- XRP surged 17% following the SEC’s recognition of new ETF filings.

- The SEC has 240 days to decide on the fate of these filings, with decisions at the end of this year.

- The SEC’s actions raise hopes for both XRP ETF approval and the conclusion of the ongoing Ripple lawsuit.

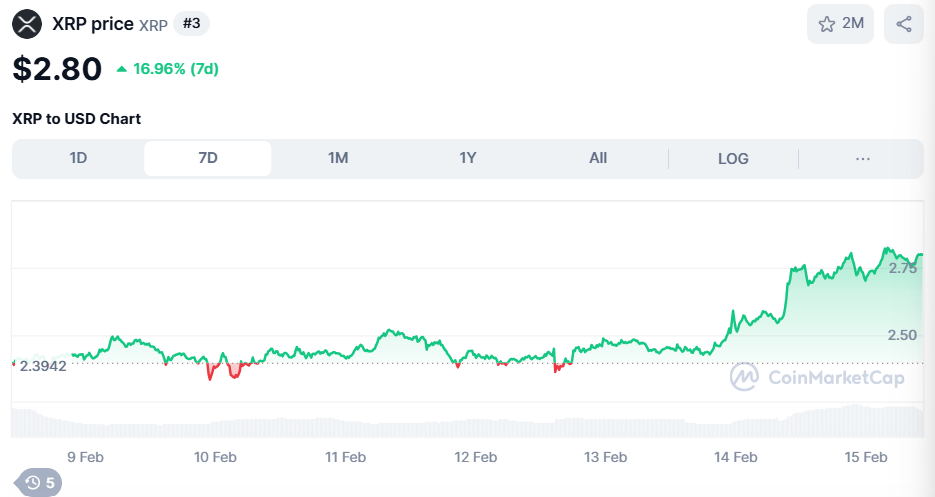

The price of XRP saw a significant boost, climbing 17% over the past week, following the U.S. SEC’s acknowledgement of another XRP ETF filing.

On Friday, the SEC acknowledged the application from asset manager 21Shares, just a day after recognizing Grayscale’s XRP ETF application. This latest news brought in excitement within the XRP community, suggesting that official approval could be coming.

XRP ETF: SEC Decision Timeline

The SEC’s acknowledgement is definitely a step forward, but it doesn’t guarantee approval.

However, it does show the SEC is willing to consider these filings. This is different from their recent approach to other crypto ETFs. For example, a Solana ETF was withdrawn in December after the SEC hinted they weren’t interested in pursuing those applications.

The SEC now has 240 days to decide on the fate of these XRP ETF filings, with decisions expected toward the end of the year.

Notably, the regulator still has at least three other form 19b-4 filings of XRP ETFs to acknowledge, specifically from asset managers Bitwsie, WisdomTree, and Canary Capitals. Public commentators suggest the recognition could come next week.

Related: Ripple CEO: XRP ETF Approval “Inevitable” – Analyzing Potential XRP Price Reaction

XRP Price Reacts to ETF News

As the XRP community eagerly anticipates further recognition for the remaining ETF filings, XRP’s market price started surging.

At press time, XRP is trading at $2.80 after briefly touching a two-week high at $2.83 following an 8.5% intraday gain. At its current price, XRP is now only about 26% below its all-time high of $3.84.

Essentially, the ETF development has fueled optimism, making the future of XRP ETFs a hot topic for crypto enthusiasts.

ETF News Raises Hope of Ripple Lawsuit Close

At the same time, the SEC’s acknowledgment of XRP ETF applications has raised hopes that the long-running Ripple lawsuit may soon end.

The SEC’s willingness to review XRP ETF applications indicates possible shifts in how the regulator is viewing Ripple’s case.

Related: Is the Ripple Lawsuit Set for a Breakthrough After SEC and Binance Agree to Pause Suit?

Besides, the regular recently paused the litigation in the Binance case, with some suggesting this approach could be extended to Ripple as well. These moves are happening under the new SEC leadership, with interim chair Mark Uyeda viewed as more crypto-friendly than his predecessor.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.