5 Token Unlocks to Watch Next Week

Major token unlock events are scheduled next week for Optimism and other projects, releasing previously blocked tokens under fundraising terms. These events can lead to price volatility based on market conditions and investor reactions.

Token unlocks release previously restricted tokens tied to fundraising agreements. Projects schedule these events strategically to limit market pressure and stabilize prices.

Here are five large token unlocks scheduled for next week.

Ethena (ENA)

- Unlock date: January 29

- Number of tokens unlocked: 12.86 million ENA

- Current circulating supply: 3.03 billion ENA

Ethena, a synthetic currency protocol on Ethereum, delivers a solution independent of traditional banking. It also offers global users a dollar-denominated savings tool called the “Internet Bond.”

Ethena’s native token, ENA, allows holders to take part in governance decisions for the protocol. On January 29, Ethena will unlock over 12 million ENA tokens, valued at $11 million, with the funds allocated to ecosystem development.

ENA Unlock. Source:

Tokenomist

ENA Unlock. Source:

Tokenomist

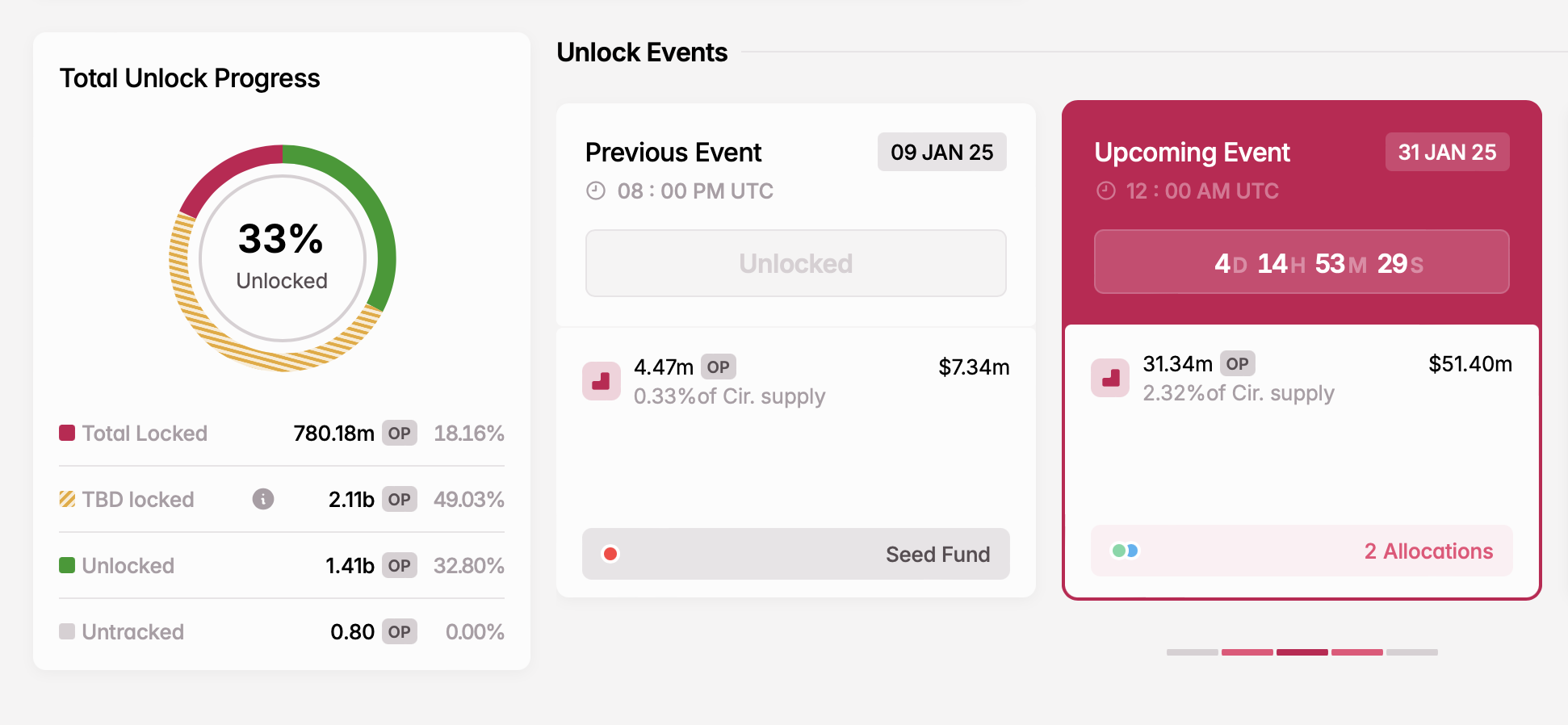

Optimism (OP)

- Unlock date: January 31

- Number of tokens unlocked: 31.34 million OP

- Current circulating supply: 1.35 billion OP

Optimism, a Layer-2 scaling solution, speeds up transactions and reduces costs on Ethereum. Its OP token is essential for governance, letting holders vote on proposals and influence the network’s future.

On January 31, Optimism will unlock 31.34 million OP tokens. According to Tokenomist (formerly TokenUnlocks), these tokens will be distributed to core contributors and investors.

OP Unlock. Source:

Tokenomist

OP Unlock. Source:

Tokenomist

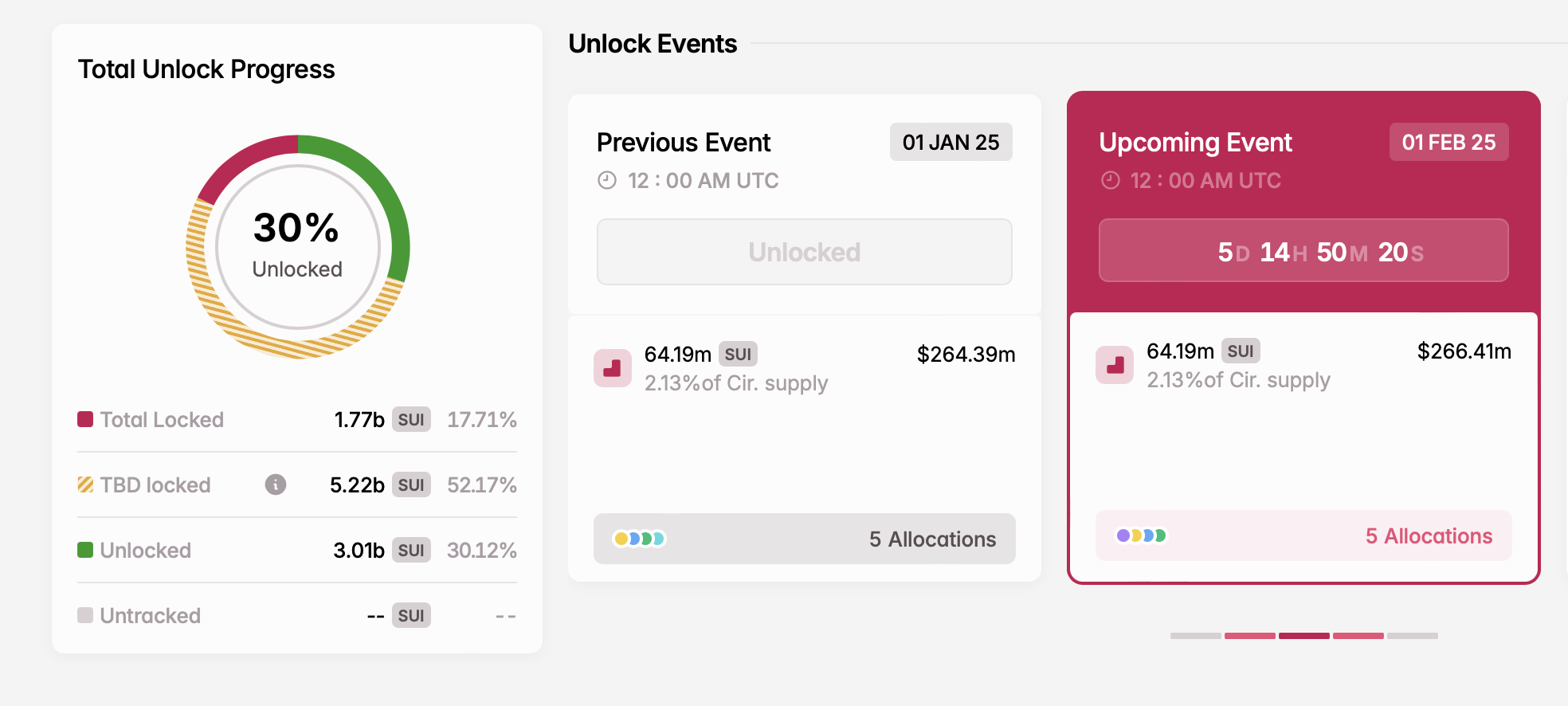

Sui (SUI)

- Unlock date: February 1

- Number of tokens unlocked: 64.19 million SUI

- Current circulating supply: 3 billion SUI

Sui is a high-performance Layer-1 blockchain built to optimize network operations and security through a Proof-of-Stake consensus mechanism. Launched in 2021 by Mysten Labs, the project was founded by former Novi Research employees who contributed to the development of the Diem blockchain and the Move programming language.

The SUI token enables governance, allowing holders to vote on proposals and shape the platform’s future. On February 1, a major token unlock will release tokens allocated to Series A and B participants, the community reserve, and the Mysten Labs treasury.

SUI Unlock. Source:

Tokenomist

SUI Unlock. Source:

Tokenomist

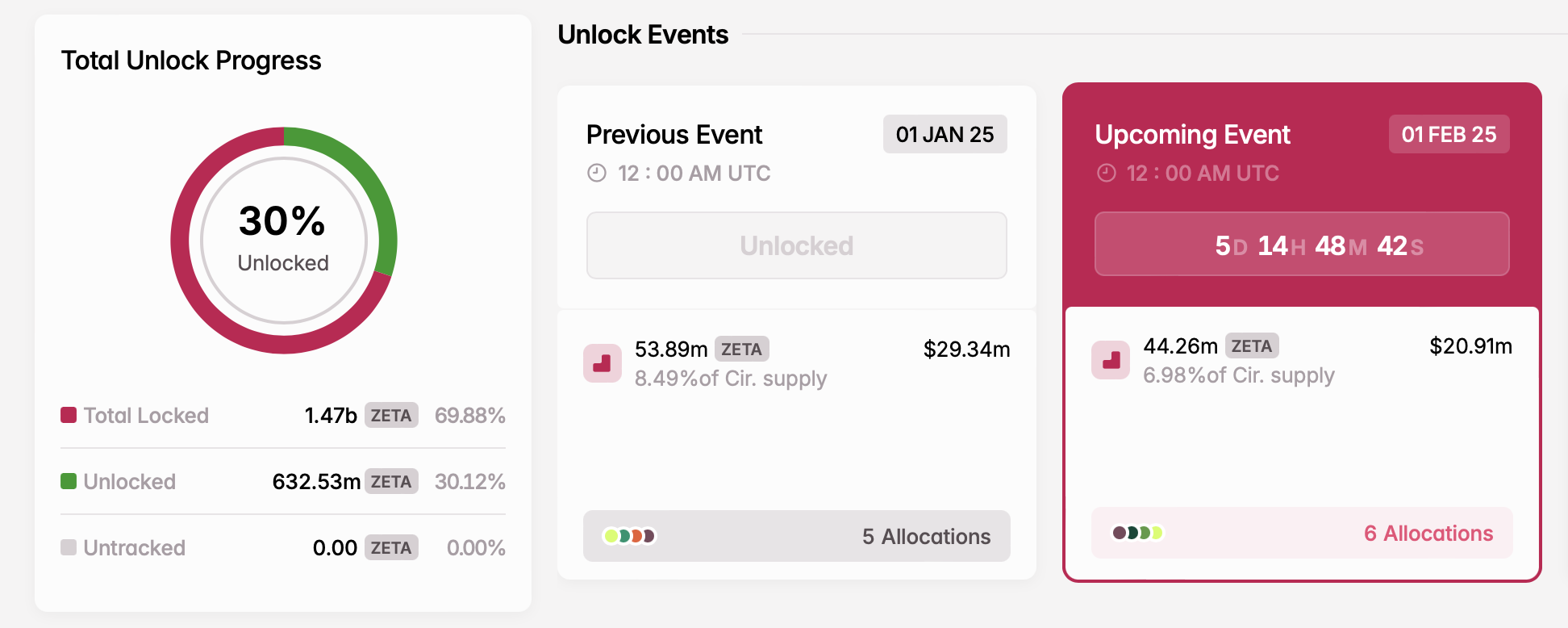

ZetaChain (ZETA)

- Unlock date: February 1

- Number of tokens unlocked: 44.26 million ZETA

- Current circulating supply: 634.37 million ZETA

ZetaChain is a decentralized blockchain platform that facilitates seamless interoperability across different blockchain networks. Its key feature allows cross-chain communication, enabling the transfer of tokens and data between blockchains like Ethereum and Binance Smart Chain.

On February 1, ZetaChain will unlock nearly 45 million ZETA tokens. These tokens will fund initiatives such as a user growth pool, an ecosystem growth fund, core contributor rewards, advisory roles, and liquidity incentives.

ZETA Unlock. Source:

Tokenomist

ZETA Unlock. Source:

Tokenomist

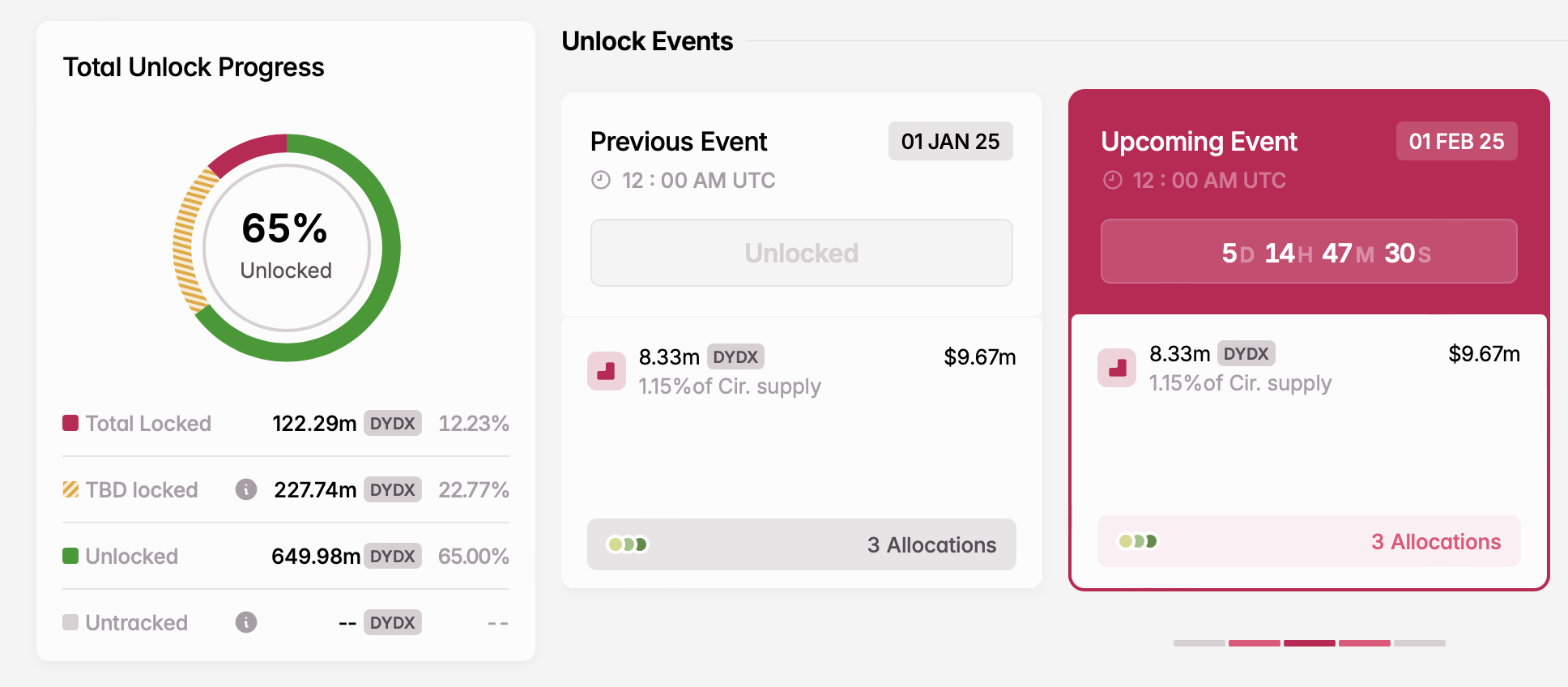

dYdX (DYDX)

- Unlock date: February 1

- Number of tokens unlocked: 8.33 million DYDX

- Current circulating supply: 722 million DYDX

In early 2023, dYdX, the largest decentralized perpetual futures trading protocol, announced changes to its initial tokenomics. According to the update, 27.7% of dYdX’s total supply will go to early investors, 26.1% to the treasury, 15.3% to the team, and 7.0% to future dYdX employees and consultants.

Most DYDX unlocked on February 1 will be distributed among founders and investors, with the remaining tokens reserved for current and future employees.

DYDX Unlock. Source:

Tokenomist

DYDX Unlock. Source:

Tokenomist

Next week’s cliff token unlocks will also include Eigen Layer (EIGEN), Celo (CELO), and Moca Network (MOCA), among others, with a total combined value exceeding $450 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Institutional Investors Continue Buying Bitcoin Despite Market Sell-Off in Stocks and Cryptocurrencies

- U.S. stocks closed lower Thursday as macroeconomic fears and Fed policy uncertainty drove Nasdaq over 2% down, with Bitcoin hitting $86,100. - Abu Dhabi's ADIC nearly tripled its stake in BlackRock's Bitcoin ETF to $520 million, signaling institutional confidence amid crypto volatility. - CME FedWatch reduced December rate cut odds to 43.8%, while Bitcoin ETFs saw $75M inflows on Nov. 19 despite broader crypto selloffs. - Institutional caution persists as ETF outflows and whale selling tighten liquidity,

Bitcoin News Update: Waning Expectations for Rate Cuts and Massive Bitcoin ETF Outflows Trigger Sharp Stock Decline

- U.S. stocks fell sharply on Thursday, with the Nasdaq Composite dropping over 2% amid fading Fed rate-cut hopes and Bitcoin ETF redemptions. - Bitcoin prices dipped to $86,100 as BlackRock's IBIT ETF recorded a $523M outflow, marking its worst redemption since January 2024. - Institutional investors added $5.7M in Bitcoin short positions, while FedWatch data cut December rate-cut odds to 46% from 93.7% a month ago. - U.S. spot Bitcoin ETFs face $3B in November outflows, with analysts noting a shift from

Fed Navigates Uncertainty as Data Gaps Obscure Rate-Cut Decision

- U.S. Treasury Secretary Bessent urges Fed to continue rate cuts to support growth amid volatile markets and weak labor data. - Delayed September jobs report and 183% October layoff surge cloud Fed's December decision amid inflation concerns. - Market expectations for a 25-basis-point cut dropped to 42.9% as Fed officials split between hawkish caution and dovish relief calls. - Strong Nvidia earnings temporarily eased AI bubble fears but analysts warn of limited capital budgets amid macro risks. - Global

Zcash Halving Event: Driving Value Growth and Prompting Miner Adjustments

- Zcash's 2028 halving will cut block rewards to 0.78125 ZEC, reinforcing its deflationary model and potentially boosting investor demand. - Historical data shows 500% price surges post-halving (2020) and $589 peak in 2025, with Grayscale managing $137M in Zcash assets. - Miners transitioned to PoS post-2024 halving; ECC's 2025 roadmap prioritizes privacy upgrades and institutional adoption via Ztarknet and NU6.1. - Risks include regulatory scrutiny of shielded transactions and volatility, but decentralize