Bitcoin Price Prediction: BTC Price Over $100,000 AGAIN Soon?

Bitcoin Open Interest Surge: A Potential Breakout Signal

Recent data indicates a steady rise in Bitcoin's open interest within perpetual futures markets. This surge suggests heightened trading activity, which often precedes a Bitcoin price breakout . Analysts highlight that while a significant price movement is expected, the direction remains uncertain and dependent on further market signals.

Bitcoin and Ethereum Options Set to Expire

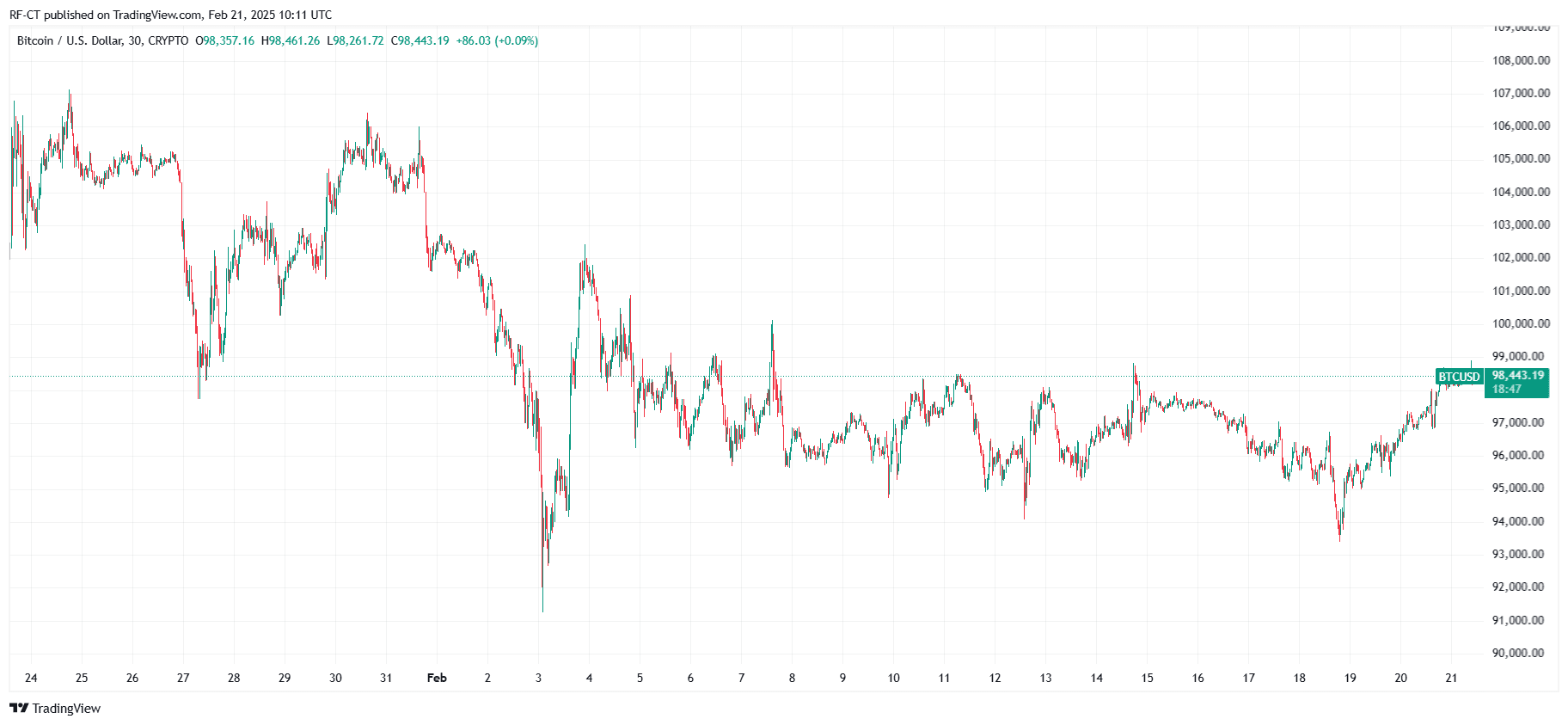

Today, Bitcoin and Ethereum options worth approximately $2.04 billion are set to expire. These expirations frequently cause increased market volatility as traders rebalance their positions. The maximum pain price—the level at which the most options expire worthless—is $98,000 for Bitcoin and $2,700 for Ethereum. Since Bitcoin is trading near these levels , its price action may be influenced by option settlement pressures.

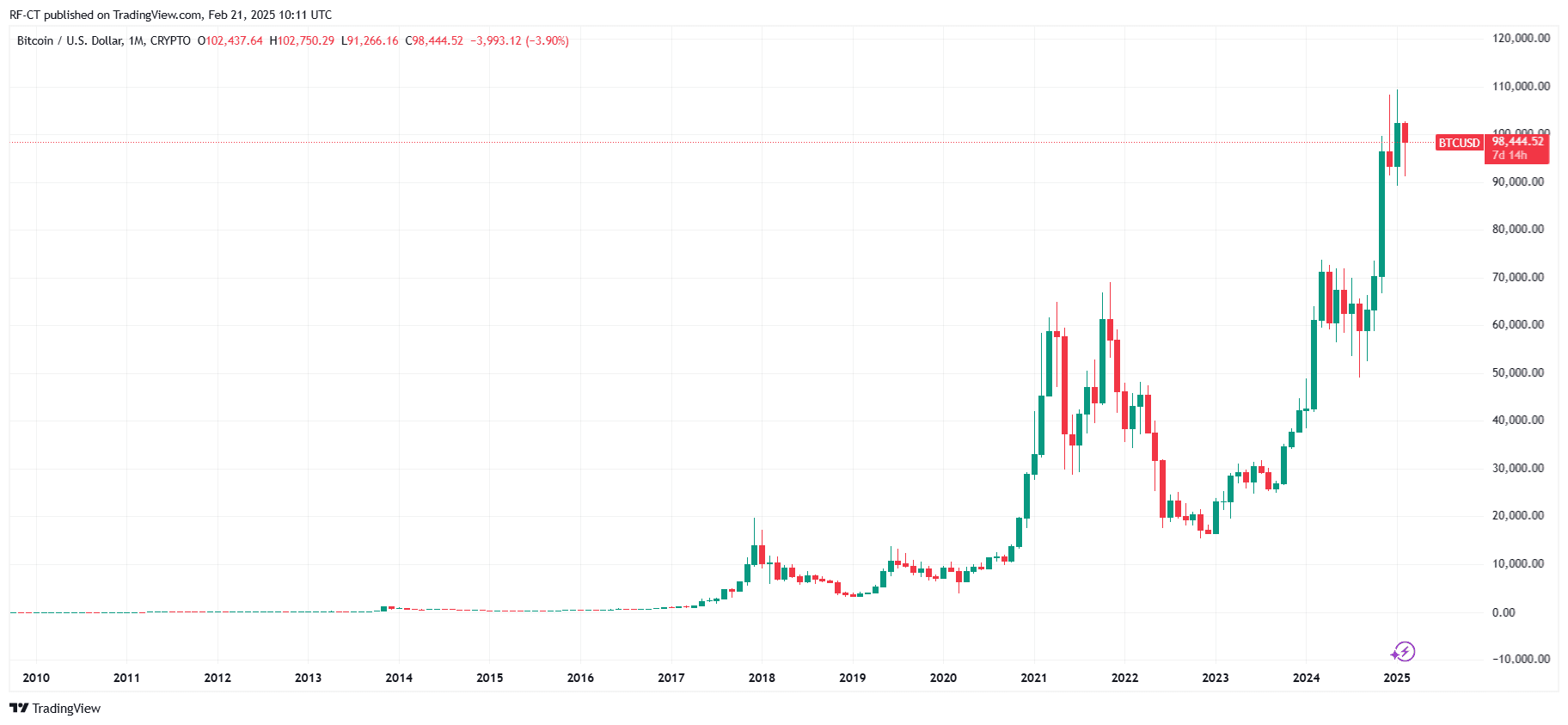

Bitcoin Price Prediction: BTC Price Over $100,000 AGAIN Soon?

By TradingView -

BTCUSD_2025-02-21 (1M)

By TradingView -

BTCUSD_2025-02-21 (1M)

Key Price Levels and Market Outlook

Currently, Bitcoin is trading around $98,774 , with strong support levels between $91,000 and $95,000. The resistance level is near $103,900. If Bitcoin surpasses $100,000, it could trigger bullish momentum and push prices toward new highs. Conversely, if Bitcoin falls below $91,000, increased selling pressure might drive further declines. Traders are closely monitoring these key levels amid heightened activity in Bitcoin futures and options markets.

By TradingView - BTCUSD_2025-02-21 (All)

By TradingView - BTCUSD_2025-02-21 (All)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Prospects of Ethereum Protocol Technical Upgrade (1): The Merge

This article will interpret the first part of the roadmap (The Merge), explore what technical design improvements can still be made to PoS (Proof of Stake), and discuss ways to implement these improvements.

DYDX Boosts Market Moves with Strategic Buyback Decision

In Brief DYDX increases revenue allocation for token buybacks from 25% to 75%. Price gains expected due to reduced supply pressure and strategic decisions. Increased buybacks viewed as a crucial financial strategy amidst volatile conditions.

Corporate Crypto Treasuries Shift as Bitcoin Loses Ground to Altcoins

Bitwise Chainlink ETF Hits DTCC Registry, Edging Closer to SEC Approval