Litecoin Bucks Market Trend, Gains 10% as Whales Increase Holdings

From beincrypto by Abiodun Oladokun

Layer-1 coin Litecoin has emerged as the market’s top gainer over the past 24 hours, bucking the prevailing downtrend seen in the broader cryptocurrency market.

The 10% rally comes amid a notable increase in whale accumulation, with large investors gradually building their positions over the past week. With a growing bullish bias, LTC appears poised to extend its current gains.

Litecoin Whales Increase Holdings

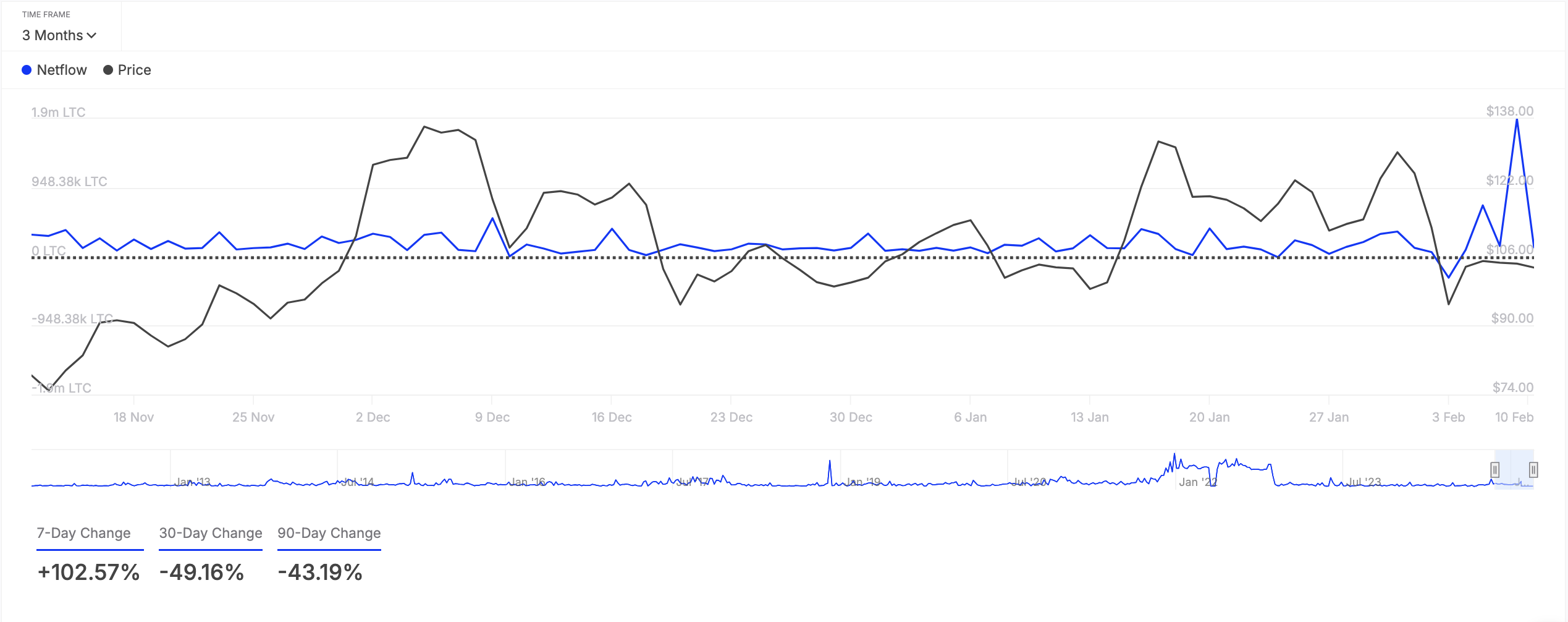

On-chain data reveals that LTC has seen a triple-digit surge in its large holders’ netflow over the past week. According to IntoTheBlock, this has climbed by 103% during that period.

Litecoin Large Holders Netflow. Source: IntoTheBlock

Litecoin Large Holders Netflow. Source: IntoTheBlock

Large holders refer to whale addresses that hold over 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins these investors buy and the amount they sell over a specific period.

When an asset experiences a spike in large holder netflow, its whale addresses are increasing their holdings. This is a bullish signal, typically driving upward price momentum as these big investors bet on the asset’s future growth.

Retail investors often follow this trend, seeing the increased whale activity as a sign of confidence. As whales accumulate, the rising demand could push LTC’s price higher, creating a positive feedback loop in the market.

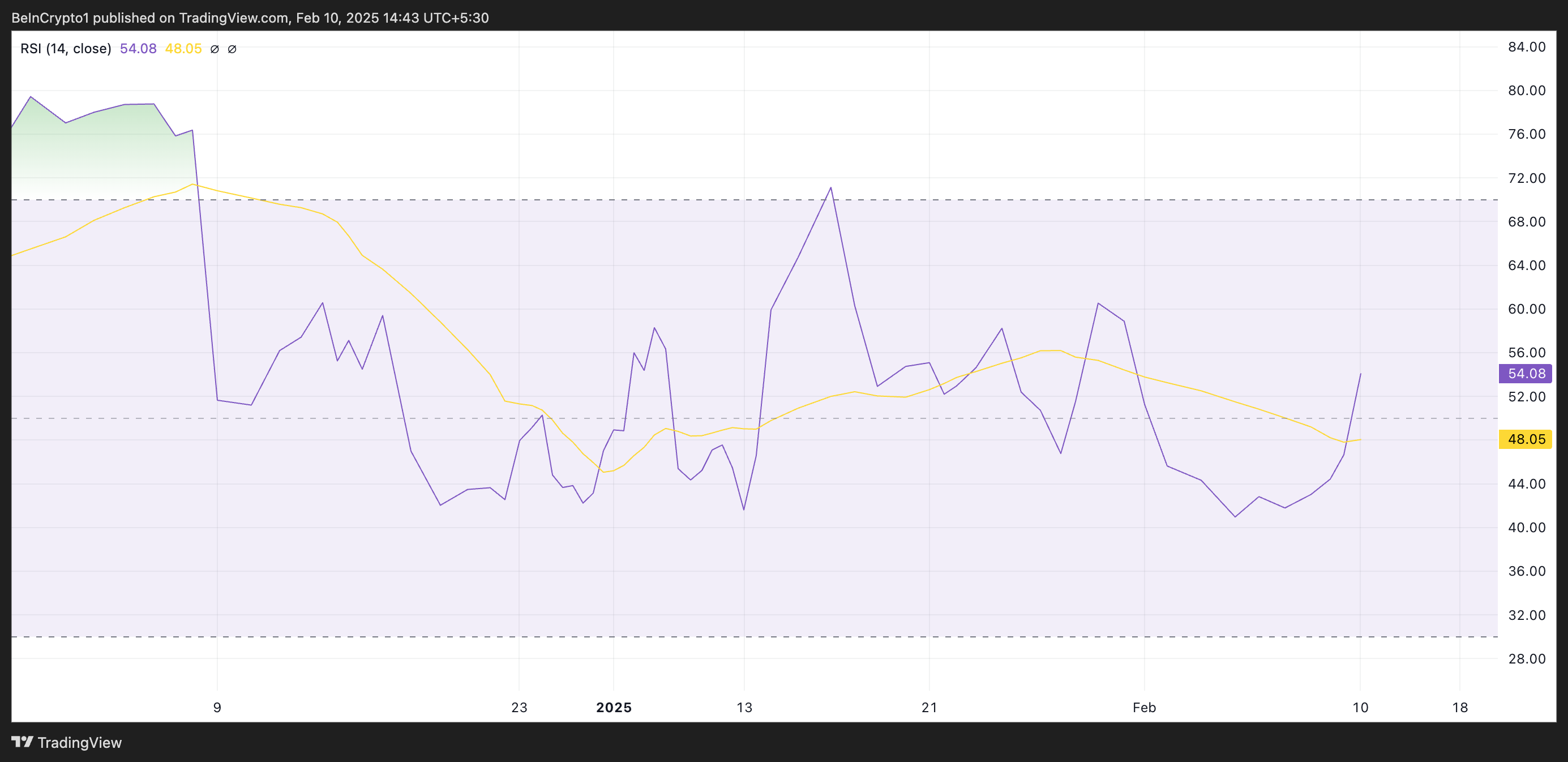

Further, the coin’s Relative Strength Index ( RSI ), assessed on the daily chart, confirms the surge in demand. At press time, LTC’s RSI is at 54.08 and is on an upward trend.

Litecoin RSI. Source: TradingView

Litecoin RSI. Source: TradingView

This momentum indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values under 30 suggest that the asset is oversold and may witness a rebound.

At 54.08 and climbing, LTC’s RSI suggests a moderate bullish momentum. It indicates growing buying pressure with the potential for further upward movement if the trend continues.

LTC Price Prediction: Could $124 Be Next?

LTC’s Elder-Ray Index has posted a positive value for the first time in eight days, highlighting the bullish shift in market trends. At press time, it is at 4.26.

An asset’s Elder-Ray Index measures the relationship between its buying and selling pressure in a market. When the index is positive, it indicates that bullish momentum is dominant, suggesting that buyers are in control and the asset’s price is likely to continue increasing.

If this holds, LTC’s value could rocket above $120 to trade at $124.03.

Litecoin Price Analysis. Source: TradingView

Litecoin Price Analysis. Source: TradingView

However, if profit-taking resurfaces, LTC’s price could shed current gains and drop to $109.81.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin ETFs See $1.9B Outflow While Competing Altcoins Draw $420M in Just 16 Days

- U.S. Bitcoin ETFs saw $1.9B in 4-day outflows as prices fell below $90,000 amid macroeconomic uncertainty. - BlackRock's IBIT lost $1.43B in 5 days, reflecting institutional risk aversion ahead of potential Fed policy shifts. - Altcoin ETFs attracted $420M in 16 days, with XRP and Solana funds gaining traction through staking yields and regulatory clarity. - Analysts warn sustained outflows could push Bitcoin toward $85,000, highlighting diverging investor priorities between blue-chip and emerging crypto

Connecting Firepower and Blockchain: RTX Corp's Two-Pronged International Approach

- RTX Corp secures $92M U.S. arms sale to India and $105M Patriot system sustainment deal for Ukraine, expanding global defense contracts. - Subsidiary Remittix raises $28.1M via RTX token presale to launch PayFi, a blockchain-powered cross-border payment app supporting 60+ countries. - Collins Aerospace partners with Netherlands for F-35/CH-47F avionics center (2026) and expands commercial aviation with Ethiopian Airlines seating contracts. - Dual-track strategy leverages military contract revenues to fun

Bitcoin’s Rapid Uptake by Institutions in November 2025: Key Opportunities for Retail Investors in the Face of Favorable Macroeconomic Trends

- 2025年比特币机构采用加速,监管明确(如现货ETF获批)和基础设施完善(如BlackRock IBIT、JPMorgan托管服务)推动资本流入。 - 美联储转向量化宽松及降息至3.75%-4%,叠加政府停摆结束带来的流动性,强化比特币作为风险资产的吸引力。 - 技术指标显示比特币RSI超卖(30.52)且MACD趋平,机构ETF资金流出现反弹(如IBIT单日流入7547万美元),暗示短期修正可能。 - 散户投资者可关注9万美元关键支撑位及ETF资金流向,结合宏观宽松与机构动向把握战略入场时机,但需警惕HODL/FBTC等基金的持续看空信号。

Stellar News Today: Established Market Prefers Altcoins with Practical Use Cases Rather Than Pure Speculation

- MoonBull (MOONBULL) raised $600,000 in funding, highlighting growing institutional interest in utility-driven altcoins with DeFi infrastructure and staking rewards. - Crypto.com's CRO token maintains stability through expanded merchant partnerships and AI-driven tools, positioning it as a "safe haven" amid market volatility. - Stellar's XLM sees renewed adoption via cross-border payment partnerships, with 20% higher transaction volumes reflecting demand for low-cost solutions in emerging markets. - Marke