Date: Thu, Jan 23, 2025, 12:01 PM GMT

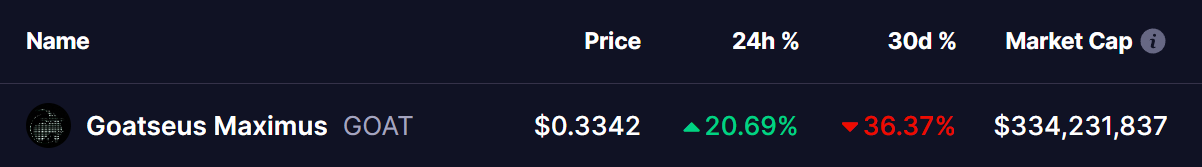

In the cryptocurrency market today, where major memecoins are facing significant corrections with Bitcoin (BTC) down by over 3%, Goatseus Maximus (GOAT) has captured the spotlight. The token has surged with an impressive double-digit rally of over 20% in the last 24 hours, fueled by a key technical breakout.

Source: Coinmarketcap

Source: Coinmarketcap

This rally comes as a potential end to its recent downtrend correction, which saw the token lose over 36% in the last 30 days.

Key Breakout Fuels Rally

Between mid-October and mid-November 2024, GOAT achieved a massive rally, surging by 1795% and reaching a peak price of $1.37. After this explosive growth, the token entered a falling wedge pattern, a consolidation phase that often indicates a reversal or continuation depending on the breakout direction.

Today, GOAT has successfully broken out of this falling wedge pattern at the $0.3172 level, signaling renewed bullish momentum. Following the breakout, the token has moved near a horizontal resistance zone, highlighted by the red-shaded area on the chart. GOAT is currently trading at $0.3340, and retesting the breakout level before approaching the upper boundary of this resistance zone near $0.4180.

A confirmed breakout above $0.4180 could ignite further gains, with the next resistance levels identified at $0.6350, $0.9528, and ultimately the previous high of $1.37. This sequence of targets represents a potential 300% upside from current levels if bullish momentum continues to build.

From a technical standpoint, the MACD (Moving Average Convergence Divergence) indicator is showing signs of a bullish crossover, with the MACD line poised to move above the signal line. Additionally, the histogram is shifting into positive territory, reinforcing the possibility of sustained upward momentum.

Final Thoughts

Goatseus Maximus (GOAT) is gaining attention as one of the top-performing memecoin today, with its breakout from the falling wedge pattern marking a potential turning point. However, traders should watch the price action near the $0.4180 resistance zone, as a failure to break higher could lead to consolidation or a pullback.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.