XRP Price Crash Recovery Hinges on Bitcoin’s Next Move

XRP’s price struggles after losing key support, but Bitcoin’s recovery could trigger a rebound. Can XRP break resistance and resume its uptrend?

XRP recently attempted to form a new all-time high but faced resistance due to market top pressure. The failure led to significant losses for investors as selling pressure increased.

Now, the cryptocurrency’s recovery hinges on Bitcoin’s trajectory, with its price movement influencing XRP’s future performance.

XRP Loses Key Supports

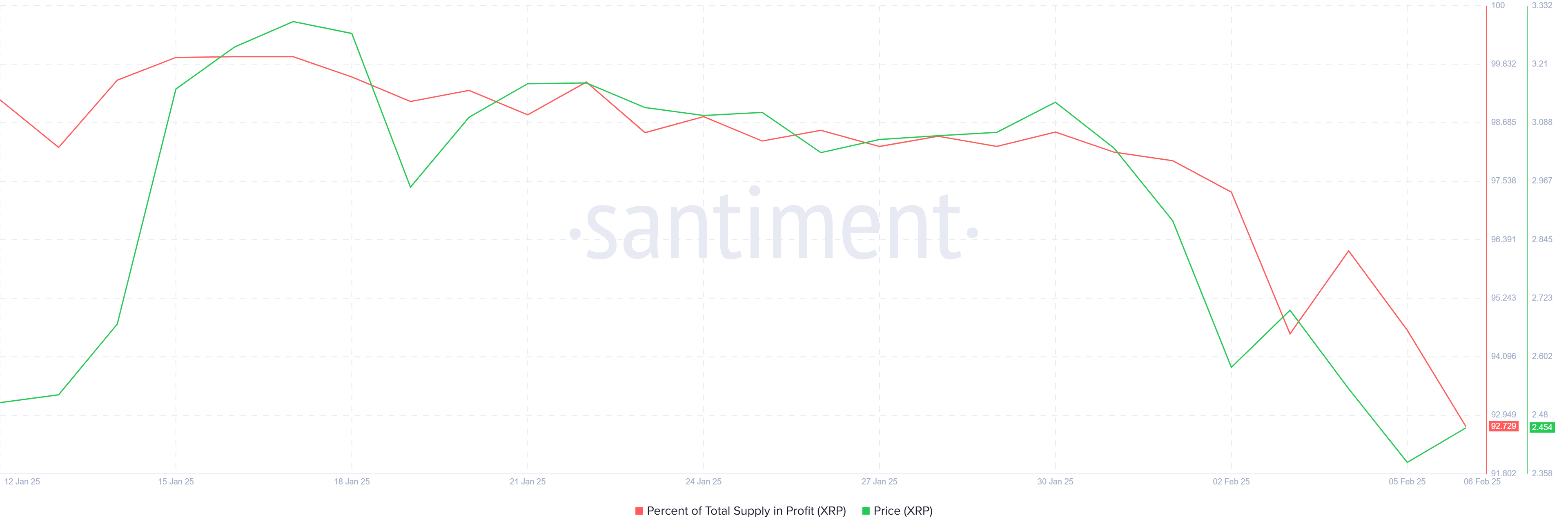

The percentage of XRP’s supply in profit surpassed 95% earlier this week, signaling a market top. This development triggered a wave of selling pressure, resulting in a sharp drawdown. As a consequence, 3% of the profit supply has already been wiped out, increasing concerns among investors.

Declining profits present a significant risk, as more holders may sell to lock in gains. If this trend continues, downward pressure could further drive prices lower. The asset’s ability to retain investor confidence will be crucial in determining its next move.

XRP Supply In Profit. Source:

Santiment

XRP Supply In Profit. Source:

Santiment

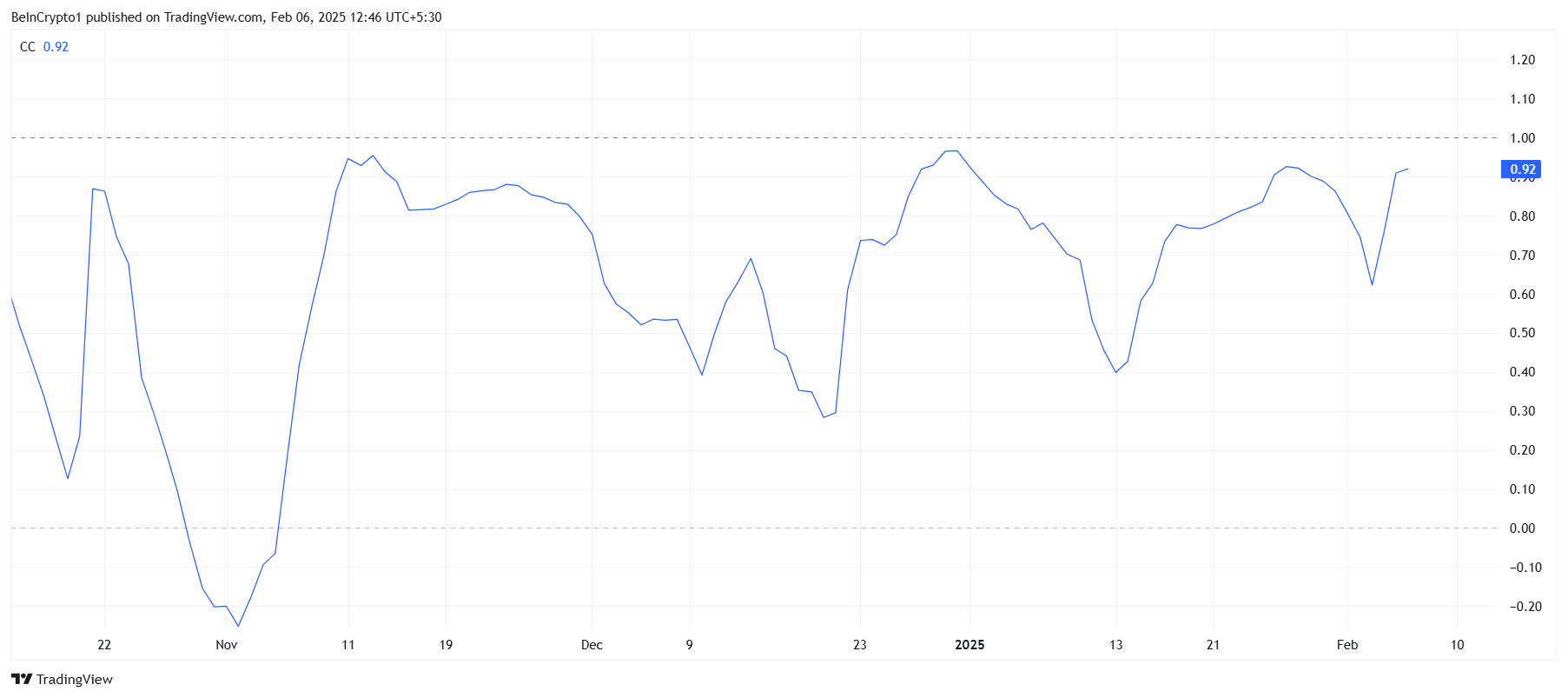

XRP’s macro momentum remains closely tied to Bitcoin, with its correlation now at 0.92. This strong relationship means XRP is likely to mirror Bitcoin’s price movements, which could be beneficial given Bitcoin’s bullish outlook.

Bitcoin appears poised to reclaim support at $100,000, which would likely uplift the broader market, including XRP. If Bitcoin’s price stabilizes and trends upward, XRP could find the support it needs to resume its own recovery.

XRP Correlation With Bitcoin. Source:

TradingView

XRP Correlation With Bitcoin. Source:

TradingView

XRP Price Prediction: Escaping The Bears

XRP is currently trading at $2.46, having dropped below critical support levels at $2.95 and $2.70. The price decline paused when the altcoin tested support at $2.33, preventing further losses for the time being.

The altcoin’s next challenge lies in reclaiming lost ground. However, breaking past $2.70 may prove difficult, as resistance at this level remains strong. Consolidation under this price point is a possible scenario unless stronger bullish momentum emerges.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

If XRP follows Bitcoin’s lead, a significant recovery could be on the horizon. Reclaiming $2.70 would be a key turning point, potentially opening the path for further gains. A move beyond $2.95 would invalidate the current bearish-neutral outlook, paving the way for a full recovery and further upside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan Unveils $110B Stimulus: Major Shift from Fiscal Restraint to Economic Expansion and National Security

- Japan's PM Sanae Takaichi unveils $110B stimulus to combat stagnation and bolster security amid China tensions. - Plan includes tax cuts, utility subsidies, defense spending, and strategic investments in AI, semiconductors , and shipbuilding. - Funded by 14-trillion-yen supplementary budget, with potential expansion to 20-trillion-yen ($133B) as per analyst estimates. - Shift from austerity reflects Takaichi's hardline security stance and response to China's travel advisory over Taiwan remarks. - Impleme

Bitcoin News Update: Bitcoin Reaches $96K Amidst Institutional Interest and Challenges from Regulations and Price Barriers

- Bitcoin surged past $96,000 as buyer accumulation and seller exhaustion drove short-term recovery, though $106,000–$118,000 remains a key resistance zone. - Harvard’s $443M investment in BlackRock’s IBIT highlights growing institutional adoption, contrasting traditional preferences for private equity. - Bitcoin Depot reported 20% Q3 revenue growth but faces regulatory challenges, expanding internationally while projecting Q4 declines due to compliance costs. - MicroStrategy’s Michael Saylor denied Bitcoi

Bitcoin News Today: Bitcoin Faces $62K Drop Threat Amid Fed's Data Silence Predicament

- Bitcoin faces $62K crash risk amid Fed uncertainty caused by U.S. government shutdown's "data blackout" disrupting inflation/labor data. - Post-Nov 13 reopening saw BTC rebound above $102K, but markets remain fragile with 20% decline from October peak despite $140B ETF growth. - Fed rate cut odds dropped to 52% for December, creating volatility as institutions like Harvard Endowment invest $443M in Bitcoin ETFs. - U.S. miners struggle with 37.75% global hashrate share amid lack of federal incentives, con

Bitcoin Updates Now: Crypto Faces a Standstill as Market Anxiety Meets Harvard’s Confident Bitcoin Investment

- Alternative Data's Fear & Greed Index hit record low 10 on Nov 16, signaling extreme crypto market fear and frozen investor sentiment. - Bitcoin fell 5% to $96,000 while CD20 lost 5.8% as profit-taking, liquidations, and liquidity declines accelerated selloffs. - Rising U.S. Treasury yields and central bank uncertainty worsened losses, with Nansen noting "perfect storm" of macro risks and institutional outflows. - Harvard's $443M IBIT ETF investment contrasts current bearishness, highlighting diverging i