Why did XRP Price Jump over 20% Following Trump's Crypto Reserve Announcement?

The cryptocurrency market is witnessing a significant rally, with XRP leading the surge after former U.S. President Donald Trump revealed plans for a U.S. Crypto Strategic Reserve. This initiative aims to include major digital assets such as XRP , Solana (SOL), and Cardano (ADA), reinforcing crypto adoption in the United States.

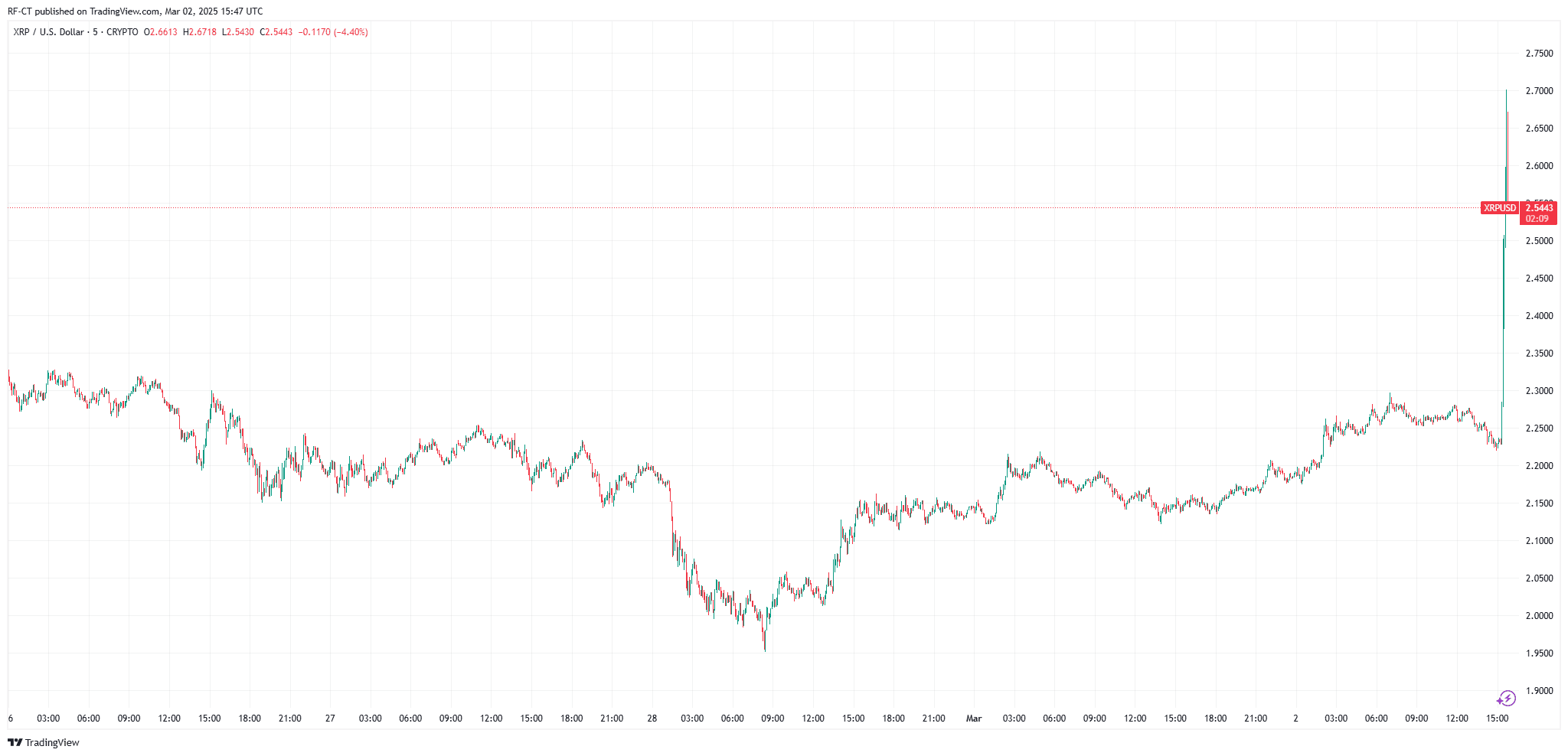

By TradingView - XRPUSD_2025-03-02 (5D)

By TradingView - XRPUSD_2025-03-02 (5D)

Trump’s Announcement Boosts XRP and Crypto Market

Trump’s recent statement emphasized that a Crypto Reserve would support and elevate the industry after years of regulatory scrutiny under the Biden administration. His declaration has reignited bullish sentiment in the market, with XRP among the biggest gainers.

XRP's Explosive Price Action

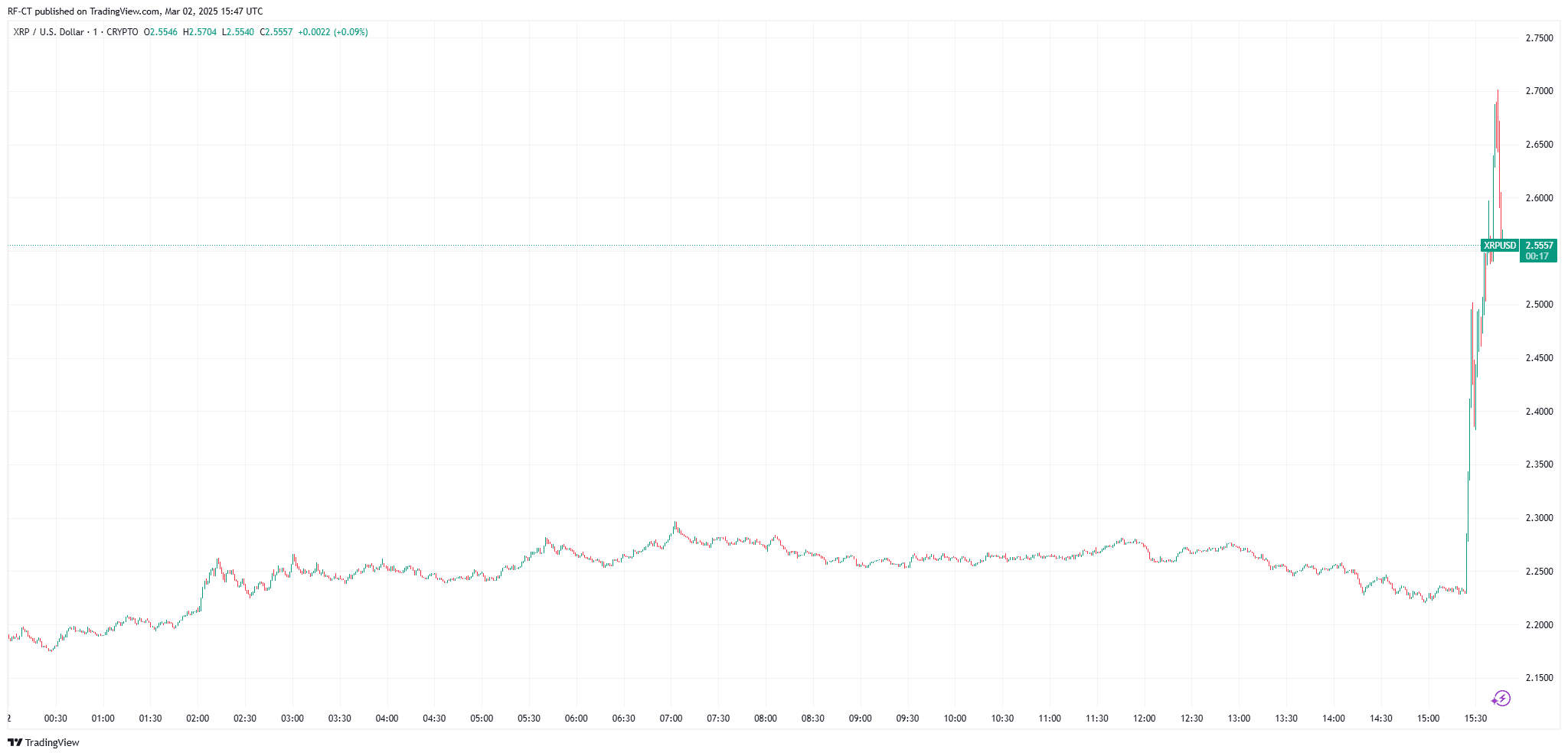

Following Trump's announcement, XRP saw an immediate surge of over 20%, climbing to an intraday high of $2.66, a level not seen in weeks. This rally comes after the token previously hit a 30-day low of $1.95, demonstrating a strong recovery fueled by renewed investor confidence.

The sudden price spike also saw XRP’s trading volume surge past $5 billion, indicating heightened buying pressure. This marks one of the most significant intraday gains for XRP in recent months.

Market Sentiment and Future Outlook

- Short-Term Outlook: Analysts predict continued bullish momentum for XRP if the market maintains positive sentiment around the Crypto Reserve initiative. Resistance is expected at the $2.75 - $3.00 range.

- Long-Term Impact: If implemented, the Crypto Strategic Reserve could create an institutional-level demand for XRP, SOL, and ADA, potentially pushing their values even higher.

By TradingView - XRPUSD_2025-03-02 (1D)

By TradingView - XRPUSD_2025-03-02 (1D)

Trump’s pro-crypto stance and the announcement of a U.S. Crypto Reserve have significantly impacted the market, particularly for XRP, SOL, and ADA. With XRP surpassing $2.66 in a rapid rally, investors are closely monitoring further developments. The coming days will be crucial in determining whether this bullish momentum can sustain or lead to further price corrections.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.