LTC Price Prediction: New 2025 Litecoin Price ATH?

Litecoin (LTC) , often referred to as the "silver to Bitcoin's gold," has long been a staple in the cryptocurrency market. As 2025 begins, traders and investors are eagerly speculating whether Litecoin can achieve a new all-time high (ATH). With its strong fundamentals and significant price action, the technical analysis of LTC reveals crucial insights into its potential trajectory. In this article, we’ll dive into the recent LTC price trends, evaluate key support and resistance levels, and predict whether Litecoin can achieve a new ATH this year.

How has the Litecoin (LTC) Price Moved Recently?

Litecoin is currently priced at $117.60 with a 24-hour trading volume of $4.07 billion, a market cap of $8.87 billion, and a market dominance of 0.25%. Over the past 24 hours, the price of LTC has surged by 14.70%.

Litecoin reached its all-time high of $410.76 on May 10, 2021, while its all-time low of $1.11374 was recorded on January 14, 2015. Since its ATH, the lowest price LTC fell to was $40.47 (cycle low), and the highest price achieved since that point is $146.23 (cycle high). The current price prediction sentiment for Litecoin is bullish, and the Fear Greed Index indicates a level of 75 (Greed).

Litecoin has a circulating supply of 75.41 million LTC out of a maximum supply of 84.00 million LTC. The current yearly supply inflation rate stands at 1.77%, with approximately 1.31 million LTC created in the past year.

Litecoin Price Prediction: Technical Analysis of the Chart

LTC/USD Daily Chart : TradingView

LTC/USD Daily Chart : TradingView

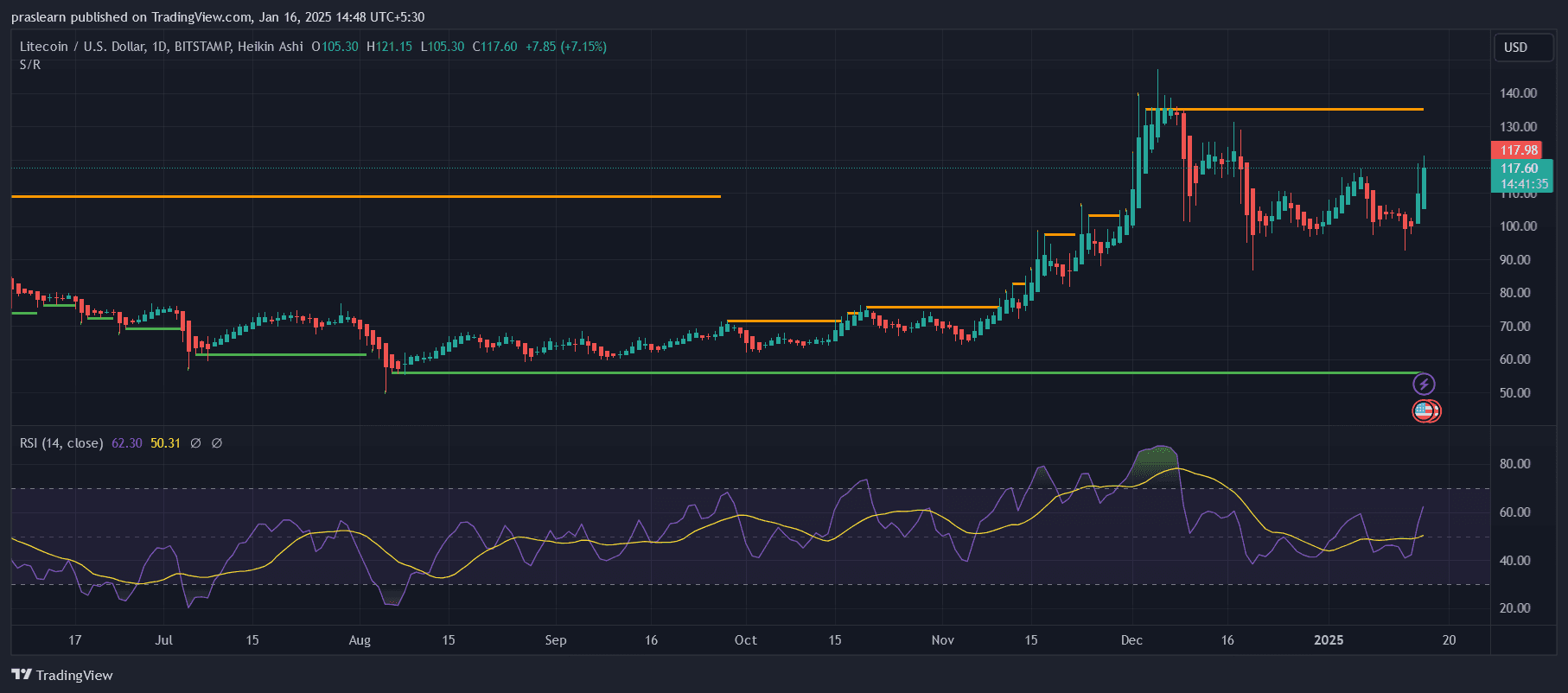

The daily LTC/USD chart shows significant bullish momentum developing over the past few months. The price has risen sharply from lows near $50, surpassing key psychological and technical resistance levels. Currently, LTC is trading at approximately $117.60, with a notable 7.15% gain in recent sessions.

Key observations include:

- A clear breakout above $100 , which served as a strong resistance zone in previous months.

- Sustained higher lows, indicating an upward trend and strong buying interest.

- A retest of the $90-$100 support region, successfully holding the upward momentum.

Support and Resistance Levels

Support Levels:

- $100: A critical psychological and technical level. If LTC pulls back, this zone is likely to act as strong support due to previous price action.

- $60-$65: A long-term support area where LTC consolidated for months before the recent breakout.

Resistance Levels:

- $140: The next major resistance level based on historical price action.

- $180-$200: Represents a critical resistance zone nearing Litecoin's previous ATH of $412 (achieved in May 2021).

Relative Strength Index (RSI)

The RSI is currently at 62.30 , indicating bullish momentum without being overbought. This suggests there is room for further upside before a potential correction. The RSI breakout above 50 earlier signaled a shift in sentiment from neutral to bullish.

Moving Average Analysis

The price is well above its 50-day and 200-day moving averages, confirming a strong bullish trend. Historically, such positioning indicates that a sustained rally is likely.

Key Observations

- Litecoin has recently broken out of a consolidation phase, marked by a series of higher highs and higher lows.

- Volume profiles suggest increasing participation during upward price movements, a strong indicator of demand.

Will LTC Hit a New ATH in 2025?

The current market structure and momentum suggest that Litecoin has significant upside potential in 2025 . However, several factors will determine whether LTC can reach a new ATH:

Bullish Case for a New ATH:

- Market Momentum: If the broader cryptocurrency market remains bullish, LTC could benefit from a spillover effect.

- Key Resistance Breakouts: Breaking above $140 and $180 would likely set the stage for LTC to target $300 or higher.

Bearish Risks:

- Macro Conditions: A bearish crypto market due to macroeconomic factors could cap LTC’s price gains.

- Failure to Hold Key Supports: Falling below $100 could invalidate the bullish setup.

Conclusion

Based on current technical indicators, Litecoin price appears well-positioned for further price gains in 2025. The next major challenge lies in breaking the $140 resistance zone. If successful, LTC could target $180 and eventually set sights on a new ATH, potentially exceeding $400. Investors should watch key support levels around $100 for any signs of weakening momentum.

Litecoin’s long history of resilience, coupled with its growing adoption and strong market fundamentals, makes it a promising contender for significant price gains this year. However, as with all investments, risks remain, and traders should monitor both market and macroeconomic conditions closely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.