Bitget Research Institute: The market lacks significant short-term catalysts, but the circulation of stablecoins at an all-time high is building momentum for long-term growth

The net outflow of BTC spot ETFs exceeded $700 million last week, with market sentiment remaining low. According to CME Federal Reserve observation data, after the Bureau of Labor Statistics released unemployment data, the probability of the Fed cutting interest rates by 50 basis points in September dropped to 30%.

Bitget Research Institute pointed out in its latest report today: "However, amidst the low market sentiment, the circulating market value of stablecoins (excluding algorithmic stablecoins) has quietly risen to a historic high of $158 billion. USDT and USDC have each issued more than 2.2% in the past month alone, accumulating strength for future increases."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

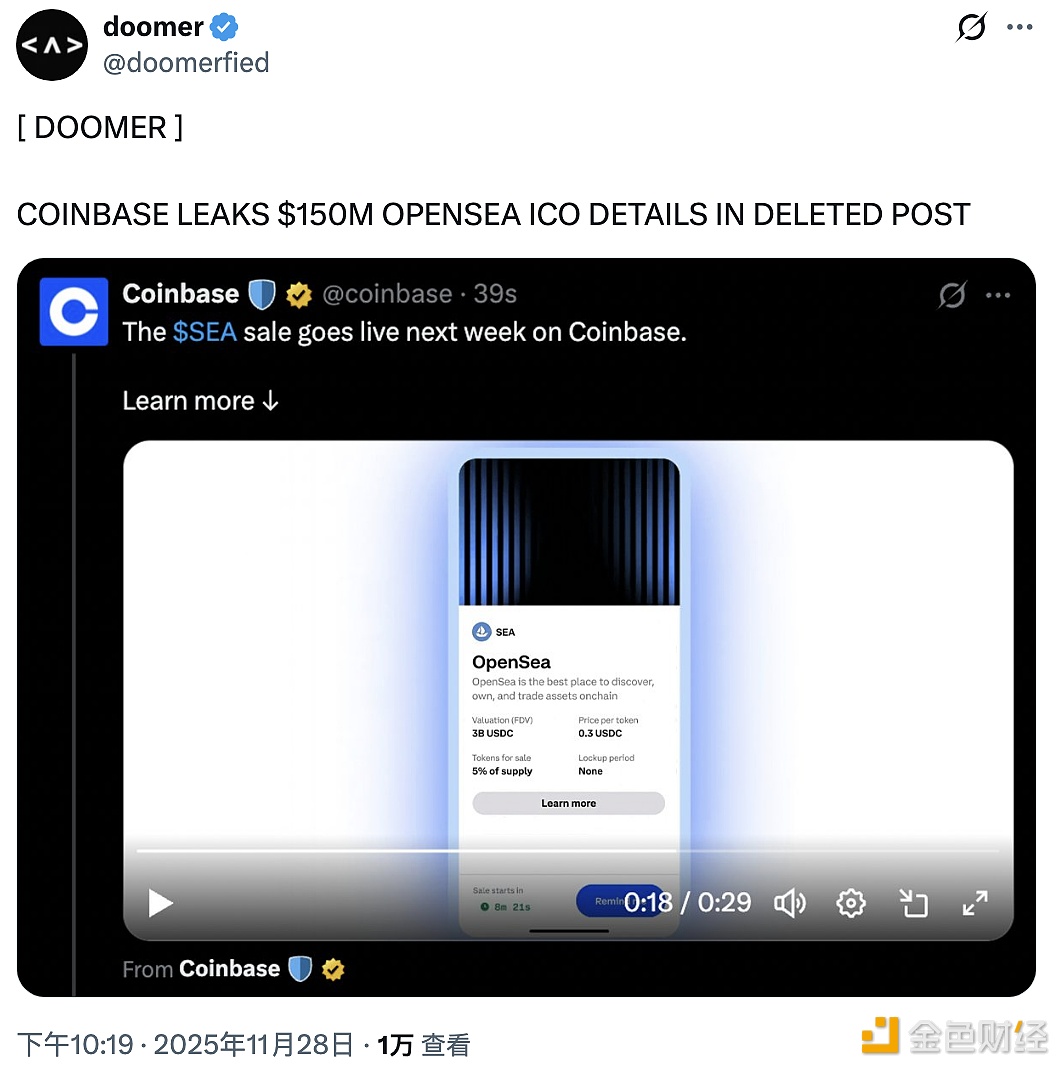

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.