Analysis: The Bitcoin funding rate has largely returned to normal, which may indicate that the leverage liquidation is nearing its end

BlockBeats reports that on November 26, according to intotheblock analysis, the Bitcoin pullback can be attributed to higher funding rates, indicating over-leveraged positions. The good news is that funding rates have largely returned to normal, suggesting that leverage liquidation may be nearing its end.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

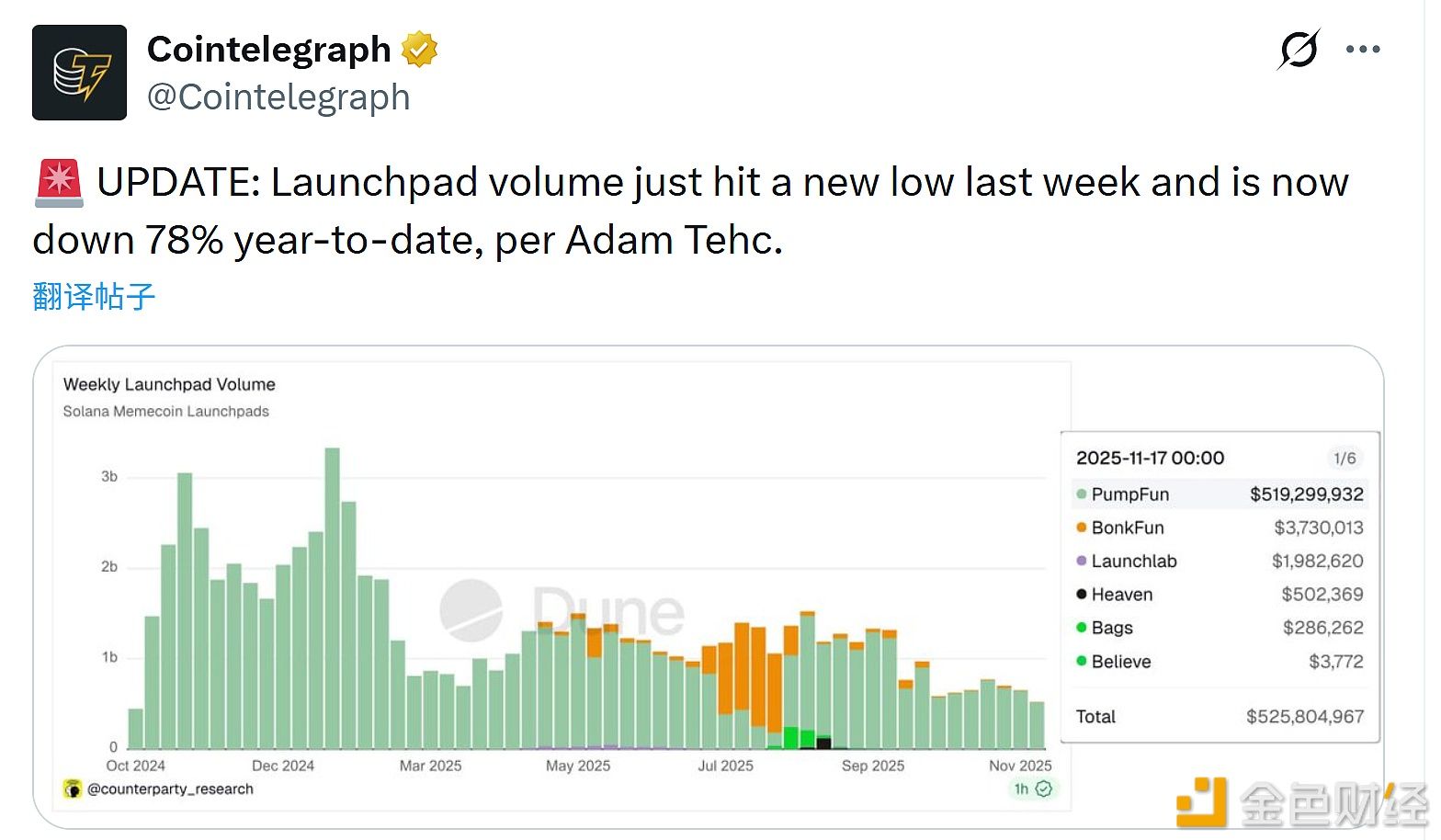

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93

Tether suspends Bitcoin mining operations in Uruguay due to rising energy costs