Analyst: Traders are pursuing short-term put options for BTC, ETH, and SOL

Block Scholes analyst Andrew Melville, citing Deribit data, said that traders are chasing short-term bearish options for BTC, ETH and SOL due to Trump's crypto strategic reserve plan not meeting expectations. Options skew data shows that short-term BTC, ETH and SOL put options are trading at a premium relative to call options, indicating market concerns about downside risk. However, XRP options show a preference for call options in all time frames except one.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

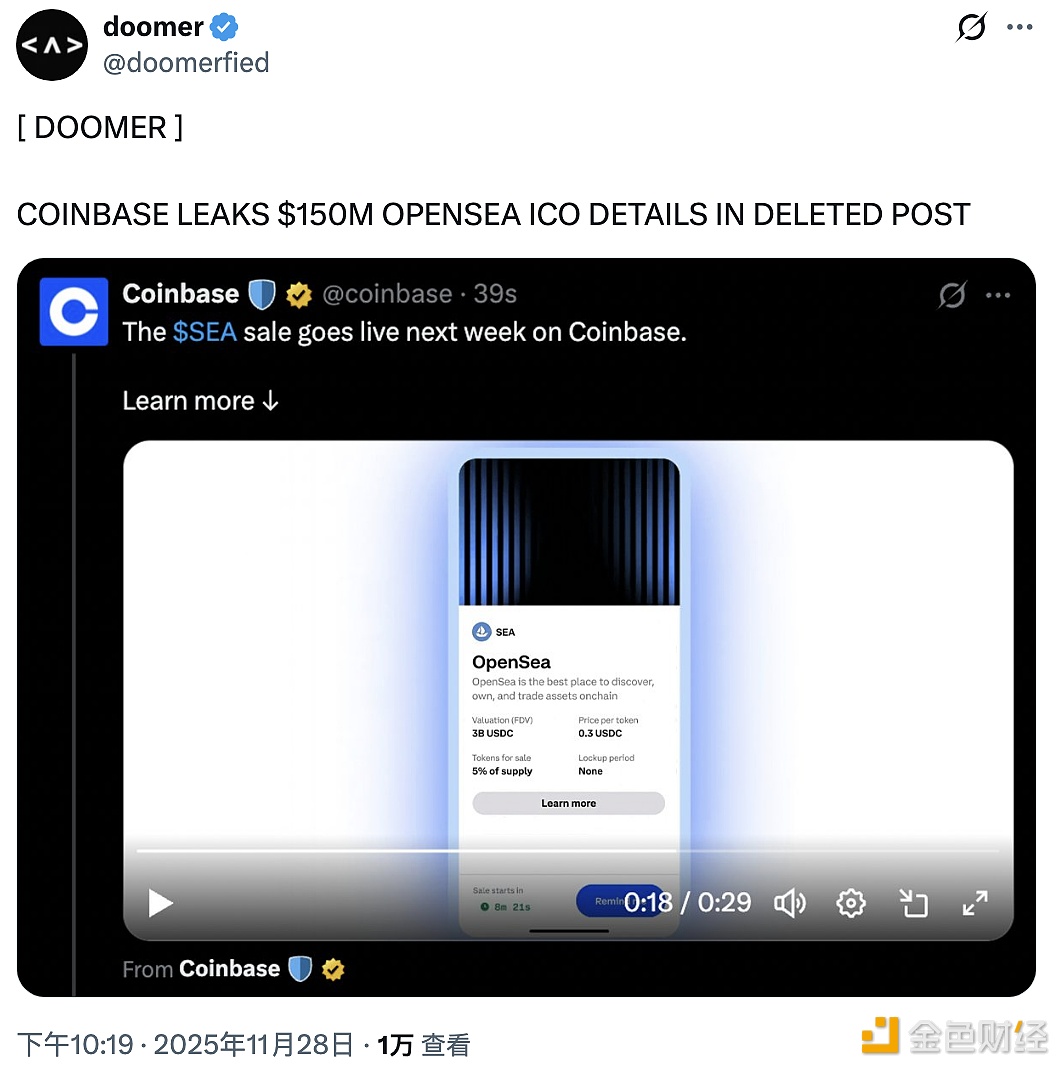

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.