Grayscale XRP Trust returns, offering regulated exposure to XRP

Can Grayscale’s XRP Trust revive institutional interest in XRP?

On Jan. 17, 2024, Grayscale Investments, a digital currency asset management firm, has announced the reopening of its XRP ( XRP ) Trust to eligible accredited investors.

The Grayscale XRP Trust allows institutional and accredited investors to gain exposure to XRP through a regulated investment product. The Trust is structured to reflect the market price of XRP, minus fees and expenses, without requiring investors to directly purchase or manage the cryptocurrency. XRP itself is used primarily for cross-border payments and is supported by the Ripple Network, a decentralized blockchain system facilitating fast and efficient transactions.

XRP is a digital asset created and transmitted via the Ripple Network, a decentralized blockchain system that facilitates fast and efficient transactions. The network allows users to exchange tokens of value, called XRP, with speed and minimal friction.

Launched on Sept. 5, 2024, the Grayscale XRP Trust is benchmarked against the CoinDesk Ripple Price Index (XRX). With a performance fee of 0.00% and a management fee of 2.50%, the Trust offers a cost-effective solution for accredited investors seeking exposure to XRP.

The reopening of the Grayscale’s XRP Trust coincides with major developments in Ripple Labs’ legal proceedings with the U.S. Securities and Exchange Commission (SEC). In December 2020, the SEC filed a lawsuit against Ripple, alleging that the company raised over $1.3 billion through an unregistered securities offering by selling XRP. In July 2023, a federal judge ruled that XRP is not a security when sold to the general public on digital-asset exchanges, though sales to institutional investors were considered unregistered securities transactions. This partial legal victory has bolstered confidence in XRP’s regulatory standing.

Grayscale has recently expanded its range of digital asset products. On Dec. 12, 2024, the company launched the Lido DAO ( LDO ) Trust and Optimism ( OP ) Trust, providing exposure to governance tokens linked to Ethereum staking and scaling solutions. These launches followed earlier additions, including the Grayscale Sui Trust in August, the XRP Trust in September, and the Aave Trust in October, reflecting Grayscale’s commitment to diversifying its investment products.

As of Jan. 17, 2025, XRP is trading at $3.27, with a 24-hour trading volume of $25.77 billion. The circulating supply stands at approximately 57.56 billion XRP tokens, resulting in a market capitalization of around $188.23 billion. Over the past 24 hours, XRP has experienced a price increase of 7.01%.

XRP 1D chart | Source: crypto.news

XRP 1D chart | Source: crypto.news

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

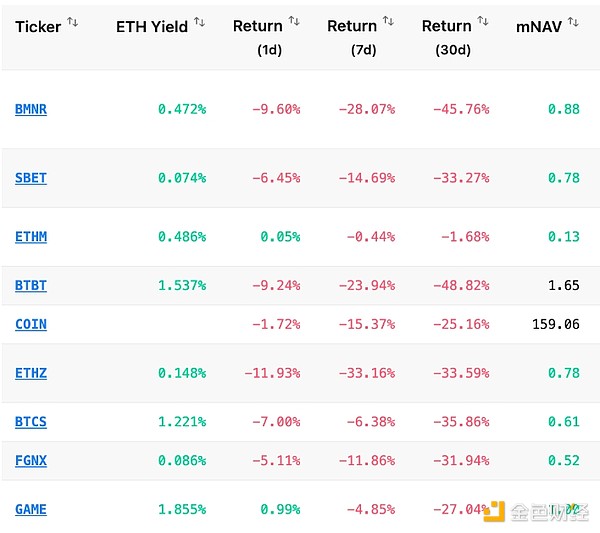

With the market continuing to decline, how are the whales, DAT, and ETFs doing?

The New York Times: $28 Billion in "Black Money" in the Cryptocurrency Industry

As Trump actively promotes cryptocurrencies and the crypto industry gradually enters the mainstream, funds from scammers and various criminal groups are continuously flowing into major cryptocurrency exchanges.

What has happened to El Salvador after canceling bitcoin as legal tender?

A deep dive into how El Salvador is moving towards sovereignty and strength.

Crypto ATMs become new tools for scams: 28,000 locations across the US, $240 million stolen in six months

In front of cryptocurrency ATMs, elderly people have become precise targets for scammers.