-

Movement Network (MOVE) is currently under scrutiny as key technical indicators signal a potential cooling of its recent bullish momentum.

-

Despite a 13% increase over the last week, MOVE’s price action is facing pivotal support levels that could dictate its next moves.

-

“The current downward drift in +DI and the rise of -DI suggest a shift in market sentiment that could lead to further declines,” stated a recent analysis from COINOTAG.

An in-depth look at Movement Network (MOVE) reveals signs of potential downward pressure as technical indicators signal a shifting market sentiment.

Assessing MOVE’s Current Technical Landscape

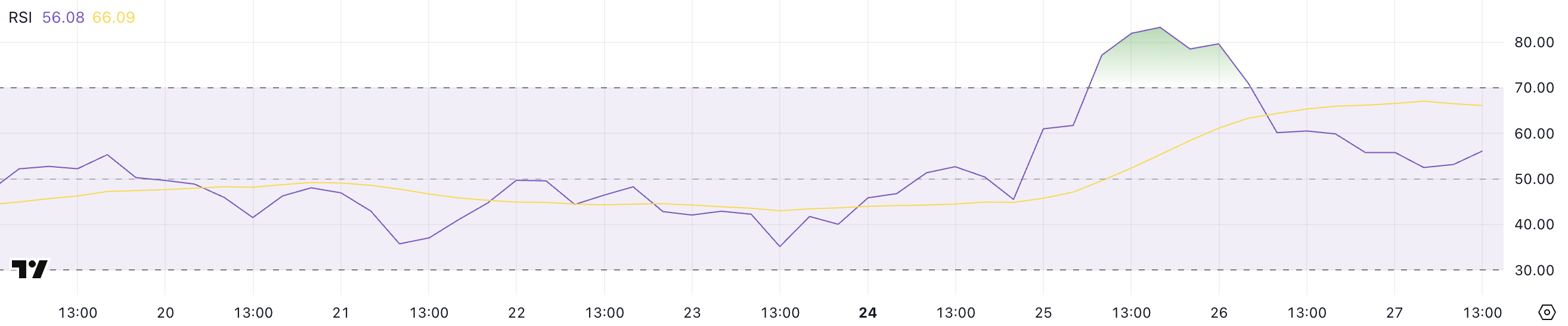

The advent of Movement Network’s $38 million buyback announcement has certainly stirred up interest, yet the Relative Strength Index (RSI) shows a significant decline to 56 from a recent high of 83, indicating a potential shift in bullish momentum. This change in the RSI, a crucial momentum oscillator, raises questions about the sustainability of MOVE’s recent gains.

According to the RSI scale, readings above 70 suggest overbought conditions, which can often lead to corrections. Following the prior momentum phase, MOVE’s recent reading remains in the neutral territory but hints at possible consolidation before a potential next rally.

Prior to the spike, MOVE’s RSI was in neutral territory for a substantial 23-day span, reflecting a period marked by price stability. The sharp pullback following its peak further emphasizes the precarious nature of current market conditions.

Understanding the Implications of the DMI Trend

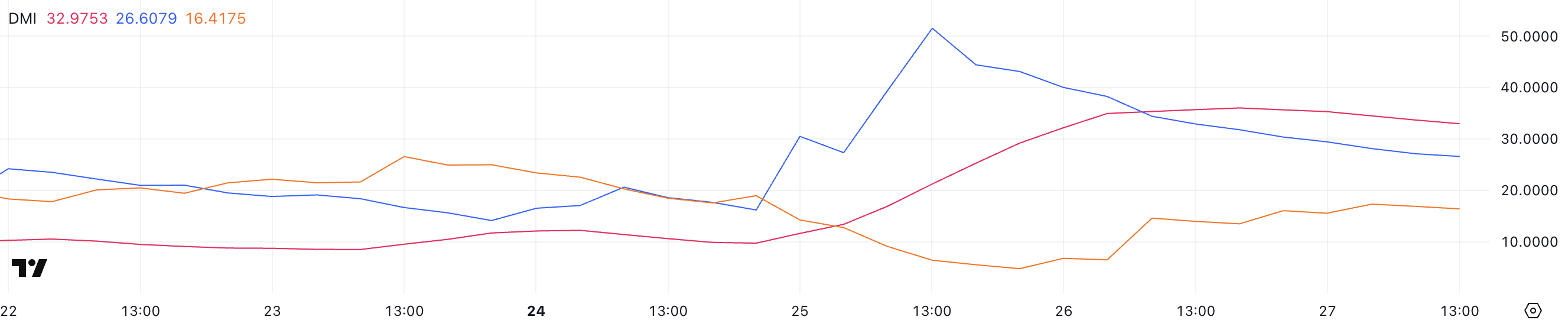

Analyzing the Direction Movement Index (DMI), the current Average Directional Index (ADX) stands at 32.97, indicating a robust trend has indeed formed. Nonetheless, the movement of the +DI, which has now significantly dropped to 26.6 from 51 two days ago, contrasts with the rise of -DI to 16.41, highlighting a gradual increase in bearish sentiment.

This divergence raises concerns about the current bullish trend’s strength. While a strong trend is present, the narrowing gap between the +DI and -DI suggests waning buying momentum and escalating selling pressure, potentially leading to a consolidation phase or a corrective pullback in the near future.

Evaluating Key Support Levels for MOVE

In the aftermath of MOVE’s impressive 30% price surge on March 25, the altcoin is now facing a likely pullback as it trades approximately 11% below its peak price. Key support levels are pivotal to watch, with the first target set at $0.479. Failure to maintain this level could trigger a further decline toward $0.433 and $0.409, with a more profound drop towards $0.37 possible if bearish momentum persists.

Market sentiments will play a crucial role as traders gauge whether the recent sell-off is temporary or the start of a more sustained downtrend. Should confidence in the MOVE ecosystem rebuild, a rebound towards resistance levels such as $0.539 could be viable, potentially paving the way for a breakout above $0.55, previously unbroken, and aiming towards $0.60.

Conclusion

The current dynamics surrounding Movement Network (MOVE) illustrate a critical juncture as key indicators reflect a cooling off from its recent bullish trends. A robust examination of technical indicators highlights both potential challenges and opportunities for MOVE as it navigates through this consolidation phase. Market watchers will need to closely observe price movements around critical support levels for insights into its future trajectory.