Analysts Set $8K Ethereum Target With ‘Imminent’ Altseason – Why 2025 Could Be Altcoins’ Best Year Yet

Altseason in 2025 could make it the best year yet for altcoins, with Ethereum targeting $8K and Bitcoin dominance expected to drop to 45%.

According to their December research note, Steno Research not only paints bullish price projections for Ethereum in a 2025 altseason but also for Bitcoin, setting eyes on a $150,000 all-time high.

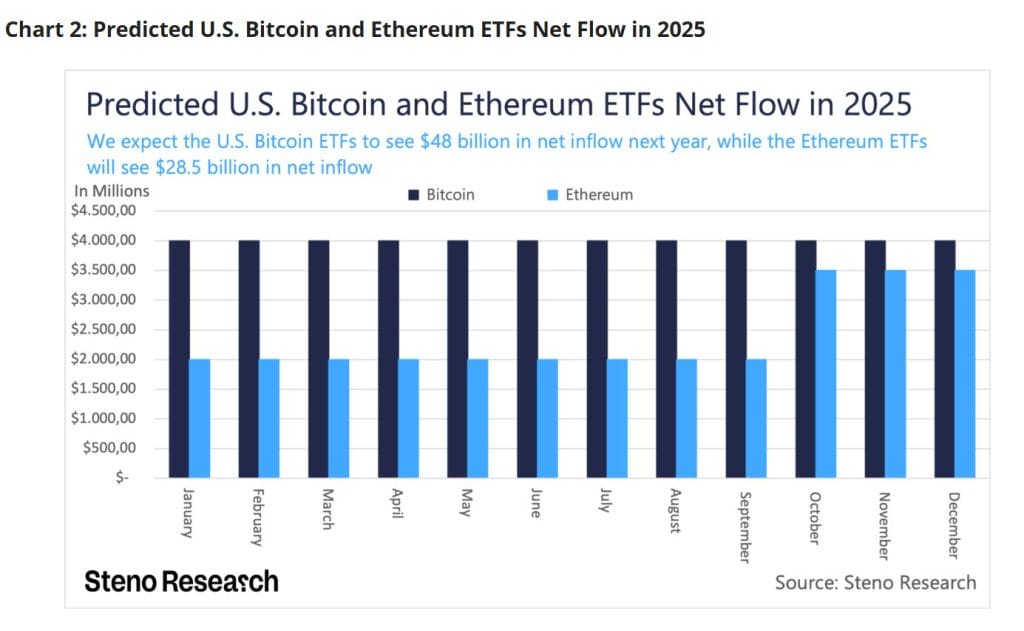

The report cites institutional adoption as the main driver behind these optimistic targets, anticipating “unparalleled levels, further bolstered by significant inflows into U.S.-based Bitcoin and Ethereum ETFs.”

Source: Steno Research /

Bitcoin and

Ethereum ETF net flows in 2025

Source: Steno Research /

Bitcoin and

Ethereum ETF net flows in 2025

Steno forecasts BTC and ETH exchange-traded funds (ETFs) to see net inflows in 2025 of $48 billion and $28.5 billion, respectively.

While Bitcoin has been the primary market mover thus far, Steno expects altcoins to dominate in 2025 , stating they are “increasingly optimistic about an imminent altcoin season ” that could see Ethereum outperform the world’s leading cryptocurrency.

This sentiment is echoed by popular X trader Crypto Rover, who notes historical trends of Ethereum outperformance during the year’s first quarter.

Bitcoin Dominance to Fall to ‘Altseason’ Levels

Given this materializes, Bitcoin would find itself further decoupled from the altcoin market.

Steno expects the ETH/BTC ratio to hit “at least 0.06”. That is nearly double the current level of around 0.035, according to TradingView data .

This will usher in a broader altcoin season, with Bitcoin dominance dropping from its current levels of nearly 58% to around 45%, according to the report.

According to Blockchain Centre’s Altcoin season index , the market currently lies at 47, far from its 88 stints in November and the 75 thresholds considered an active altseason.

Bullish Fundamentals Could Make 2025 Altcoin’s Best Year

Steno Research also noted stacking fundamentals in favor of a potential altseason that stands to make 2025 the biggest year for cryptocurrencies yet.

The incoming Trump administration’s “exceptionally favorable regulatory environment for cryptocurrencies ” is expected to play a key role in advancing the asset class.

However, this assumes that the argument that the proposition to make the U.S. “crypto capital” is favorable to altcoins as well as Bitcoin holds true, the analysts noted.

Trump’s presidency “encourages more robust on-chain activity, which benefits altcoins such as Ethereum and Solana significantly,” Steno said, with total value locked (TVL) in dApps to top $300 billion in 2025, far surpassing 2021’s highs of $180 billion.

Source: Steno Research / The TVL on DeFi protocols is forecasted to hit $300BThe report also highlighted that the macroeconomic climate now favors a more risk-on attitude among investors, “marked by declining interest rates and improved liquidity.”

After successfully achieving a soft landing on the following recession concerns in 2024, cryptocurrencies are now a more attractive investment.

However, anticipations of stagflation in 2025 , marked by rampant inflation and stagnant economic growth could introduce volatility.

Finally, the report cited “historically strong post-Bitcoin-halving performance” as another factor that could lead to massive movements in the coming year.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.