

Bitcoin liquidity sinks to $62.5K as BTC price struggles at US open

BTC price momentum sags as Wall Street returns amid surprise that Bitcoin could not capitalize further on last week’s macro news.

"No straight lines" for Bitcoin rebound

Data from Cointelegraph Markets Pro and TradingView revealed signs of weakness starting to show on low timeframes as BTC/USD stayed below $64,000.

A trip to $63,128 on Bitstamp, the lowest since before the weekend, set the scene for cautious words from popular market commentators.

“TLDR: There are NO straight lines,” trading resource Material Indicators wrote in a post on X.

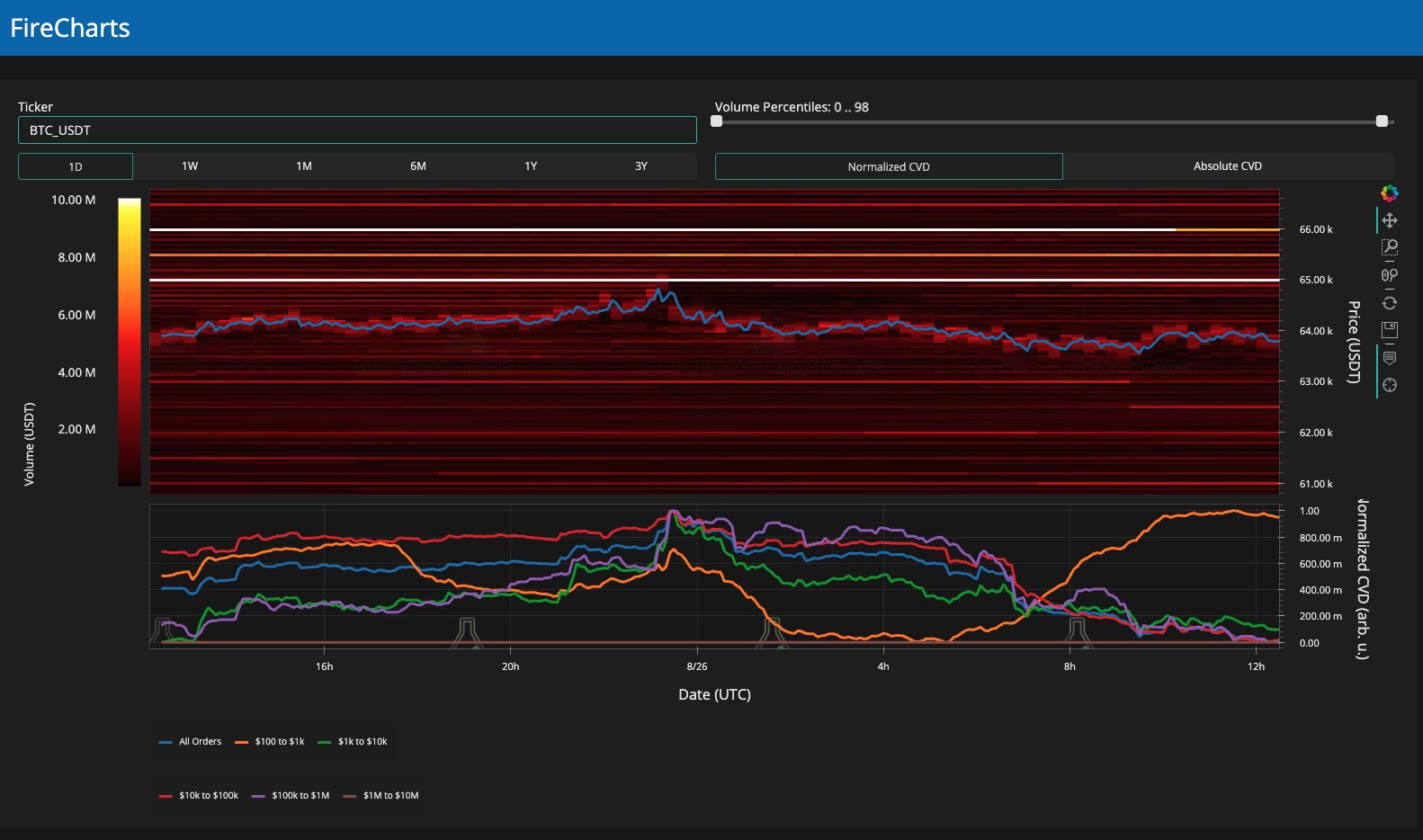

An accompanying chart from one of its proprietary trading tools showed shifting order book liquidity on largest global exchange Binance favoring bears’ cause.

“FireCharts shows Bitcoin bid liquidity moving down to $62.5k. Moves like this tend to draw price downward. It also tends to lure in late shorts,” it continued.

“Be mindful of your positions and resist the urge to overtrade. Expecting volatility through the monthly close.”

Popular trader Crypto Chase meanwhile warned that Bitcoin “lacking the aggressive follow through you'd typically see from a true breakout.”

“The more people given an opportunity to get aboard (US waking up), the less one should trust it IMO. After sweeping a low prior to a true pump, local prices typically aren't offered for hours,” he wrote about short timeframes.

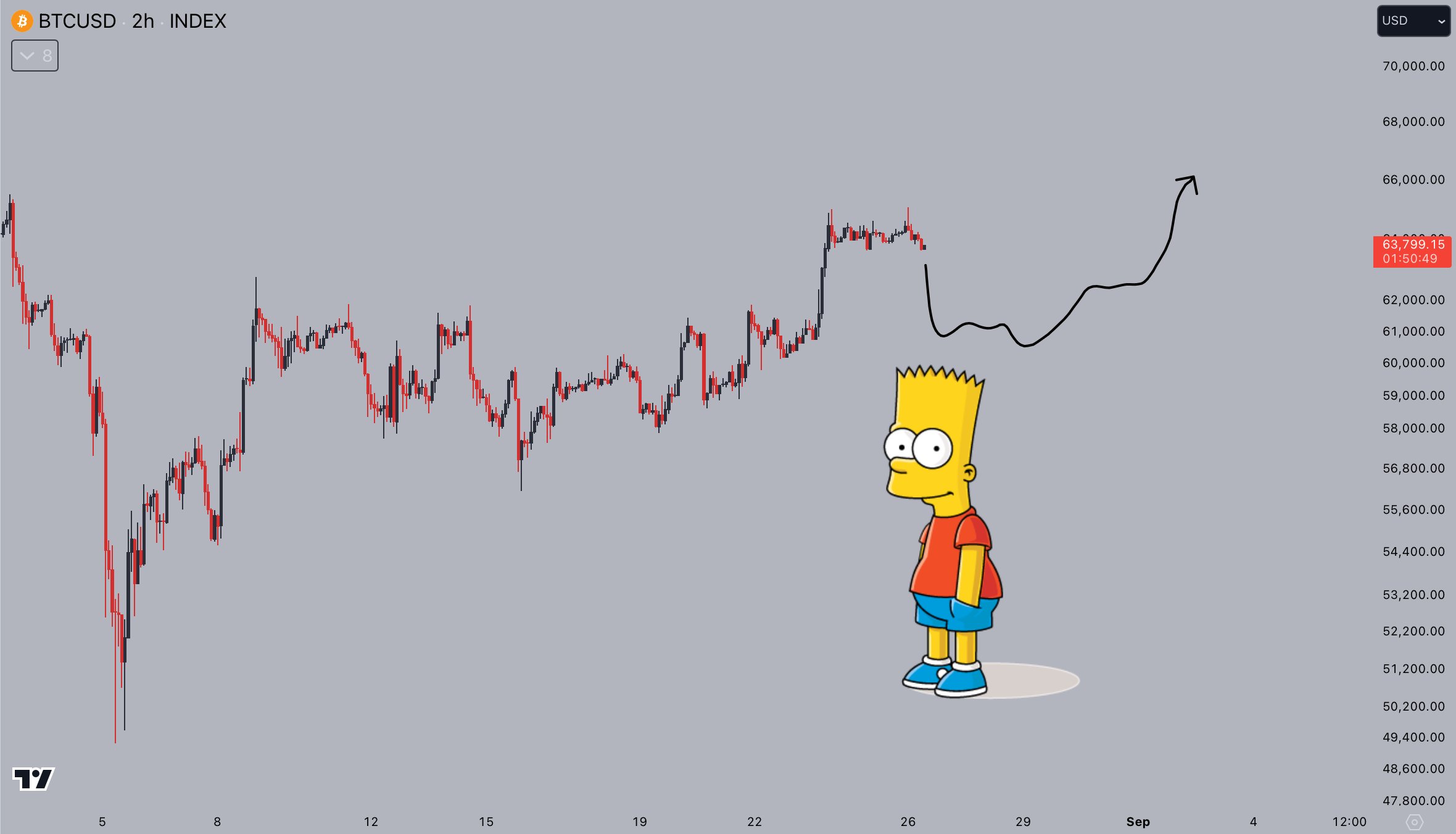

Others added to existing concerns over a possible “Bart Simpson” maneuver occuring, where price would gap lower to its position from late last week.

Among them was popular trader Jelle, who described such an outcome as one which “wouldn’t surprise.”

He nonetheless argued that the market was “looking much stronger than it has on previous bart-esque occasions in the past few months.”

Bulls in turn faced an ongoing battle to make August a “green” monthly candle, having erased the majority of the crash to six-month lows two weeks prior.

Markets were "well positioned" for BTC price upside

Following last week’s positive United States macro developments , trading firm QCP Capital was equally surprised by the absence of sustained BTC price upside.

Markets, it suggested in its latest bulletin to Telegram channel subscribers, had already assumed that the Federal Reserve would announce the start of interest rate hikes next month.

“Even with higher spot, BTC and ETH vols are currently more skewed for Puts than Calls till Oct,” it revealed.

“This is surprising given the overwhelmingly bullish sentiment. It possibly indicates that the market was well positioned for this move and was very quick to take profit by selling calls.”

QCP added that it expected BTC/USD to maintain a range between $62,000 and $67,000 “in the near term.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.