Date: Sat, March 29, 2025 | 07:25 AM GMT

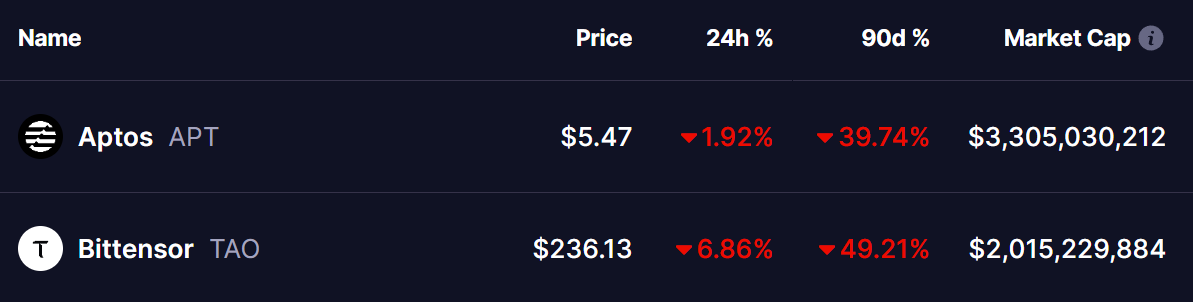

The cryptocurrency market is under renewed selling pressure, erasing recovery gains made earlier this week. Ethereum (ETH) has dropped over 6% in the past 48 hours, falling below the $1,900 level. This downturn has triggered widespread declines across major altcoins , including Aptos (APT) and Bittensor (TAO), both of which have extended their 90-day correction phase.

Source: Coinmarketcap

Source: Coinmarketcap

Double Bottom Formation Stay Intact

Despite recent selling pressure, both APT and TAO have maintained their double bottom formation, a classic technical pattern that often signals a potential trend reversal. Earlier this week, both tokens managed to bounce from this key support level, hinting at a possible recovery. However, the broader market correction has brought them back to retest the same crucial support area.

A key factor influencing these tokens’ price action is Bitcoin dominance (BTC.D), which dictates capital flow within the crypto market. The relationship between BTC dominance and altcoin performance will be critical in determining whether APT and TAO can sustain their current support or experience further downside.

What to Expect?

The movement of BTC dominance is now a deciding factor for the next phase of the altcoin market. BTC dominance has rebounded from both the 50-day moving average (MA) and the rising wedge support, climbing from 61.34% to 62.17%.

BTC.D Daily Chart/Coinsprobe (Source: Tradingview)

BTC.D Daily Chart/Coinsprobe (Source: Tradingview)

As BTC dominance approaches its resistance trendline, there are two possible outcomes:

- Rejection from Resistance: If BTC dominance fails to break the resistance trendline, we could see a rebound in altcoins, including APT and TAO. A rejection would indicate capital rotating back into altcoins, fueling a recovery.

- Breakout Above Resistance: On the other hand, if BTC dominance breaks above the resistance, altcoins may face another wave of selling pressure. This scenario could lead to further downside for APT and TAO.

The coming days will be crucial in determining whether the altcoin market can regain strength or continue its bearish trend. Traders should closely monitor BTC dominance levels for signs of a potential shift in market sentiment.

Disclaimer:: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.