Bitcoin Price: Key Analysis and Predictions for the Upcoming Weeks

Bitcoin Price Analysis: A Closer Look at the Current Trends

Over the past week, the Bitcoin price fell below the psychologically significant $100K level, a move that rattled investor confidence. As of now, Bitcoin is trading at $94,500, marking a 4% drop over the past 7 days. Despite this recent decline, prices appear to have found some stability near the $95,000 mark, offering a momentary reprieve for traders.

Key Metrics at a Glance:

- Current Bitcoin Price: $94,500

- 24-hour Trading Volume: $18.5 billion

- 7-day Performance: -4%

BTC/USD 4-hours chart - TradingView

This stabilization suggests that market participants are carefully weighing their next moves, with many awaiting a decisive breakout in either direction.

Why Bitcoin Price Dropped Below $100K

Bitcoin’s recent decline can be attributed to a mix of market conditions, including profit-taking from the recent bull run and a general slowdown in crypto activity as the year-end holidays approach. Additionally, macroeconomic factors such as speculation on future interest rate adjustments have contributed to this cooling off in Bitcoin’s rally.

Bitcoin Price Prediction: Two Likely Scenarios

Looking ahead, the Bitcoin price prediction is poised for significant movement in one of two directions. Here are the most probable scenarios according to market analysts:

Scenario 1: A Recovery Toward $100K

If Bitcoin can maintain its current stability around $95,000 and trading volume increases, there’s a strong chance of a recovery back to $100K. Breaking above this psychological resistance could trigger renewed bullish momentum, pushing prices higher in the coming weeks.

Scenario 2: A Drop Below $90K

On the downside, if selling pressure intensifies and Bitcoin breaks below $90K, the next support levels are at $85K and $82K. A move to these levels would represent a deeper correction, potentially signaling the end of the bull cycle and a transition into a consolidation phase.

BTC/USD 4-hours chart - TradingView

What’s Next for Bitcoin?

With Bitcoin stabilizing near $95,000, all eyes are on the market’s next move. Whether the price heads back toward $100K or falls to test lower supports will largely depend on external factors like market sentiment and macroeconomic developments.

For investors and traders, staying informed and ready to adapt to these scenarios is key to navigating this volatile yet potentially lucrative market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

RootData Crypto Calendar Fully Upgraded: Say Goodbye to Information Delays and Build Your 24/7 Trading Alert System

Only with information transparency can wrongdoers be exposed and builders receive their deserved rewards. The RootData calendar section has evolved into a more comprehensive, accurate, and seamless all-weather information alert system, aiming to help crypto investors penetrate market uncertainties and identify key events.

Major Overhaul in US Crypto Regulation: CFTC May Fully Take Over the Spot Market

The hearing on November 19 will determine the final direction of this long-standing dispute.

As economic fissures deepen, Bitcoin may become the next "pressure relief valve" for liquidity

Cryptocurrencies are among the few areas where value can be held and transferred without relying on banks or governments.

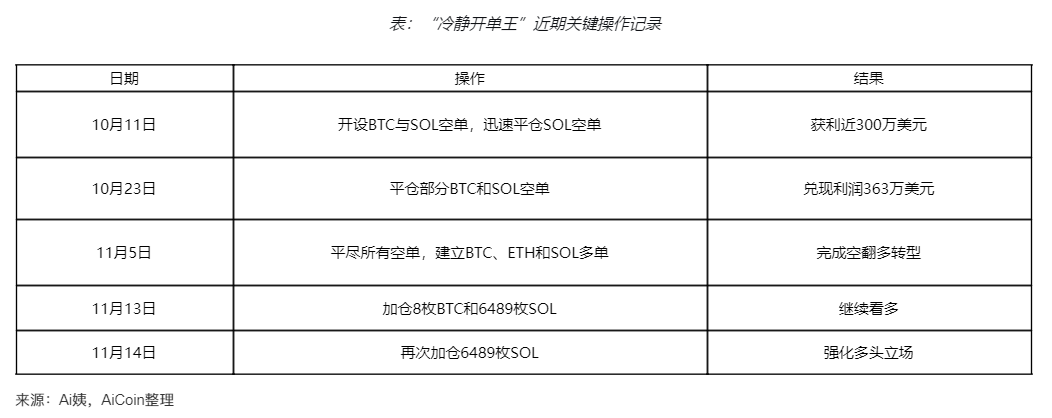

"The Calm Order King" increases positions against the trend, strengthening the bulls!