The grayscale report classifies the encryption industry into five major sectors, including currency, smart contracts, finance, consumer culture and infrastructure services

Grayscale has released a cryptocurrency industry classification framework, dividing the digital asset market into five major sectors: Currencies, Smart Contract Platforms, Financials, Consumer & Culture, and Utilities & Services.

The report shows that despite Bitcoin's significant rise this year, the overall trend of crypto assets is diverging. Currency assets include Bitcoin, XRP and Zcash; Smart Contract Platforms include Ethereum, Solana and Polygon; Financials include Maker, Uniswap and Aave; Consumer & Culture includes ApeCoin, Decentraland and Sandbox; Utilities & Services includes Chainlink, Filecoin and Lido DAO.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Chairman Paul Atkins warns that cryptocurrency could become a financial surveillance tool

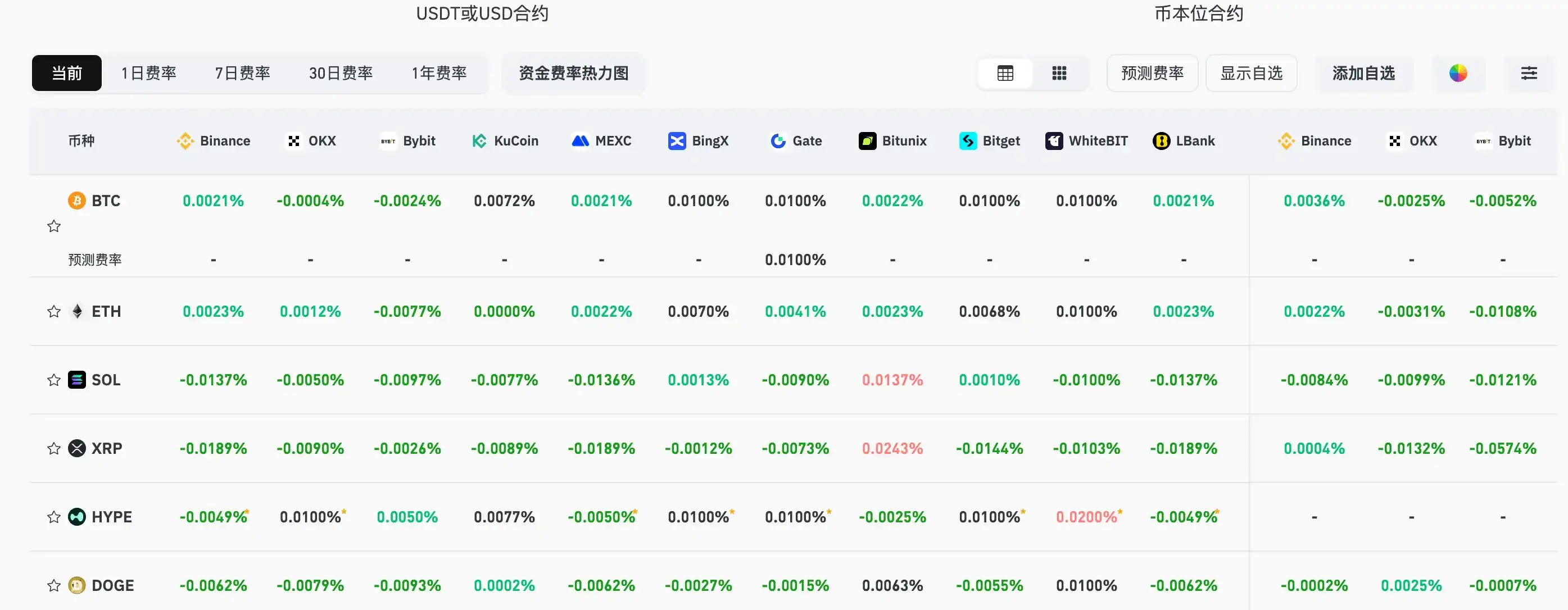

Data: Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish

Bitget CEO featured on the cover of "CEO and Business Leaders" and shares insights on the new economy