Bitcoin market indicators are getting a reset as investors nurse 4% weekly BTC price losses.

In a Quicktake blog post on Jan. 10, onchain analytics platform CryptoQuant reported a new chance to buy the dip.

Onchain data shows Bitcoin moving at a loss

Bitcoin ( BTC ) sentiment has taken a hit this month as volatility favored the downside and bulls failed to reclaim and hold the $100,000 mark .

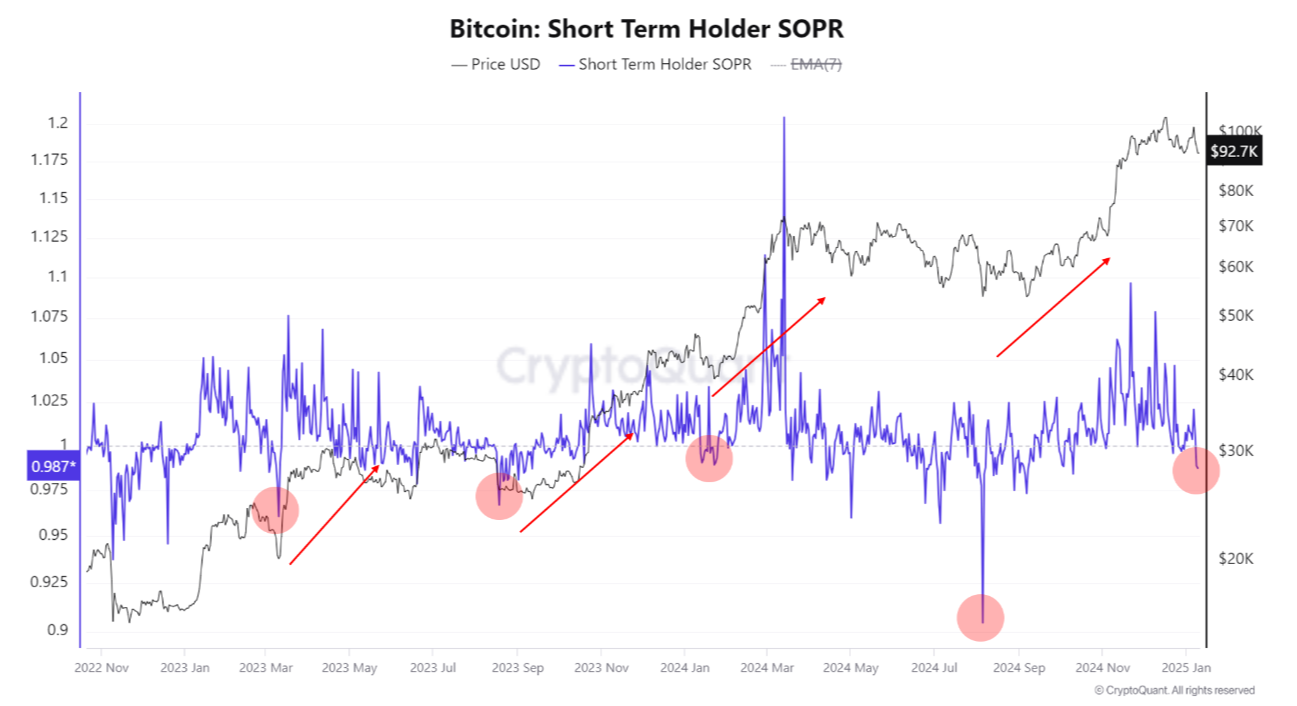

Among the signs of rising capitulation among speculative investors — those who are traditionally more sensitive to short-term price movements — is a dip in the spent output profit ratio (SOPR).

SOPR monitors the proportion of unspent transaction outputs, or UTXOs, created at a profit or loss compared to when the coins involved last moved.

The result is a snapshot of investors’ willingness to spend coins at a profit or loss, and thus analysts can gain an insight into prevailing sentiment trends.

Currently, the SOPR value for short-term holders (STHs) — entities hodling a given unit of BTC for up to 155 days — is below the breakeven point of 1.

“As BTC declines, negative headlines are increasingly visible on YouTube and news media. This indicates that market sentiment is turning bearish,” CryptoQuant contributor MAC_D said.

“This is reflected in the short-term SOPR, which shows the market sentiment of short-term investors, at 0.987, indicating that investors holding for less than 6 months are selling Bitcoin at a loss.”

![]() Bitcoin STH-SOPR chart (screenshot). Source: CryptoQuant

Bitcoin STH-SOPR chart (screenshot). Source: CryptoQuant

While bearish on the surface, loss-inducing onchain activity can be a silver lining for bulls. Capitulation among speculative investors, historical data shows, often coincides with short-term BTC price bottoms.

In August 2024, STH-SOPR hit its lowest levels in more than three years, an event that coincided with the first of two near-term bottoms of about $55,000 for BTC/USD, which remain in place.

“Ironically, historical examples show that when short-term investors experience losses, the market has often shown an upward trend, making it a good time for accumulation,” the blog post said.

Analysis: Selling BTC may be “very unwise”

As Cointelegraph reported , other sentiment gauges currently paint a similar picture of increasing market nerves.

This week, the Crypto Fear Greed Index returned to “Neutral” territory, marking its lowest level since October.

This is still notably higher than the equivalent index for traditional markets, which currently measures just 32/100 in a return to “Fear.”

Fear Greed Index as of Jan. 10 (screenshot). Source: Feargreedmeter.com

At the same time, large-volume investors have upped BTC exposure once more after the holiday lull, with CryptoQuant showing Bitcoin whales adding 34,000 BTC in the 30 days through Jan. 8.

“As short-term investors experience more pain, it often presents better opportunities for accumulation,” MAC_D said.

“If there is further decline from the current price, smart investors will likely accumulate the coins sold cheaply by short-term investors. Therefore, selling coins at this juncture might prove to be a very unwise decision.”