The US Spot Bitcoin Exchange-Traded Funds (ETFs) recorded a rebound after a series of major outflows while Ether linked investment funds remained in the red. It depicts the investors’ sentiment for the crypto market as the Fear and Greed Index still stands in the ‘Fear Zone’ with 33 points.

The cumulative crypto market cap recorded a minor decline over the last day, but it still maintained the $2 trillion mark. Bitcoin hovered around the $58,000 level after gaining more than 2% in the last 7 days, while Ether remained under selling pressure.

Bitcoin ETFs bounce back

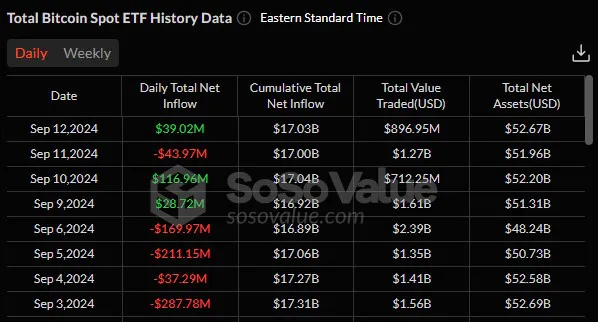

As per the data provided by Sosovalue, spot Bitcoin ETFs posted a daily net inflows of $39.02 million on September 12 and reversed the previous day’s losses. ARK 21Shares Bitcoin ETF (ARKB) led the pack with an impressive $18.34M million net inflows. Fidelity’s FBTC followed the trend with $11.47 million inflow. However, BlackRock’s IBIT showed no flow of funds for the day.

VanEck’s HODL posted $4.95 million in inflows, Franklin Templeton’s BTC fund brought in $3.38 million, and Bitwise’s BITB added $2.22 million. Grayscale ETF GBTC saw an outflow of $6.5123 million, while its mini ETF BTC had an inflow of $5.17 million.

BTC ETFs showed a rebound from the withdrawal of $43.97 million recorded on September 12, trying to reverse the bearish trend. Meanwhile, these funds saw an inflow of $116.96 million on September 11. The total daily trading volume for Bitcoin ETFs was $896.92 million, down from $1.27 billion the previous day. Since their launch in January, BTC funds have accumulated $17.03 billion in net inflows.

Source: Sosovalue

Source: Sosovalue

The biggest crypto is trying to break out from the ongoing bear waves as its price fluctuated around the $58K zone. BTC is trading at an average price of $57,797 at press time. Its 24-hour trading volume took a dip of 17% to stand at $30.24 billion.

Ether ETFs bleed out

Ether ETFs continued its outflow streak after posting an inflow of $11.44 million back on September 12. These ETFs saw $20.14 million in net outflows, marking their second consecutive day of losses. All outflows come straight from Grayscale’s ETHE, while the other eight funds showed no movement.

The daily trading volume for Ether ETFs was $106.14 million. It is down from $126.22 million. Total net outflows for the Ether ETFs now stand at $582.74 million. The second biggest crypto seems to be stuck in bear claws. ETH price dropped by 14% in 30 days and 30% over the last 60 days. Ether is trading at an average price of $2,340 at press time.