On September 18, the US Federal Reserve announced a 50-basis-point (bps) reduction in the benchmark interest rate to 4.75%–5.00% for the first time in four years, aligning with Wall Street estimates. This decision has significant implications for various financial markets, including cryptocurrencies.

Marc P. Bernegger, a cofounder of AltAlpha Digital, also predicted earlier that the federal funds rate cut may significantly boost the price of cryptocurrencies.

Bernegger predicted that the reduced interest rate would boost financial system liquidity and draw investors to riskier assets like cryptocurrency. Lower borrowing costs are likely to encourage more money to flow into digital currencies, which “could serve as a catalyst for a year-end rally,” he added

Historically, lower interest rates tend to drive up asset prices by making borrowing cheaper and improving investor sentiment. For cryptocurrencies, increased liquidity from the rate cut could boost demand and elevate prices. Bernegger believes that a rate cut might enhance market sentiment and contribute to a broader bullish trend in the crypto space.

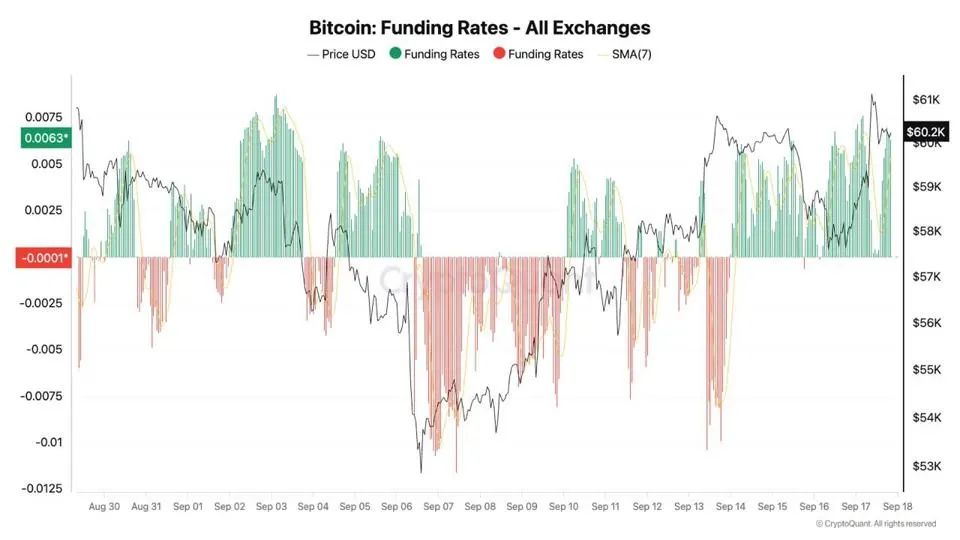

Bitcoin funding rates for all exchanges

Bitcoin funding rates for all exchanges

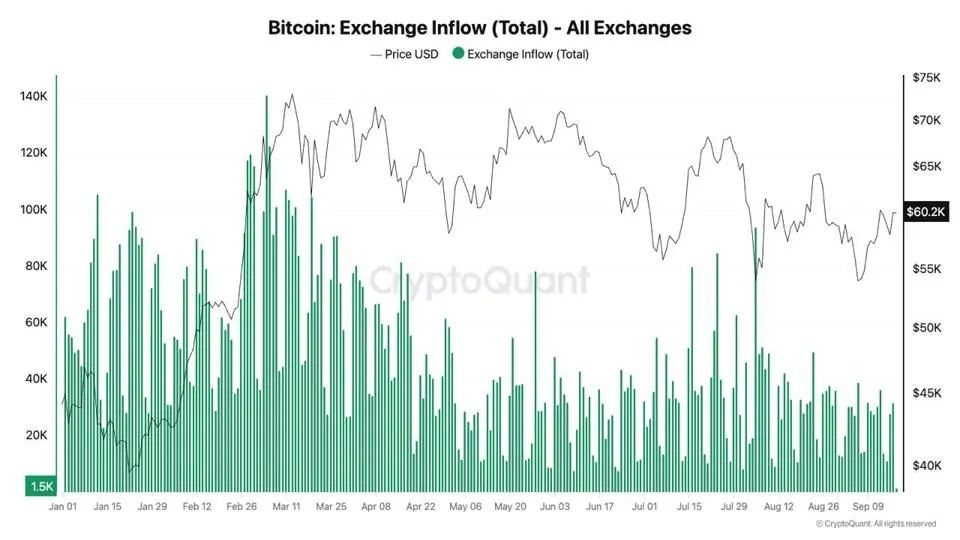

Julio Moreno, head of research at CryptoQuant, noted that Bitcoin perpetual futures data shows traders are positioning for a price increase. Low exchange inflows suggest they aren’t rushing to sell, indicating cautious optimism and expectations of higher prices.

Bitcoin exchange flow – all exchanges

Bitcoin exchange flow – all exchanges

However, Moreno also highlighted a decrease in open interest, indicating that some traders might be closing long positions to take profits. This trend points to a nuanced market response, where cautious profit-taking could occur amidst an otherwise optimistic outlook.

Overall, the Federal Reserve’s rate cut is poised to significantly influence the trajectory of cryptocurrency markets.