MicroStrategy may affect Nasdaq 100 eligibility due to ICB classification

Dec. 12 (Bloomberg) -- MicroStrategy's Nasdaq 100 eligibility may be affected by its ICB classification, Bloomberg analyst James Seyffart predicted. Although the company is currently classified as a technology stock, its share price performance is closely tied to its bitcoin-related financial business, and MicroStrategy Chairman Michael Saylor has said he wants to transform the company into a ‘bitcoin bank. If the ICB reclassifies MicroStrategy as a financial stock, the company could lose its Nasdaq 100 status.

ICB classifications are based on a company's revenue stream, and Nasdaq plans to announce a final decision on 15 December, with the reclassification process expected to begin by the end of January next year. The biggest current risk is that MicroStrategy could be excluded due to the classification issue.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: Stablecoin circulating market cap returns to $305 billions, with a cumulative increase of 0.8% recently

S&P 500 index futures rise 0.2%

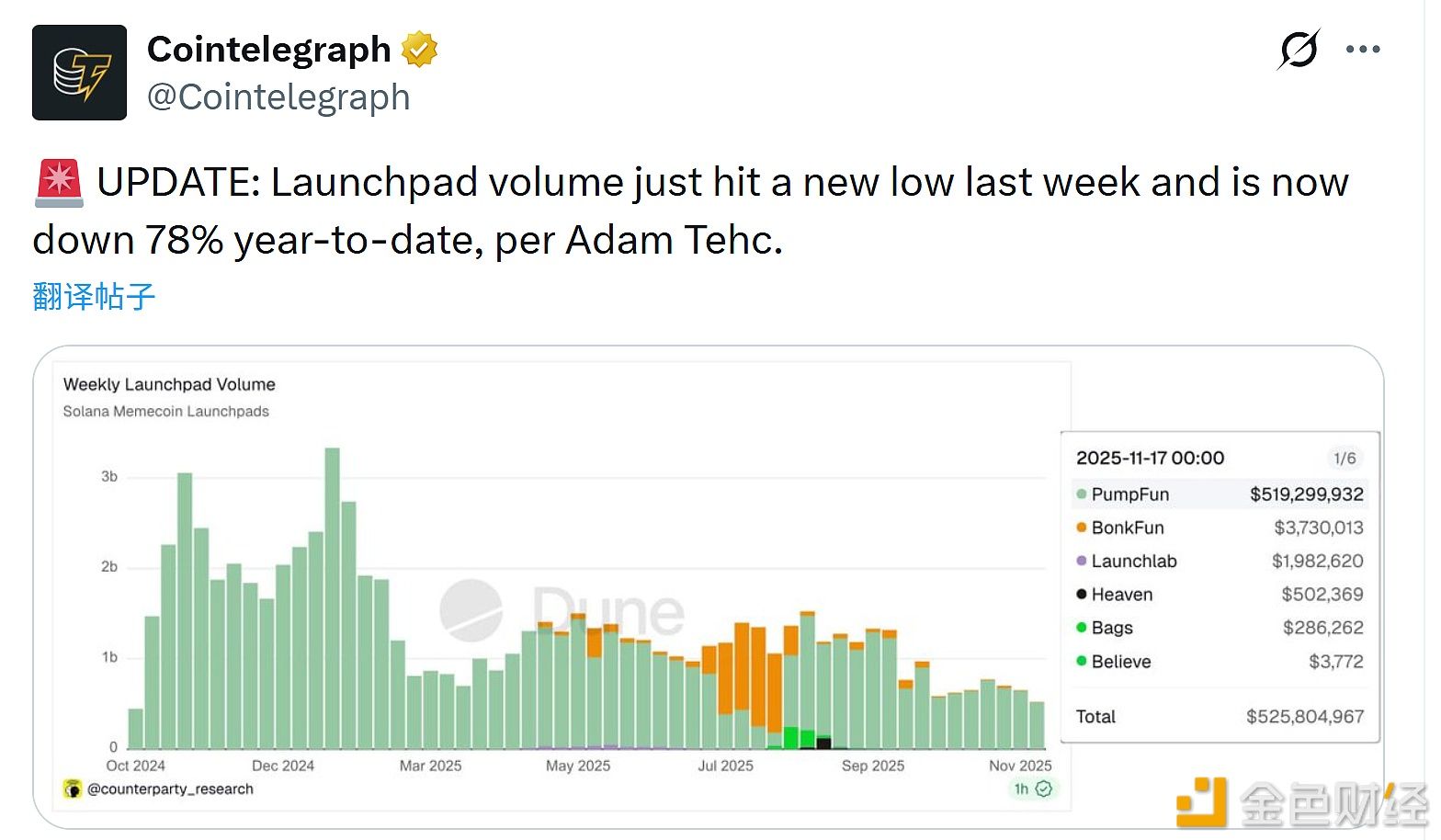

Adam Tech: Launchpad trading volume hit a new low last week