Analysis: Currently, the majority of unliquidated Bitcoin put options are concentrated at the end of December and the end of January next year

Amberdata data shows that put options with strike prices of $95,000 and $100,000 had the largest open interest in the past 24 hours. Demand for put options in the range of $75,000 and $70,000 also increased. Luke Nolan, a research assistant at crypto asset management company CoinShares, said that currently most open contracts for put options are concentrated at the end of December and January next year, with some in February next year. This is logically reasonable as it can hedge against any pullbacks or unexpected situations that may occur from this significant increase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

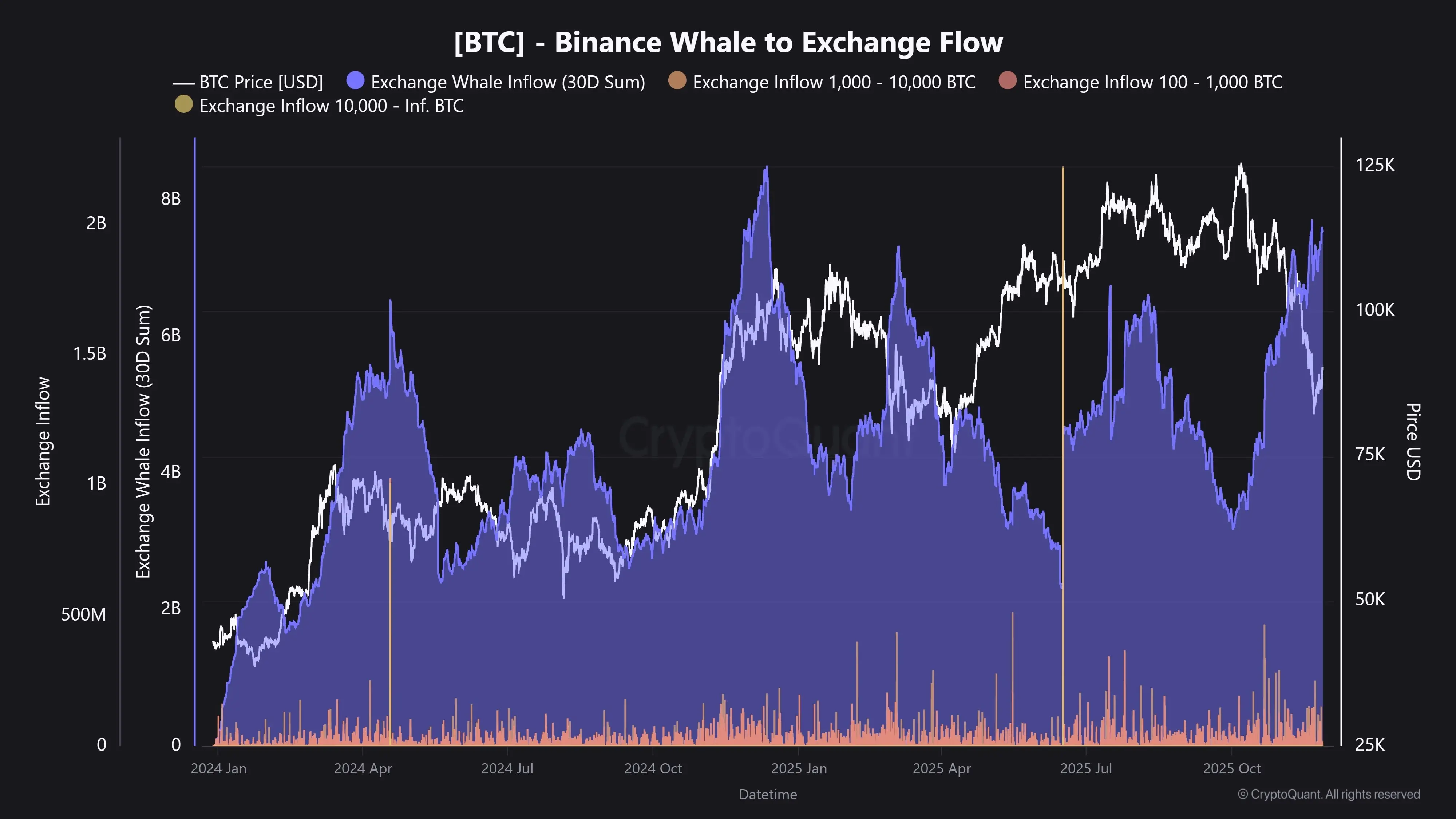

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month

Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.

CME Group: BrokerTec EU market is now open for trading, all other markets remain suspended