Bitcoin News: BTC Price Faces Uncertainty Amid Network Decline, and Institutional Developments

Bitcoin continues to experience heightened uncertainty as market dynamics shift, driven by macroeconomic factors, regulatory developments, and varying institutional engagement levels., with conflicting price predictions, decreasing network activity, and increased institutional engagement creating a complex landscape for investors. As experts debate the cryptocurrency's future trajectory, the potential impact of these developments on Bitcoin's market performance remains a focal point for the industry.

Bitcoin Network Activity Decline Sparks Concern

Recent reports indicate a significant decline in Bitcoin network activity , with a 15% drop in transaction volumes and a 20% decrease in active addresses over the past month, with on-chain metrics revealing reduced transaction volumes and active addresses. This drop in activity raises concerns about the cryptocurrency's short-term price stability, as decreased network engagement often correlates with bearish market sentiment. Analysts suggest that this decline could reflect cautious behavior among retail investors amid ongoing market volatility.

By CoinMarketCap -

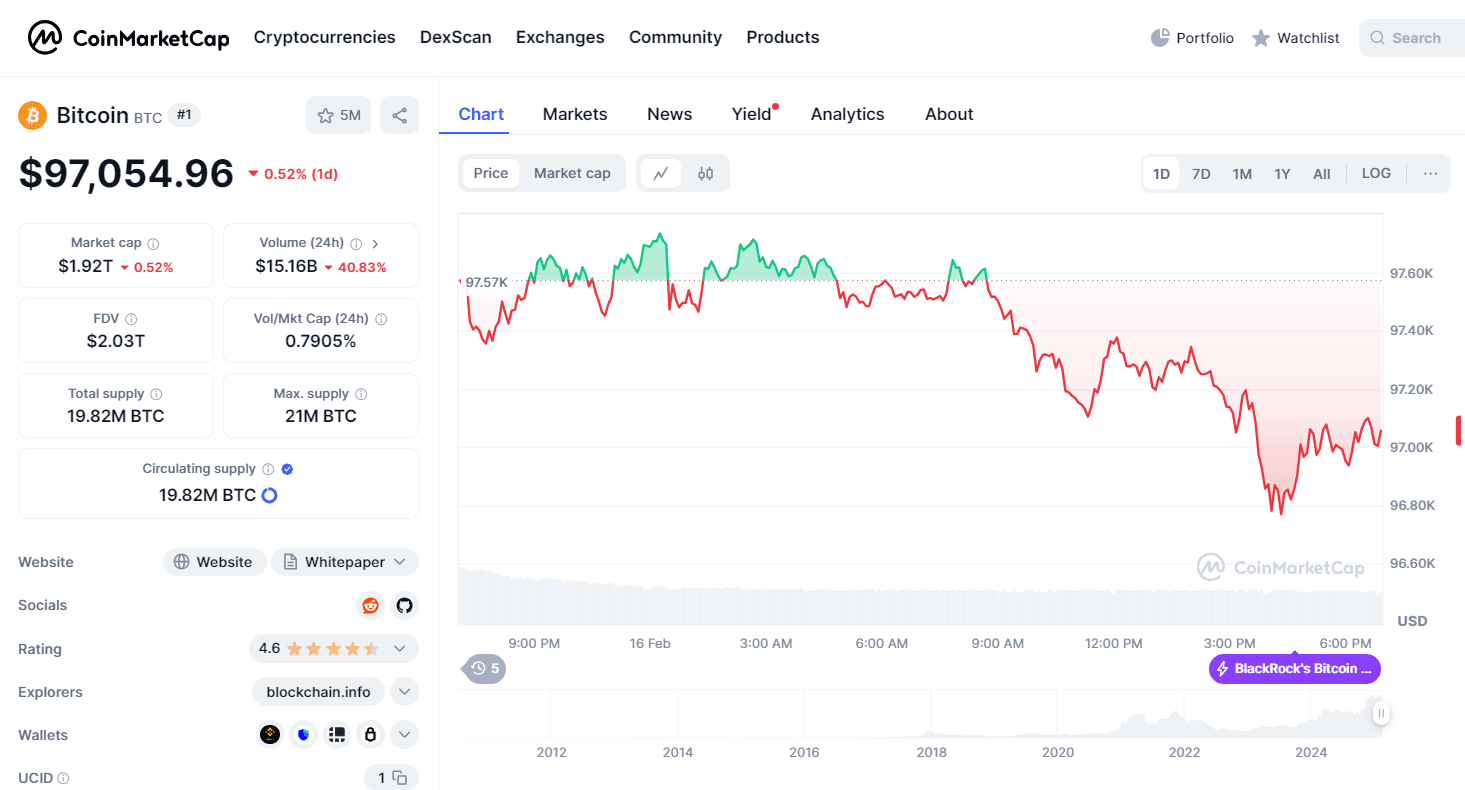

Bitcoin Overview (Price, Market Cap, Volume, and Performance)

By CoinMarketCap -

Bitcoin Overview (Price, Market Cap, Volume, and Performance)

Michael Saylor's Insights Amid Market Uncertainty

Michael Saylor, a prominent Bitcoin advocate, recently spoke at industry events highlighting Bitcoin's resilience and long-term potential, and recently addressed the prevailing market uncertainty, emphasizing Bitcoin's long-term value proposition despite current challenges. Saylor highlighted that Bitcoin's fundamental characteristics—scarcity, decentralization, and security—remain intact, regardless of short-term price fluctuations. His message aims to reassure investors of Bitcoin's potential as a reliable store of value amid the ongoing market turbulence.

Samson Mow's Bold $2 Million Bitcoin Prediction

Bitcoin enthusiast Samson Mow has made a bold prediction, referencing historical Bitcoin bull runs and the asset's scarcity-driven price increases, suggesting that Bitcoin could reach a staggering $2 million in the future. Mow's optimistic forecast is based on Bitcoin's limited supply and increasing institutional demand. While such projections spark excitement within the crypto community, skeptics caution against overly ambitious predictions, advocating for a more measured approach when evaluating Bitcoin's price potential.

Texas Bitcoin Reserve Proposal: Institutional Influence Grows

In a notable development, Texas lawmakers are considering establishing a state Bitcoin reserve, which could potentially drive Bitcoin demand and impact its price due to increased institutional participation, which could significantly influence the market. If implemented, this initiative would mark a substantial step in legitimizing Bitcoin as a strategic financial asset. Institutional involvement, as demonstrated by such proposals, underscores the growing recognition of Bitcoin's role in broader economic frameworks.

By TradingView -

BTCUSD_2025-02-16 (1M)

By TradingView -

BTCUSD_2025-02-16 (1M)

Bitcoin's market outlook remains uncertain as network activity decreases, market sentiment wavers, and bold predictions stir curiosity. However, growing institutional interest, such as Texas's proposed Bitcoin reserve, reflects the cryptocurrency's evolving role in the global financial landscape. Investors should remain vigilant, considering both optimistic forecasts and fundamental on-chain data when assessing Bitcoin's future trajectory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.