Blockchain Creating Digital Infrastructure That Fortifies US Dollar Supremacy, According to Pantera Capital

Blockchain technology is fortifying the strength of the US dollar rather than weakening it, according to the digital asset investment firm Pantera Capital.

In a new analysis , Jeff Lewis, Pantera’s hedge funds product manager, and Erik Lowe, the firm’s head of content, write that blockchain tech will reverse a decades-long trend of international de-dollarization.

“Far from eroding the dollar’s supremacy, blockchain technology has created a digital infrastructure that fortifies it. The ability to tokenize and mobilize dollar assets globally allows the dollar to remain indispensable even as geopolitical and technological forces drive de-dollarization pressures.

As J.P. Morgan noted in their report, the structural factors supporting the dollar’s dominance — deep capital markets, rule of law, and institutional transparency — remain unparalleled. Stablecoins extend these advantages to a digital, borderless context.”

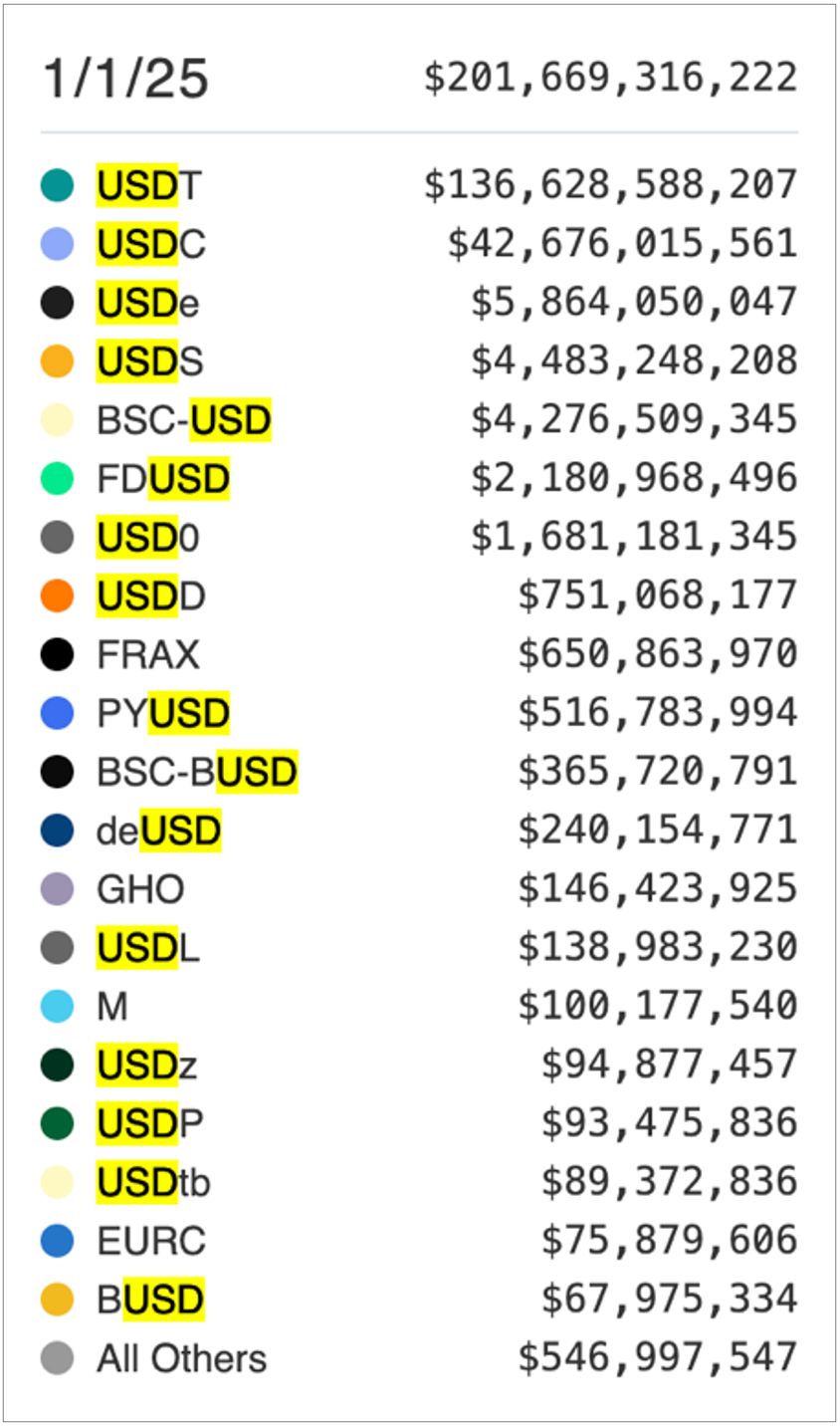

Lewis and Lowe note that 18 of the top 20 fiat-backed stablecoins have the letters USD in their names.

Source: Pantera Capital

Source: Pantera Capital

They also note Bitcoin ( BTC ) is now increasingly perceived as a store of value rather than a medium of exchange and a threat to the US dollar.

“The stablecoin/RWA (real-world asset) phenomenon has risen up to allow blockchain to make good on Bitcoin’s initial promise, by providing a means of exchange with stability and, ultimately, yield. Rather than eroding the dollar’s relevance, it is amplifying it.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget margin trading to support BGB cross margin trading and loans

Bitget has decoupled loan interest rates from futures funding rates for all coins in spot margin trading

[Important] Bot copy trading upgrade—update your app now

CandyBomb x UAI: Trade futures to share 200,000 UAI!